The patent tax system is the only special regime available only to individual entrepreneurs. Often, buying a patent turns out to be more profitable than paying taxes under other regimes.

Read more: Patent for individual entrepreneurs for 2021: types of activities

However, in 2021, the constituent entities of the Russian Federation received the right to establish the potential annual income for PSN without restrictions. This has led to the fact that the cost of patents in some regions has increased significantly (for example, in the Stavropol Territory up to 10-12 times).

But there is also a positive aspect - from 2021, an individual entrepreneur can reduce the cost of a patent for insurance premiums transferred for himself and his employees. Therefore, we recommend first using a patent calculator to compare the tax on PSN with the tax burden on other taxation systems. If necessary, you can contact us for a free consultation.

Form an application to reduce a patent

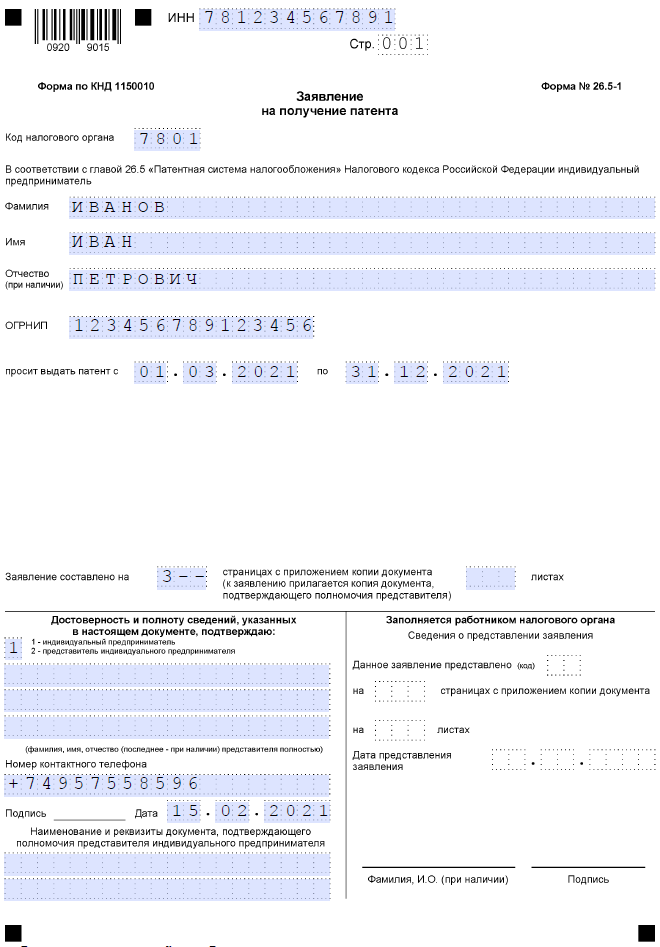

If you are convinced that PSN is the best option for you, then you need to submit an application for a patent to the inspectorate, its other name is form 26.5-1.

Please note: from January 11, 2021, a new application form is in effect, approved by Federal Tax Service order No. KCh-7-3 dated December 9, 2020/ [email protected] All previous forms (from Federal Tax Service order No. MMV-7- dated July 11, 2017 3/ [email protected] , letters dated 02/18/2020 SD-4-3/ [email protected] and dated 12/11/2020 N SD-4-3/20508) have lost their validity.

Free tax consultation

Form 26.5-1

The patent application consists of five pages:

- title, for reporting identification information about an individual and the validity period;

- name of the type of activity;

- information about the place of business;

- information about vehicles (when choosing to transport goods and passengers);

- information about objects used in business (for leasing premises; retail trade; provision of catering services).

The first two pages are filled out by all applicants, and the pages containing information about transport or about trade and catering facilities are completed only when choosing the appropriate line of business.

The form is in editable PDF format. To fill it out correctly, it is recommended to use Acrobat Reader.

