Income tax

The percentage rate of income tax (NDFL) is not affected by citizenship, but by whether a person is a tax resident of the Russian Federation or not. For residents, personal income tax is set at 13%, for non-residents - 30%.

A resident is considered a person who stays in Russia for at least 183 days during the year. That is, when hiring a foreign citizen, the employer pays 30% personal income tax for him during the first half of the year. If at the end of the tax period this employee acquires resident status, a recalculation is made and then the rate is reduced to 13%.

However, there is a large block of exceptions. Thus, citizens of the EAEU countries, HQS, refugees, foreigners with a work patent and participants in the resettlement program pay 13% income tax starting from the first day of work in Russia, regardless of their tax status.

Personal income tax for foreign workers. Photo: migranturus.com

True, there is one BUT about citizens of the Eurasian Union: if at the end of the year such an employee does not become a resident, then the income tax will be recalculated at a rate of 30%. This is stated in Letter of the Ministry of Finance N 03-04-06/34256.

For example: an Armenian citizen comes to Moscow and gets an official job. From the very first month, the employer pays 13% personal income tax for it. If he serves in this place for more than 6 months, then there will be no questions. However, if he quits after 3 months and returns home, at the end of the year his personal income tax will have to be recalculated at 30%.

Also note that non-residents are not entitled to tax deductions, even if they pay 13%.

Is freelancing more profitable than working in an office?

The tax amount is not a fixed amount, but is calculated based on transport information:

- Group (land, air, water transport);

- Period of use;

- Tax base, which depends on engine power, capacity;

- Type of transport (car, truck, motorcycle, etc.).

Depending on the type of vehicle and the power of its engine, basic tax rates are established, but regional authorities can increase them at their discretion.

Important

To calculate the tax amount, multiply the tax rate and engine power.

For example, for Moscow for cars with power up to 100 hp.

The bet is 12.

If the car you own has 90 hp, then the tax amount will be: 90x12=1080 rubles.

Thus, when determining the tax status of an individual, an organization must take into account the 12-month period preceding the date the individual received income, including those that began in the previous calendar year.

If on the date of payment of income the employee is recognized as a tax resident of the Russian Federation, his income from sources in the Russian Federation is subject to taxation at a rate of 13 percent.

That is, a residence permit confirms the right of an individual to reside in the Russian Federation, and is not a document confirming the actual time of his stay in the country. When determining the tax status of an employee of an organization, the actual time of his stay in the Russian Federation is taken into account, which must be documented.

Let’s imagine that you were credited with 30 thousand rubles. How much taxes and contributions will be withheld from this amount?

| Payment type | % of salary | Amount from 30 tr. |

| Income tax | 13% from accrued salary | 3900 rub. |

| Contributions to the Pension Fund | 22% | 6600 rub. |

| Contributions to the Social Insurance Fund | 2,9% | 870 rub. |

| Contributions to the Federal Compulsory Medical Insurance Fund (for medicine) | 5,1% | 1530 rub. |

| Contributions for insurance against accidents and occupational diseases (AS and PP) | from 0.2% (depending on the type of activity) | from 60 rub. |

| Total: | 12960 rub. | |

In some industries, accident insurance premiums may be higher, for example if a person works in a hazardous workplace. We took the minimum tariffs into account.

In total, from our conditional salary, the employee and employer will pay 12,960 rubles. The employee will receive 26,100 rubles. (30 thousand – 13% personal income tax).

It turns out that in total the paid salary and taxes amounted to 26,100 12,960 = 39,060 rubles. Of these, 26,100 rubles. the employee received, and 12,960 rubles. - state.

If we take the amount for the year, the employee will receive 313,200 rubles, and the state – 155,520 rubles. In total, these figures will amount to 468,720 rubles.

What happens if you don't pay taxes? How does the tax office find violations?

Let's imagine that the same amount is 468,720 rubles. You made money as an individual entrepreneur on a simplified basis. How much taxes will you pay? We count:

- Simplified tax (6% of turnover) = 28,123 rubles.

- Contributions to the Pension Fund of the Russian Federation and the Federal Compulsory Medical Insurance Fund = 22,261.38 rubles. from turnover up to 300,000 rub. and 1% above this amount, resulting in 22261.38 1687.20 = 23948.58 rubles.

We invite you to read: Tax liability under the Tax Code of the Russian Federation in 2020

But that is not all! Simplified workers without employees can reduce the payment of 6% tax on the amount of contributions to the Pension Fund of the Russian Federation down to zero. Thus, our individual entrepreneur will pay 23,948.58 rubles to the Pension Fund of the Russian Federation and the Federal Compulsory Medical Insurance Fund, and will transfer only 4,174.42 rubles to the tax office.

In total for the year of all taxes, our simplifier will pay 28,123 rubles. Compare this with the amount of taxes for a person working in an office - 155,520 rubles. A simplifier will pay 127,397 rubles from essentially the same income. less!

