Tax authorities often use the concept of residence. We are talking about whether a legal entity or individual must pay taxes on all their income in the Russian Federation. Non-residents are foreign citizens/organizations that pay taxes only on activities in Russia. To facilitate interaction with the tax service, a taxpayer identification number (TIN) has been introduced. Let's find out how the TIN is assigned and what the TIN should be for non-resident legal entities.

What is a TIN and why does a non-resident legal entity need it?

Regulates the registration of foreign organizations with the tax authorities of the Russian Federation by Order of the Ministry of Finance dated September 30. 2021 No. 117n. This document obliges foreign legal entities operating in the Russian Federation to register with the Russian tax authorities. Tax inspectors are required to register such companies within 5 days and enter the relevant information about them into the Unified State Register of Legal Entities (USRLE) after receiving the relevant documents.

Simultaneously with registration, the tax payer is assigned a taxpayer identification number. It is not necessary to submit a separate application to obtain a TIN of a foreign legal entity on the territory of the Russian Federation.

The TIN is valid for the entire life of the organization and cannot be replaced, for example, when the address changes, etc.

In general, the TIN of a legal entity is a combination of 10 Arabic digits, in which:

- the first 4 digits indicate the place of registration of the organization, the initial 2 are the region code, the next 2 are the tax inspectorate code of the Federal Tax Service;

- the next 5 digits are OGRN (main state registration number), that is, the number of the entry in the state register made when registering a legal entity;

- the tenth digit is a verification digit and does not carry specific information.

For reference, let us inform you that the TIN of individuals is longer: it consists of 12 digits.

What is ITIN, what is it for and who needs it?

An analogue of the Russian TIN for individuals (in the USA ITIN) is a nine-digit number, the first digit of which is always 9, and the fourth and fifth can have a value in the range from 70 to 99. This identification number is assigned to foreign and local citizens of America for timely tax reporting at the federal level. .

The main department that issues ITIN is the IRS, on whose website detailed information is published about the TIN of the employer (legal entity) “EIN”, the individual “Itin” and the special number for those awaiting adoption in the USA “ATIN”.

What is Itin used for?

If you have a Social Security Number (SSN), then even as a foreigner, you have a number of advantages and benefits, but you cannot apply for an ITIN, which in general is not necessary. For non-residents, an ITIN can be used as an alternative to an SSN, but with fewer options.

Information: American-born persons, Green Card holders, work visa holders, and US citizens can obtain an SSN in the USA. This document gives full access to data, and in case of theft, the crime is regarded as Identity Theft (personal data theft).

ITINs are issued regardless of the applicant's immigration status and are not used for purposes other than US Federal tax reporting.

What opportunities (additionally) does ITIN give to a foreigner (non-resident individual):

- open a bank account in the USA;

- file your taxes with the IRS;

- obtain a driver's license, which became possible in 2021 in some US states where it is allowed to use an ITIN instead of an SSN;

- prove the place and duration of residence in America, which in some cases may be required by an immigrant;

- open a company in the United States;

- If the child has an SSN, ITIN-holder parents are eligible to receive Child Tax Credits (CTC), up to $2,000 based on the applicant's income.

ITIN cannot be the basis for:

- issuing SSN;

- American work permits and identity verification;

- The ITIN does not provide immigration status in the United States;

- In 2021, under the Coronavirus Aid, Relief, and Economic Security (CARES) Act of March 27, 2021, ITIN holders are not eligible for stimulus payments even if they filed their 2021 federal tax returns. To receive benefits, you will need to provide valid Social Security numbers for both spouses unless one is serving in the Armed Forces.

In short, ITIN allows: foreign individuals to remain within the legal framework of the American state even without citizenship of the jurisdiction, as well as to declare income, submit reports and pay taxes on property assets (apartment, car, etc.) and receive profit from investments in American companies.

Important! To register a company in the USA by a non-resident individual, it is enough to obtain an ITIN. If a company is formed by a foreign legal entity, a federal employer tax number (EIN) must be obtained to identify the business entity.

Who needs to get an ITIN?

If you are included in one of the presented categories of persons, then it is better to obtain an ITIN as quickly as possible:

- You are not eligible for an SSN or have not yet received one.

- There are US tax filing obligations.

- You are legally present in the United States and are one of the following categories of citizens: A nonresident alien who owns or invests in a U.S. business and receives taxable income from that business but resides in another country.

- An international student who qualifies as a US resident based on days spent in the country.

- Dependent spouse of a U.S. citizen or legal permanent resident.

- Dependent or spouse of a foreign citizen on a temporary visa.

Tax reporting in the USA is a mandatory procedure for all citizens, including non-residents of the state, who are conditionally divided into 2 groups:

- Those wishing to receive tax benefits.

- Conducting trade or business activities in the United States.

In the latter case, this also applies to foreign founders of companies living in a country that has concluded an agreement with the United States on unilateral payment of taxes in only one state.

