How to open an individual entrepreneur for a foreign citizen

Of course, there are additional conditions for registering an individual entrepreneur by a foreign citizen. One of these conditions is that simultaneously with the registration of an individual entrepreneur, a foreign citizen must obtain a work permit. This requirement is established by paragraph 15, clause 1, article 2 of Law No.

State registration of a foreign citizen as an individual entrepreneur is carried out at the tax office at the place of residence (Clause 3, Article 8 of Law No.). The place of residence of a foreigner is the address of his temporary residence (registration), which is indicated on a mark (stamp) of the established form in an identity document (insert), or in a separate document.

Registration of an individual entrepreneur with a residence permit

When registering as an individual entrepreneur, a residence permit is the main document confirming the legality of a foreign citizen’s long stay in the Russian Federation. Having this crust in hand, registering as an individual entrepreneur will not be difficult. What else does a residence permit give to foreigners?

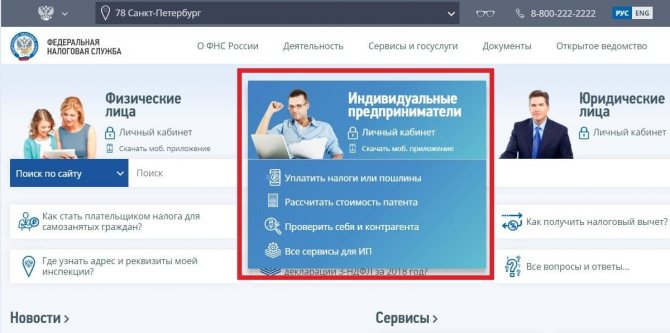

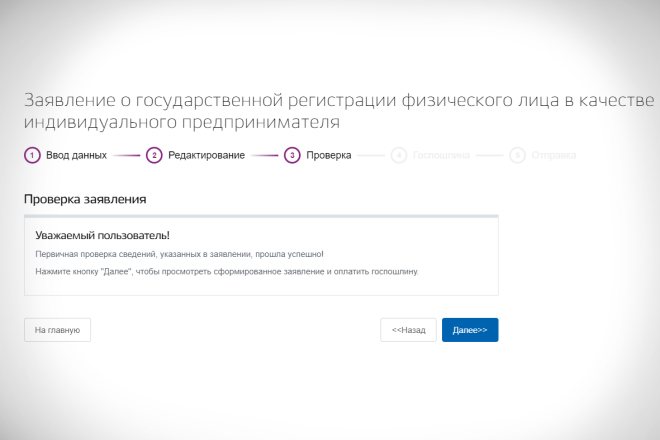

The first thing you need to do is to correctly fill out the application on form No. P21001 (applications can be found on the tax website). The application form is not complicated; you can fill it out by hand or on the computer. The most important thing at this stage is to correctly indicate the OKVED code. Be sure to look in the directory before you enter the numbers on the form.

Foreign citizens fill out the full name column in Latin letters, in full accordance with the entry in the foreign passport. State codes according to OKSM.

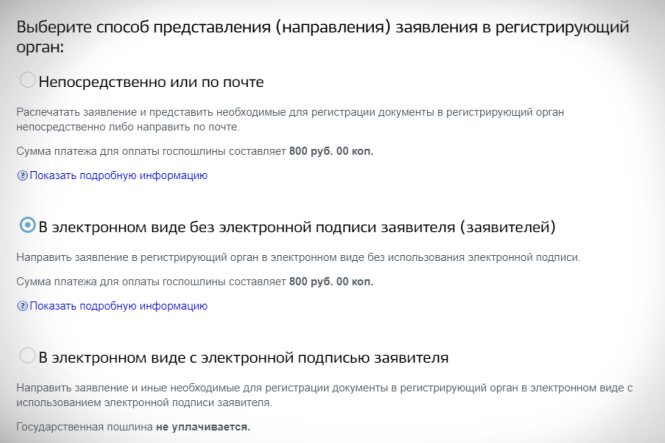

The second step is collecting the necessary documents and paying a state fee of 800 rubles. However, from January 1, 2021, you do not need to pay a fee if you send documents electronically through the MFC or a notary. Among the required documents:

- passport with a notarized translation;

- Residence permit and its copy;

- patent or work permit (if required in your case);

- a certificate of no criminal record and a medical record (if you are going to work with children or in the provision of medical services);

- statement.