Extension and re-registration of the patent in 2021

Current as of February 13, 2021

The patent application consists of five sections:

- title page - general information about the entrepreneur and the validity period of the patent;

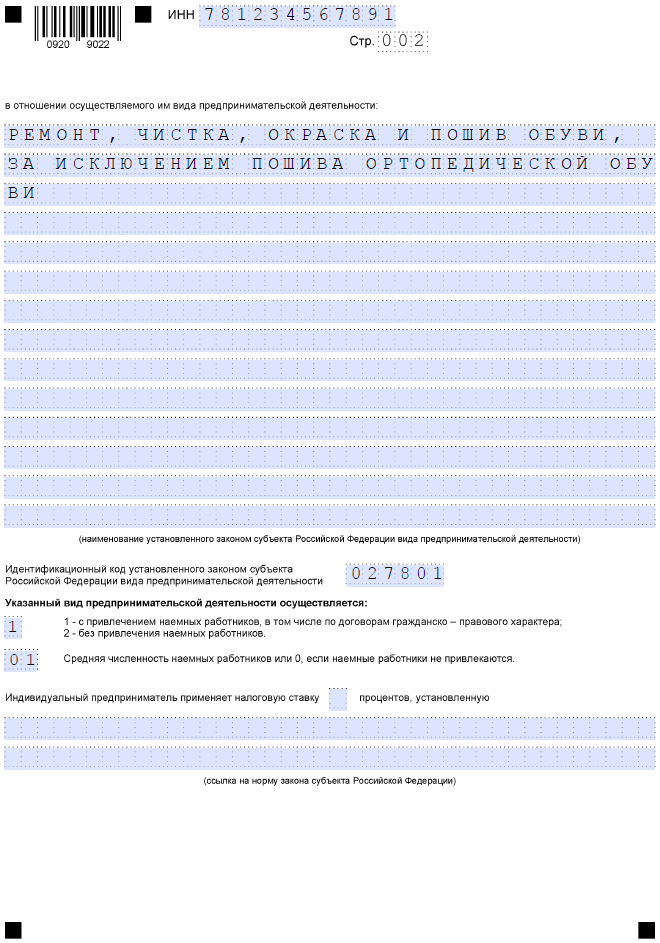

- page 002 – name of the type of activity for which the individual entrepreneur plans to obtain a patent, availability of hired personnel, tax rate;

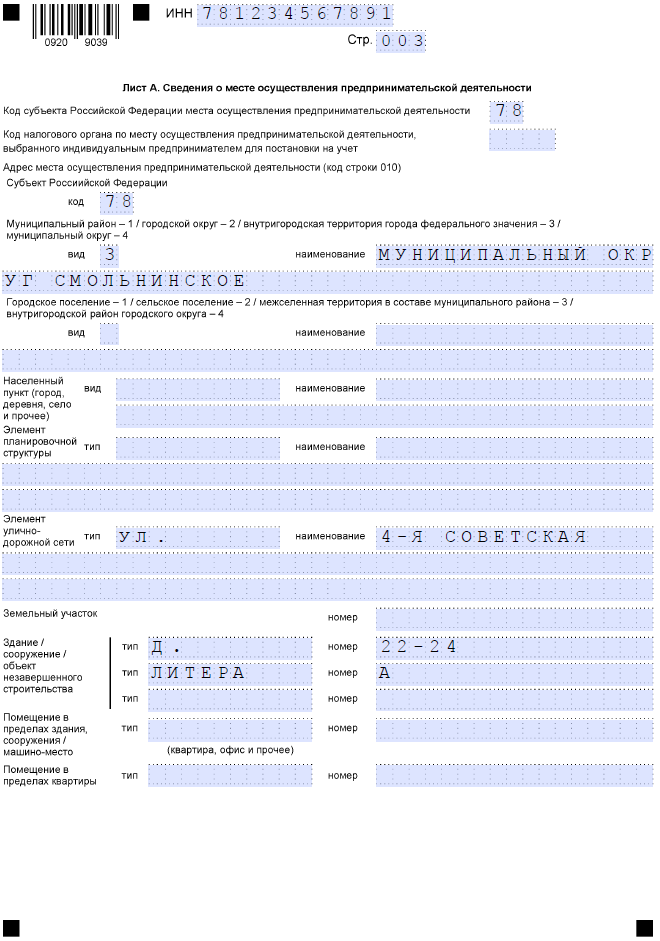

- sheet A – information about the place of business activity;

- sheet B - information about vehicles used in carrying out activities for the transportation of goods and passengers;

- sheet B - information about the objects used in the implementation of activities for leasing premises; retail; provision of catering services.