Internationalwealth experts offer: legal support for the procedure for obtaining and restoring an ITIN, registering a company in the United States, obtaining permits to conduct business in the United States, as well as all related procedures, including citizenship by investment on an E2 visa , opening a bank account in the United States and choosing a bank in offshore.

How to get a TIN for a non-resident in the Russian Federation

If a foreign company plans to operate in Russia for 30 or more days a year (no matter whether it is a branch, representative office, bureau, agency or other division), it must register with the Federal Tax Service of Russia. The procedure will be carried out after submitting to the tax authority the papers specified in the Order of the Ministry of Finance dated June 30. 2021 No. 117n.

Required documents

An application for registration in Form No. 2001I must be submitted to the Federal Tax Service no later than 30 days from the date of commencement of activities in Russia. Along with the application the following must be submitted:

- Constituent documents of a foreign legal entity.

- A document confirming the status of the organization. Different countries have their own procedure for registering legal entities. The document provided must correspond in legal force to an extract from the register of legal entities of the country of origin of the foreign organization.

- A document from the tax authority of the organization’s country of registration stating that it is a tax payer there. The document must indicate the taxpayer code.

- The decision to create a division in the Russian Federation, adopted by the authorized body of a foreign legal entity, and the regulations on this structural unit. If there is no such paper, a contract or other document must be provided on the basis of which the foreign organization operates in the Russian Federation.

- A power of attorney issued in the name of the head of a department of a foreign legal entity, giving him the necessary powers.

- Documents confirming accreditation, if required by Russian law.

- Documents granting the right to use Russian subsoil if the company operates in this area.

All papers, unless otherwise provided by Russian laws or international treaties, must be legalized by affixing an apostille.

Duration and cost of the procedure

The division of the Federal Tax Service of Russia, to which a foreign organization has applied, is obliged to register the legal entity and assign it a taxpayer identification number within five days. In this case, the registration date will coincide with the day the application is submitted to the tax service.

Currently, the law does not provide for a fee for issuing a TIN for a representative office of a foreign company in Russia. That is, this procedure is free.

Financial abbreviations with translation

| Abbreviated term in Russian | Full name | Shortened version in translation | Full meaning in translation |

| BIC | Bank Identification Code | BIC | Bank Identification Code |

| TIN | Taxpayer Identification Number | ITN | Individual Taxpayer Number |

| SNILS | Insurance Number of Individual Personal Account | Insurance Number of Individual Ledger Account | |

| OGRNIP | Main State Registration Number of an Individual Entrepreneur | PSRNSP | Primary State Registration Number of the Sole Proprietor |

We will also consider the names of the main classifiers in two languages.

| OKPO | All-Russian Classifier of Enterprises and Organizations | OKPO | All-Russian Classifier of Enterprises and Organizations |

| OKONH | All-Russian Classifier of Sectors of the National Economy | OKONKh | All-Russian Classifier of Economy Branches |

| OKVED | All-Russian Classifier of Types of Economic Activities | OKVED | All-Russian Classifier of Types of Economic Activity |

Accreditation

In some cases, the legislation of the Russian Federation requires that the registered organization first undergo accreditation. This means obtaining a document from the authorized government bodies stating that the company is competent in the field of activity in which it is engaged. The concept of accreditation was introduced by Federal Law No. 412-FZ of December 28. 2021 The procedure is established by the following regulatory framework:

- Federal Law of July 9, 1999 No. 160-FZ.

- By order of the Federal Tax Service dated December 26. 2021 No. ММВ-7-14/

- Regulations of the Central Bank of the Russian Federation dated April 22. 2021 No. 467-P.

- By order of the Ministry of Transport dated 06.02. 2021 No. 25.

Accreditation consists of the following main stages:

- Collecting and completing the necessary documents and submitting an application.

- Payment of state duty.

- Consideration of the issue by an authorized body, in most cases this body is the Federal Tax Service.

- Making a decision on accreditation.

- Obtaining a document confirming accreditation.

What does checkpoint mean?

The registration reason code (RPC) is assigned to legal entities in addition to the TIN due to the fact that companies can be registered by tax authorities on different grounds:

- at the place of registration of the legal entity;

- at the place of registration of branches and separate divisions;

- at the place of registration of real estate;

- at the place of registration of vehicles owned by the company.

Accordingly, one company may have several checkpoints. This code does not contain information about whether its owner is a non-resident in the Russian Federation.

US Tax Number for Non-Residents

Because nonresident aliens (and some residents) cannot legally obtain an SSN, and because U.S. law requires tax identification on all federal tax returns, the IRS issues an ITIN for everyone else who owes taxes.

Spouses and dependents of ITIN holders must apply for their own number.

Unlike an SSN, an ITIN does not provide the right to work in the United States and cannot be used to identify an individual. It is also impossible to obtain social benefits or tax benefits on earned income using an ITIN. This number is assigned for federal tax processing only—nothing more.