Is it profitable to work as a freelancer-individual entrepreneur on a simplified basis? Very profitable. Is it profitable for clients to hire freelancers? Certainly. Is it profitable to switch to freelancing from the office? Yes, because you can put the tax savings into your pocket and essentially earn 40% more with the same skill level.

We recommend

Financial literacy is the level of knowledge in the field of finance, personal savings and how to manage them. In this article we will cover the basics...

Many freelancers use card-to-card transfers to receive money from clients. In this article I will tell you why you shouldn’t do this and...

to the Pension Fund of the Russian Federation - 22% (clause 1, part 1, article 5, article 58.2 of Law No. 212-FZ); 2) to the Social Insurance Fund of the Russian Federation - 2.9%; 3) to the Federal Compulsory Medical Insurance Fund - from January 1, 2012.

- 5.1%. But for certain categories of insurance premium payers during the transition period 2011 - 2027. Reduced tariffs established by Art. 58 of Law No. 212-FZ. If the policyholder applies reduced rates of insurance premiums to the Pension Fund, contributions must be calculated at the same rates in relation to foreign workers (Letter of the Ministry of Health and Social Development of Russia dated March 15, 2012 No. 19-6/3012573-1842)

Info

Taxation of foreign workers in 2021: contributions The procedure for calculating insurance premiums that the employer is required to pay depends on the migration status of the foreign worker. What taxes does the employer pay for a foreign worker? In particular, from charges in favor of a remote worker located, for example, in Australia, you should pay insurance premiums for social insurance against accidents at work and occupational diseases, because How personal income tax is withheld from foreign workers in 2021 To temporarily carry out activities, a foreigner is required to have a work permit (if he arrived on a visa) or a patent (if a visa is not required). The period of temporary stay in Russia will determine the validity period of the corresponding document.

Important This period may be extended.

temporarily staying in Russia - insurance contributions in the amount of 22% for the insurance part of the labor pension, regardless of the year of birth; no accrual is provided for the funded part; temporarily residing in Russia - for the insurance part of the TP in the amount of 22%, regardless of the year of birth, there are no charges for the funded part;

Insurance premiums

In addition to income, Russian employers transfer monthly insurance contributions from payments to employees. Contributions go to different funds and are intended for different purposes:

- pension;

- health insurance;

- insurance in case of maternity or temporary disability (VNIM);

- insurance against accidents at work or occupational diseases.

Pensions are in charge of the Pension Fund, medical insurance is in charge of the Federal Compulsory Medical Insurance Fund, and insurance of accidents at work is in charge of the little-known FSS. PHOTO: fss.ru

The status of a foreigner affects what contributions are assessed to him.

- Pension contributions (22%) and insurance in case of temporary disability (1.8%) are deducted from payments temporarily staying foreigners

- Pension (22%), medical insurance (5.1%), and VNiM insurance (2.9%) are deducted from payments made temporarily (TRP) or permanently (PRP) to IG residents as well as residents of the EAEU

- Pensions (22%) and VNiM (2.9%) are deducted from payments to highly qualified specialists

What tax does a foreign citizen pay with a residence permit?

Residents in Russia Please note: if an employee is not recognized as a tax resident of the Russian Federation, his income from sources in the Russian Federation is subject to taxation at a rate of 30%.

Answer: A citizen of Bulgaria who has a residence permit in the city.

Moscow, according to Russian legislation, has the status of “permanent resident” in relation to the payment of insurance premiums, which are calculated in the general manner, as for Russian citizens.

For payments made to a foreigner (citizen of Bulgaria), the Russian employer is a tax agent for personal income tax.

Content

TD for at least six months or for an indefinite period. Insurance contributions to the Compulsory Medical Insurance Fund from payments in favor of foreign workers The third law is Federal Law No. 326-FZ of November 29, 2010 “On Compulsory Medical Insurance...” According to the provisions of Law 326-FZ, foreign citizens, as well as stateless persons, are subject to insurance temporarily or permanently residing in the territory of the Russian Federation.

The text of the law does not mention persons temporarily staying in the territory of the Russian Federation, therefore, insurance contributions to the health insurance fund are not accrued on their income. Insurance contributions to the Compulsory Medical Insurance Fund, upon concluding an employment contract, are accrued for payments in favor of the following foreign workers: temporary residents - in general order;

It is generally accepted that an employee pays only income tax on his salary, which in Russia is 13% of the accrued salary. The remaining taxes and contributions for the employee are “sort of” paid by the employer. But this is on paper, but in fact, taxes come from the income that the employee brings to the company - and it turns out that all taxes and contributions are paid out of the employees’ pockets in any case. It’s just that employees see some taxes, while others don’t.

In addition to the income tax, which everyone knows about, the following is paid from salaries:

- Contributions to the Pension Fund;

- Contributions to the Social Insurance Fund (SIF);

- Contributions to the Federal Compulsory Medical Insurance Fund (FFOMS).

We suggest you read: How many weeks do people go on maternity leave?

Let's look at it in order, how much will you ultimately pay in taxes and contributions on a salary of 30 thousand rubles?