The first two sections are completed by all applicants, and then only the section on the relevant line of business is completed.

For example, let’s fill out a patent application for an individual entrepreneur planning to provide services to the public for the supervision and care of children and the sick. The start date of activity is 07/01/2019 (6 months).

Of the following three pages, we select only one, where we indicate additional information regarding the activities being carried out:

- sheet B – when carrying out activities to organize the transportation of goods and passengers;

- sheet B – when carrying out activities in the area of retail trade, catering and rental;

- sheet A - for other areas of business.

When filling out these pages, it is mandatory to enter information regarding the subject of the Russian Federation where the business activity is carried out. When filling out the sheets, pay attention to the tips at the bottom of the page, where the information regarding the required details for filling out is indicated and the values of the indicators are specified.

The following information is entered regarding the activities being carried out:

- sheet A – address of the place of business activity;

- sheet B – information on each vehicle used in business activities;

- Sheet B - indicate the type code and attribute of the object, indicating the address of the location of the object used to carry out business activities.

The meaning of the type code and attribute of the object are indicated in the footnote at the bottom of sheet B.

The information on the above sheets is indicated for each place of business activity.

Application in form No. 26.5-1 for a patent in 2021 ().

This application must be submitted no later than 10 working days

before starting activities on the basis of PSN.

Fill out the form

Let's take a closer look at how to fill out the form to switch to PSN. We will prepare a patent application (sample filling) using the example of an entrepreneur planning to provide services to the public for repairing, cleaning and painting shoes in St. Petersburg. The stated period of activity is ten months. Let's start filling out a patent application (filling out sample) with the title page. We indicate registration data for individual entrepreneurs for 2021:

- individual number (TIN);

- INFS code at the place of activity;

- full name of the individual;

- registration number (OGRNIP), indicated only if the individual entrepreneur registration certificate has already been issued;

- patent start date;

- patent expiration date;

- number of completed sheets.

The lower left block is intended to confirm the entered information, indicate a contact phone number and the date of submission.

Please note: the permit cannot be issued for several years at once, maximum – for one calendar year. If you want to get an annual permit for PSN, then indicate 12 months, and the validity period is from the first of January. At the end of the current year, you will have to submit a new application.

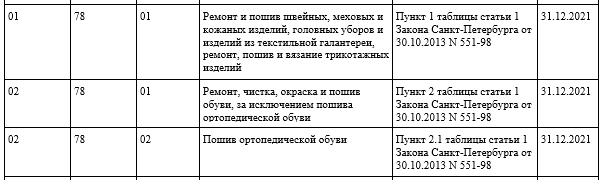

On the next page, enter the full name of the type of activity and the identification code of the type of business activity. The code consists of six digits; to find it, you need to know the number of the selected business line in Article 346.43 of the Tax Code of the Russian Federation, as well as the region code.

For example, the serial number of shoe repair in this list is 02, and the code of St. Petersburg is 78. We look for this data in the classifier table and find the full identification code - 027801.

Below we indicate the availability of employees and their number. The last fields to fill out on this page are the tax rate. In general, it is equal to 6%, but in the tax holiday regime it is 0%. In Crimea, the rate is lower than in Russia as a whole. The field is filled in only if the rate differs from the standard one, about which there is a footnote at the bottom of the page. In addition, the details of the legal act that approved the reduced rate are indicated. In our example, the rate is standard, so the field is not filled in.

Of the following three pages, select only one, where we indicate additional information:

- barcode 0920 9046 – when choosing the direction of organizing the transportation of goods and passengers;

- barcode 0920 9053 – for retail, catering and rental;

- barcode 0920 9039 – for other areas of business.

In our case, the individual entrepreneur repairs shoes in a workshop. The address is filled out in accordance with the State Address Register (FIAS).

When filling out a patent application for other types of activities (trade, catering, transportation) there are some peculiarities. In this case, we recommend following the official instructions.

Appendix No. 1. Patent application form

One of the requirements for foreign citizens wishing to work in Russia is to successfully pass an exam to test knowledge of the Russian language, history and legislation of Russia. Based on the results of the exam, the foreign person will be issued a corresponding certificate. The exam is considered passed if the correct answers to the tests are at least 60%. To pass such an exam, foreigners will also need to provide some documents:

- Identity document. Translation of this document into Russian, certified by a notary.