For these reasons, the IRS does not issue a card with an ITIN like the SSA does with a Social Security Number.

Every taxpayer must have either an SSN or an ITIN, but cannot have both.

What can you find out from your TIN?

All taxpayer identification numbers of non-resident companies begin with the same 4 digits. The TIN starts with 99 - this is the code of the interregional tax office. Next come the numbers 09. It would seem that if you see the tax number 9909 at the beginning, you can understand that you are dealing with a non-resident. However, this is not the case; some Russian companies also have a Taxpayer Identification Number (TIN), which begins with these numbers. Accordingly, this method of determining non-residents is not reliable.

It will also not be possible to check a foreign company using its tax identification number. The fact is that this is an internal Russian code that facilitates interaction with the tax service. A qualitative check of a foreign counterparty involves obtaining information from foreign registers. Such information is available upon written request or via the Internet. In this case, it is better to contact legal agencies that specialize in inspections of this kind.

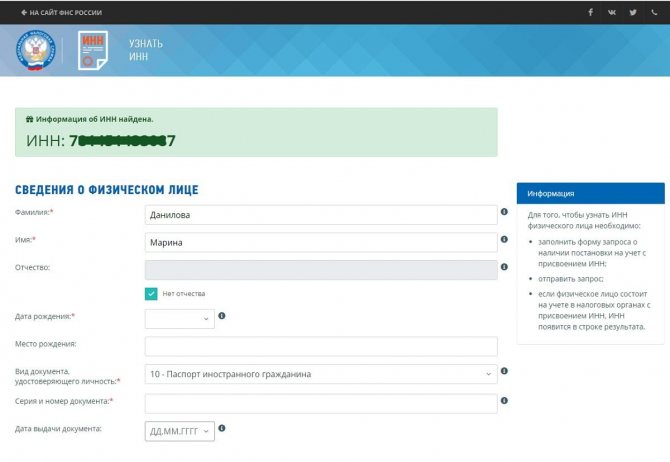

How to find out the TIN for a foreign citizen via the Internet?

It doesn’t matter whether you are a citizen of the Russian Federation or not, if you have been officially employed at least once or, for example, purchased real estate or transport in the Russian Federation, you already have a TIN. Even if you did not receive a certificate in your hands. You can quickly find out using the website of the Federal Tax Service of the Russian Federation. Actually, this site turns out to be the first in the proposed Yandex results if you enter the request “Find out your TIN”.

On the site you will be asked to consent to the processing of personal data - check the box at the bottom of the page. Then you will be asked to enter your passport information, and if you are listed in the Russian tax service database, the TIN number will appear in the upper left part of the site.

Please note: If you, as a foreign citizen, have changed your passport, then you will not be able to find out the number through the FSN website, because you need to enter into the system exactly the personal data that was relevant at the time the TIN was issued.

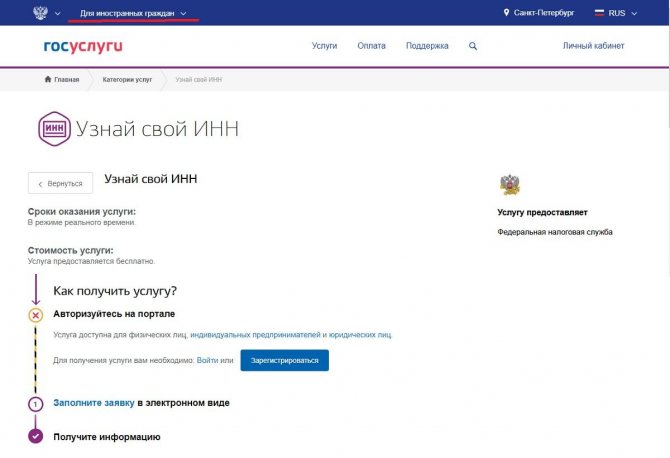

In the same way, you can find out your TIN on the State Services website, but only if you have a personal account there. On this portal it is possible to check only your own TIN.

You can find out your TIN only by identifying documents: passport, international passport (in the case of foreigners) or residence permit. It is impossible to find out the tax number using SNILS or a patent.

TIN does not belong to the category of personal data, so anyone who has access to a person’s passport can find it out. However, there is no danger in this - knowing the TIN, you can only check what kind of property a person owns and how much taxes he pays. So, if you are a law-abiding citizen, nothing can be done with this data.

How to find out whether a legal entity is resident or non-resident

Non-residents of the Russian Federation can be easily identified by bank account numbers: they start with the following combinations:

- 40804 (ruble accounts of type “T”);

- 40805 (ruble accounts type “I”);

- 40806 (conversion accounts “C”);

- 40807 (non-resident accounts);

- 40809 (investment accounts);

- 40812 (project accounts);

- 40814 (convertible accounts “K”);

- 40815 (non-convertible accounts “N”);

- 40818 (currency accounts).

Residents of Russia are not assigned such numbers.

There are other verification methods.