To employ a foreigner, the employer must obtain permission from the territorial bodies of the Ministry of Internal Affairs of the Russian Federation.

Otherwise, you will have to pay a fine of 1000-2000 rubles.

If the authorized body gives the go-ahead to issue a permit, you must pay 3,000 rubles.

state duties for each such employee. This amount can be included in the company's expenses, which will reduce the amount of taxable income.

It is imperative to take into account the norms of existing international agreements, which can significantly affect the procedure for calculating and paying taxes.

What is a subject of taxation

Property tax

Property tax in the Russian Federation implies an annual fee for owned real estate. A complete list of objects that the Federal Tax Service recognizes as real estate can be found in Article 401 of the Tax Code of the Russian Federation.

The amount of payments depends on things like the rate and tax base. The latter refers to the value of the property. But what is taken into account is not the amount specified in the purchase and sale agreement, but the cadastral value established by government agencies.

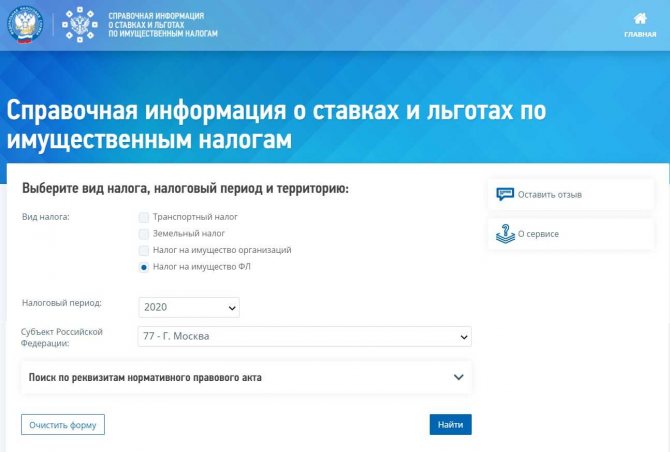

But you don’t need to deal with this yourself, since each region of the country sets it independently, but not higher than 2%. To find out what percentage applies in your case, just go to the Federal Tax Service help page, select the type of taxable object and the region of Russia. Citizenship and foreigner status do not affect the amount.

By clicking “Find” you will be taken to a page with information about the legislation in force in your region. If you click “Details”, the table of rates will open. Screenshot of the official website page.

Please note : A rate of 2% applies to objects over 300 million rubles. For others, this figure varies between 0.1-0.5%.

The fee paid upon the sale of real estate relates to personal income tax, which means it is determined by the presence of residence. If you own real estate in our country, but do not live here permanently (183 days a year), then you will have to pay 30% upon sale. However, the tax is not paid at all if the property was purchased 5 years ago or received as a gift/inheritance 3 years ago.

Russia has concluded agreements with many countries to avoid double taxation. This is done so that the duty on the sale of an apartment paid in the Russian Federation is counted in the state of citizenship of the foreigner, and he does not have to pay twice.

Land fee

The amount of land tax does not depend on the citizenship of its owner. Taxpayers are everyone who owns land by right of ownership, perpetual use or lifelong inheritable possession. Land tenants do not pay such a fee.

Payment occurs once a year, before December 31st. The cadastral value of the site is taken as the initial base, and the rate is set by local municipal authorities. However, it cannot exceed:

- 0.3% in relation to agricultural land, plots for personal farming, gardening or vegetable gardening, plots occupied by housing and infrastructure;

- 1.5% for other lands.

Transport tax

If a foreign citizen has a vehicle registered in Russia, he is obliged to pay tax for it in accordance with the general procedure. Vehicles include not only cars, but also any other types of land, water and air vehicles. For example, jet skis, snowmobiles and scooters.

Taxes are paid on any vehicle. PHOTO: unsplash.com

The percentage is set depending on the engine power. Each subject of the Russian Federation has the right to set the amount of the obligatory payment, but it cannot be more than 10 times higher than the base figure specified in Article 361 of the Tax Code of the Russian Federation.

The transport fee is paid once a year, before December 1.

If you drive a car or other vehicle under a power of attorney, then you are considered the payer of the transport duty, and not the owner of the car.

Subscribe to Migranta Rus: Yandex News.

Salary tax calculation

Convenient service for filling out tax returns What is the procedure for taxing foreign citizens Conventionally, all foreigners can be divided into groups: Taxation of foreign organizations in the Russian Federation: types and features

- those who are in Russia but do not have permission or residence permits;

- with a temporary residence permit in the Russian Federation.

- citizens with a residence permit;

Procedure for taxation of foreigners An employer, in order to employ a foreigner, must obtain permission from the territorial bodies of the Ministry of Internal Affairs of the Russian Federation. Residence permit and income taxation What is a residence permit A residence permit is a document confirming the right of a foreign citizen or stateless person to permanent residence in Russia, and also the right to free exit and entry into the country (Clause 1, Article 2 of Federal Law No. 115-FZ of July 25, 2002).