- Migration card.

In accordance with Russian legislation, foreign citizens cannot work in Russia if they are sick with diseases that are dangerous for Russian citizens. For example, HIV infection. Every foreign citizen wishing to obtain a patent will be required to undergo a medical examination to identify dangerous diseases. The patent application will need to be accompanied by a certificate confirming the absence of such diseases, including HIV.

To register a patent, you will also need to attach a voluntary health insurance policy. Obtaining such a policy has been mandatory for foreign citizens since the beginning of 2015. When choosing the duration of the insurance period, it is worth starting from the validity period of the labor patent. In order to obtain insurance, you will need to provide your passport details and registration document details. A foreigner can choose an insurance company independently.

The mandatory list of documents required to register a patent includes four photographs. Photos must be in color and of good quality. Photo requirements:

- Matte paper;

- Size 3x4;

- Lack of facial expressions that distort facial features;

- Lack of headdress;

- No sunglasses;

- Light solid background;

- Styled hair, moderate makeup.

Thus, when obtaining a patent, it will be important to correctly prepare all the necessary documents. Only after this can you contact the Main Directorate for Migration of the Ministry of Internal Affairs of Russia to obtain it.

When searching for forms on the Internet, you should pay attention to their relevance. The fact is that forms are constantly changing. These changes may be minor, but despite this, it is prohibited to use outdated forms - they simply will not be accepted for consideration. You can find current documents on the official websites of the Ministry of Internal Affairs and other government bodies. Or download forms on our website.

Since the renewal of a patent for foreign citizens in 2021 actually means the reissue of a permit to work in Russia, a foreigner will have to collect and bring to the migration authority the same package of documentation as during the initial registration. Among them:

- a personally written statement (Appendix No. 2 to the order of the Ministry of Internal Affairs of Russia dated August 14, 2017 No. 635);

- document identifying a foreigner in Russia;

- migration card;

- document confirming registration at the place of stay;

- photograph 3x4 cm (color, matte);

- medical examination documents;

- voluntary health insurance policy;

- certificate of passing the Russian language exam;

- petition from the employer. Take a careful look at the prepared sample petition from the employer for patent renewal at the Federal Migration Service 2021 and don’t miss anything, without it the right to work in the Russian Federation will not be extended;

- receipt of payment of the advance fixed payment.

The employee fills out the application by hand or on the computer. The Ministry of Internal Affairs has developed a special form for this situation, information in which is entered only according to available documents.

Not a single legislative act contains the required sample application for renewal of a foreign citizen’s patent 2021, therefore the documentary guarantee from the organization’s management is written in any form. The main thing is to indicate:

- patent details;

- details of the employment contract;

- surname, patronymic name of the employee and his passport details;

- validity period of the previously issued permit and coverage of the territory;

- profession of a migrant worker.

Also indicate in the header to which division of the migration service of the Ministry of Internal Affairs of Russia the application was sent.

The FMS specialist may refuse to renew in the following cases:

- Lack of certificates and gross errors in them;

- Personal income tax was not paid;

- The applicant changed his work region;

- Work has been identified in a specialty not specified in the permit;

- The work permit has expired.

Zero rate

The usual rate for PSN is 6%, but as part of the tax holiday, newly registered individual entrepreneurs have the right to work at a zero rate. The duration of the tax holiday can be up to two years, but in order to fall under this preferential regime, you must meet a number of conditions:

- be registered after the relevant regional law comes into force;

- choose the type of activity from those established by regional law (each subject of the Russian Federation establishes its own limited list);

- comply with other possible restrictions (on the number of employees or income received).

For the convenience of paying taxes and insurance premiums, we recommend opening a current account. Moreover, now many banks offer favorable conditions for opening and maintaining a current account.

What you need to know about a patent

- To obtain a patent, you must pass an exam on knowledge of the Russian language, Russian history and the fundamentals of Russian legislation.

- A patent is issued for a period of 1 to 12 months.

If a patent is granted for one month, it can be repeatedly extended up to twelve months. The total validity period of a patent cannot exceed twelve months from the date of issue of the patent.

Before the expiration of the twelve month period, the patent must be reissued ten days.

- The patent must be obtained within 30 calendar days from the date of entry into the country.

The entry into the country is marked on the foreign citizen’s migration card, where work is noted as the purpose of the visit. For missing this deadline, a foreign citizen is subject to administrative liability in the form of a fine of 4-5 thousand rubles.

- The patent expires if the foreign citizen has not made an advance payment for personal income tax (NDFL). In this case, the day of termination of the patent will be the day following the last day of the period for which the advance payment was paid.

This is a kind of “patent cost”. A foreign citizen is required to pay a monthly advance payment for the patent in the form of personal income tax. This amount is approved annually by the state. There is a base rate approved by the Tax Code of the Russian Federation, which is adjusted by a dilator coefficient established by the Ministry of Economic Development. This will be the federal (minimum) cost of the patent. The minimum patent value is then multiplied by the regional coefficient. Each region has its own coefficient and it depends on the regional characteristics of the labor market. Each region of the Russian Federation sets its own regional coefficient annually.

- If the patent has expired, the employer must suspend the foreign citizen from work for up to two months. Two months are given for the restoration and renewal of a patent by a foreign citizen. If within two months a foreign citizen does not restore or extend the patent, then the employer dismisses him after one month from the date of the occurrence of the relevant circumstances, with a corresponding entry in the work book.

Note: If the patent is not restored or extended for some reason, then the foreign citizen is obliged to leave the territory of the Russian Federation after fifteen days from the date of expiration of the patent.

Submission order

You can switch to PSN immediately upon registering an individual entrepreneur. To do this, completed Form 26.5-1 is submitted along with other registration documents. However, there is a nuance here that not all applicants are aware of.

The fact is that a patent is valid only in a certain territory. Until 2015, such a territory was recognized as a subject of the Russian Federation (region, territory, republic). At the same time, for all settlements of one region, a patent cost the same, regardless of where the entrepreneur does business - in a regional center, district center or village. Now the territory of action is the municipality, with the exception of such areas as road transportation and distribution (distribution) retail trade.

An entrepreneur can work throughout Russia, but he is registered with the inspectorate of the locality where he is registered. Let’s assume that registration with the Federal Tax Service takes place in Ryazan, and the individual entrepreneur plans to conduct business in the Moscow region. In this case, you must declare the transition to PSN to any municipal inspectorate at the place of activity, and only after a certificate of registration of the individual entrepreneur has been issued.

But if the place of registration and activity coincides, then the patent will be issued to you along with an individual entrepreneur certificate. There is an indication of this registration procedure in the Tax Code of the Russian Federation.

If an individual plans, from the date of his state registration as an individual entrepreneur, to carry out activities in a constituent entity of the Russian Federation, on the territory of which such a person is registered with the tax authority at his place of residence, an application for a patent is submitted simultaneously with the documents submitted during state registration. In this case, the validity of the patent issued to an individual entrepreneur begins from the day of its state registration. (from Article 346.45 of the Tax Code of the Russian Federation).

If, as in the example above, you plan to work for PSN not at your place of registration, then you must contact the tax office no later than 10 working days before the start of the proposed work. Prepare two copies, on one the inspection will leave a mark of acceptance. It is worth knowing that extradition will be refused if:

- the application indicates the line of business in respect of which the PSN does not apply;

- the validity period does not comply with the requirements of the Tax Code of the Russian Federation (indicated outside the calendar year, for example, from March 1, 2021 to February 1, 2022);

- the individual entrepreneur has arrears in payment for other patents;

- this year the right to a special regime has already been lost;

- in form 26.5-1 the required fields are not filled in.

If everything is in order, then you will receive permission to work for PSN in 5 working days.

Patent application

It is filled out if the individual entrepreneur intends to work using vehicles in the field of transporting goods or passengers. All types are listed in paragraphs. 10, 11, 32 and 33 and paragraph 2 of Art. 346.43 Tax Code of the Russian Federation. Such a sheet will need to be filled out for each vehicle.

So what you need to fill out:

- TIN;

- page number;

- code of the subject of the Russian Federation;

- Federal Tax Service code for the individual entrepreneur’s future place of work;

- vehicle code: “01” - vehicle for transporting goods; “02” - for the transportation of passengers; “03” - water transport for transporting people; “04” - water transport for cargo transportation;

- vehicle identification number;

- brand in accordance with registration papers;

- registration plate of a car, for a vessel - its registration number;

- carrying capacity (indicated only for those types of transport, including water transport, that are intended for the transportation of goods);

- number of seats (for transport, including water transport, intended for transporting people).

This sheet is filled out for each property that will be used in some types of individual entrepreneur activities (when using retail space, for catering, when renting out). They are specified in paragraphs. 19, 45, 46, 47, 48 p. 2 art. 346.43 Tax Code of the Russian Federation.

Here you need to fill in the following fields:

- TIN;

- page number;

- code of the subject of the Russian Federation;

- Federal Tax Service code at the place of work of the individual entrepreneur;

- object type code (codes are written at the bottom of the sheet under footnote “5”);

- object sign (codes are also written at the bottom of the sheet under footnote “6”);

- square;

- address (everything is simple here).

The application must be submitted at the place of registration of the individual entrepreneur's business. If an entrepreneur will work at his place of residence, then he must submit to the Federal Tax Service at his place of residence. You can do this through your personal account using an electronic digital signature, come and submit the application in person, send it by mail, or act through a proxy.

You can submit documents simultaneously with papers for individual entrepreneur registration.

The Federal Tax Service must make a decision on approval or refusal of the patent within 5 days from the date of receipt of the documents. The latter may occur in cases where the type of activity does not correspond to what can be carried out under a patent, the required amount has not been paid, the application has been filled out incorrectly, etc.

Therefore, before writing an application for a patent, you need to clarify whether your business meets the criteria for working on a PSN.

Let's take a closer look at how to fill out the form to switch to PSN. We will prepare a patent application (sample filling) using the example of an entrepreneur planning to provide services to the public for repairing, cleaning and painting shoes in St. Petersburg. The stated period of activity is ten months. Let's start filling out a patent application (filling out sample) with the title page. We indicate registration data for individual entrepreneurs for 2021:

- individual number (TIN);

- INFS code at the place of activity;

- full name of the individual;

- registration number (OGRNIP), indicated only if the individual entrepreneur registration certificate has already been issued;

- patent start date;

- patent expiration date;

- number of completed sheets.

The lower left block is intended to confirm the entered information, indicate a contact phone number and the date of submission.

You can switch to PSN immediately upon registering an individual entrepreneur. To do this, completed Form 26.5-1 is submitted along with other registration documents. However, there is a nuance here that not all applicants are aware of.

The fact is that a patent is valid only in a certain territory. Until 2015, such a territory was recognized as a subject of the Russian Federation (region, territory, republic). At the same time, for all settlements of one region, a patent cost the same, regardless of where the entrepreneur does business - in a regional center, district center or village. Now the territory of action is the municipality, with the exception of such areas as road transportation and distribution (distribution) retail trade.

Only individual entrepreneurs can work on a patent; companies are prohibited from using this regime. The list of activities for which PSN can be applied is listed in Article 346.43 of the Tax Code. In 2021, it went from mandatory to recommended. This means that each region can decide for itself what type of activity can be covered by a patent.

You can find out the types of activities of PSN from the regional law. If there is no point from Art. 346.43 of the Tax Code, you cannot obtain a patent for this. Explanations can be obtained from the Federal Tax Service.

To work on a patent, an individual entrepreneur must comply with the following conditions:

- An entrepreneur should not have more than 15 employees. Here, the number of employees is taken into account only by type of activity on the PSN, and not in total for all tax regimes, if the entrepreneur combines them.

- The annual income of an individual entrepreneur should not exceed 60 million rubles. When combined with other tax regimes, income is taken into account in total.

Related article: Pros and cons of PSN

On PSN, the tax is calculated based on potential income. That is, it is calculated how much an entrepreneur can earn by engaging in one or another type of activity. The amount of potential income is determined by each region, so it can vary greatly even in neighboring regions.

Cost of a patent per year: potential income (PE) × 6%.

When calculating the cost of a patent, in some cases, indicators such as the number of employees, the area of the sales or service area, the number of vehicles, and rental area are taken into account.

For hairdressing salons, the potential annual income on PSN in Moscow is 990 thousand rubles in 2021, and in Yaroslavl - 143 thousand. Accordingly, in the capital, a patent will be many times more expensive. In Moscow, the cost of a patent for a year will be 54,355 rubles, in Yaroslavl - 5,496 rubles.

From 2021, insurance premiums that individual entrepreneurs pay for themselves and their employees can be taken into account when calculating the cost of a patent. The principle of tax reduction is the same as for the simplified tax system Income:

- if an individual entrepreneur works on his own, he has the right to take into account the entire amount of contributions transferred for himself,

- if an individual entrepreneur has employees, the cost of a patent can be reduced by no more than 50%.

You can switch to PSN not only from the beginning of the year, but also in the middle. Entrepreneurs who are just going to register an individual entrepreneur can submit a patent application along with registration documents. You must submit an application to the tax office 10 working days before the start of application of the PSN. This can be done in person at the Federal Tax Service, by mail, TKS or through the personal account of an individual entrepreneur on the Federal Tax Service website.

A patent can be obtained for any period within a year. But the minimum validity period of a patent cannot be less than a month.

In 2021, there is only one patent application form, Form 26.5-1.

In some cases, tax authorities may refuse to issue a patent:

- The application indicates the type of activity in which it is impossible to work on a patent.

- The validity period does not meet the requirements of the Tax Code. For example, a period outside the calendar year is indicated: from March 1, 2021 to February 1, 2022.

- The individual entrepreneur has arrears in paying for other patents.

- Required fields are not filled in on Form 26.5-1.

Employment of foreign citizens is a procedure that requires special attention. An employer who hires such an employee, within 3 days from the date of concluding an employment contract with him, must send a notice of employment to the department of the Ministry of Internal Affairs of the Russian Federation located at the worker’s place of work.

The notification is issued according to a special template. This is present in Appendix 13 to Order of the Ministry of Internal Affairs of the Russian Federation No. 363 dated June 4, 2019. Notifications submitted in any other way will not be accepted.

When preparing and sending a document, it is important to avoid errors and corrections. The document, if any, is considered invalid. It is important to pay attention to the timeliness of sending the notification. If the 3-day deadline is violated, the head of the company is held accountable. A fine is imposed on him. In some cases, the company's activities are suspended for a period of 14 to 90 days.

Important! A labor patent is issued by foreign citizens who arrived from countries with which the Russian Federation has a visa-free regime and who wish to find employment in Russia.

For citizens arriving from some countries, even a patent will not be required. These are countries that are members of the Customs Union: Belarus, Kazakhstan, Armenia, Kyrgyzstan. Thus, citizens of Ukraine, Uzbekistan, Tajikistan, Abkhazia, Moldova and Azerbaijan will have to apply for a patent.

In order to obtain a work patent, a foreigner will need to provide a certain list of documents. One of them will be an identity card, which is officially recognized in Russia. This can be a national passport or a foreigner's passport. If this document is completed in a foreign language, you will need to prepare a translation into Russian and have it certified by a notary. You will also need to submit an application when applying. You can remember it by hand or on a computer, then print it out. The application form can be found on the official website of the migration service (GUVM of the Ministry of Internal Affairs of Russia), or you can fill it out when visiting this authority.

Important! The application must be filled out legibly, in Russian, without abbreviations or corrections. For convenience, you can use the filling template provided by the migration authority.

If information about education or work is included in the application, then it must be entered only on the basis of the documents presented. Accordingly, supporting documents on education will be: certificate, diploma, certificate and others.

In addition to the application, the following documents will be required to register a patent:

- Passport, translation of the passport into Russian, certified by a notary;

- TIN;

- Migration card;

- A document confirming registration with the migration authority;

- VHI policy;

- A certificate confirming the absence of dangerous diseases, as well as drug and alcohol addiction.

- A document confirming knowledge of the Russian language;

- Photo 3x4;

- Document confirming payment for the patent.

Important! You need to submit documents for a patent within 30 days from the date of entry into the Russian Federation. The migration authority will consider the documents for some time, after which a satisfactory or negative decision will be made. This will take about 10 working days in total.

Let's take a closer look at what documents are needed to obtain a work patent for a foreign person.