When registering as an individual entrepreneur, it is important to choose a favorable type of taxation. If your choice fell on a simplified taxation system, then the application to switch to the simplified tax system must be submitted along with all other documents.

The third stage is the submission of a package of documents. This can be done in person by contacting the MFC or the Federal Tax Service branch at the place of registration. Either remotely, by sending documents by mail or using the electronic service of the Federal Tax Service.

Government authorities will consider your application within 3 working days. If everything is in order with the documents, after this period you will receive a USRIP sheet.

This is what the USRIP sheet looks like

Previously, registration as an individual entrepreneur could be canceled if the residence permit expired and the citizen did not renew it on time. However, those who received a residence permit after November 2019 no longer care about this issue, because from that moment on, the Russian Federation begins to issue permanent residence permits.

Subscribe to Migranta Rus: Yandex News.

Taxation of foreign workers

- highly qualified specialists (clause 3 of article 224 of the Tax Code of the Russian Federation);

- foreign employees who are tax residents of the Russian Federation (clause 3 of Article 224 of the Tax Code of the Russian Federation);

- foreign workers who temporarily stayed in Russia on a visa-free basis and work on the basis of a patent (clause 3 of Article 224 of the Tax Code of the Russian Federation);

- foreign employees recognized as refugees or granted temporary asylum in Russia (clause 3 of Article 224 of the Tax Code of the Russian Federation);

- foreign workers who are representatives of the EAEU member countries (Belarusians, Kazakhs, Kyrgyz, Armenians) (Article 75 of the Treaty on the Eurasian Economic Union of May 29, 2021, clause 1 of Article 224 of the Tax Code of the Russian Federation).

The income tax on foreign workers who are not tax residents of the Russian Federation (that is, actually staying in Russia for less than 183 calendar days within 12 consecutive months) is calculated at a rate of 30% (clause 2 of Article 207, clause 3 of Art. 224 of the Tax Code of the Russian Federation).

What is needed to obtain IP

As already noted, to register an individual entrepreneur, you first need to obtain a temporary residence permit or residence permit. Then follows:

- collect the necessary documents;

- pay the state fee;

- provide the Federal Tax Service or the multifunctional center (MFC) at the place of registration with an application and relevant documents (in person, by mail, online, through a representative by proxy);

- choose a tax system;

- obtain a certificate of registration of individual entrepreneurs.

Required documents

To register an individual entrepreneur, you must submit to the tax service:

- application (you can also fill it out online on the official website of the Federal Tax Service https://service.nalog.ru/gosreg/#ip);

- a copy of an identification document (passport/refugee ID/certificate of temporary asylum);

- a copy of the birth certificate (required if other documents provided do not indicate the date and place of birth);

- a copy of the temporary residence permit or residence permit;

- a document (original or copy) recording the place of residence on the territory of the Russian Federation (registration);

- a copy of the taxpayer identification number (TIN);

- receipt for payment of state duty.

All documents must be translated into Russian. According to clause 2 of Article 22.1 of the Federal Law of 08.08.2001 (as amended on 03.08.2021) No. 129-FZ, notarization is not necessary.

You can register as an individual entrepreneur, as well as carry out relevant activities only at the place of registration of temporary residence or residence permit.

That is, a foreigner who has received a temporary residence permit in St. Petersburg can register as an individual entrepreneur and engage in business only in this city.

In addition to the USRIP entry sheet, a foreign citizen, in accordance with Federal Law dated July 25, 2002 (07/19/2021) No. 115-FZ, is required to obtain a work permit. Since Armenia joined the Eurasian Economic Union in 2021, its citizens do not need to obtain this permit.

Nuances of registering an individual entrepreneur in Russia for a foreign citizen

Legal entities are commercial enterprises opened with the participation of the capital of the founders. Opening a legal entity assumes that the owners bear financial responsibility within the authorized capital, can open representative offices and branches, maintain full document flow and bear the full tax burden. Citizens of Russia and foreigners can establish an organization in the Russian Federation, but registration seems much more complicated than opening an individual entrepreneur.

The Bank of Russia instruction allows Russian banks to open a balance sheet account for a non-resident individual entrepreneur and deposit accounts for foreign individual entrepreneurs, however, this procedure is not mandatory for individual entrepreneurs.

What is the taxation procedure for foreign citizens?

It is believed that if a citizen spends a significant part of the year in another country, the center of his financial interests is located here. For such cases, taxation of foreign citizens involves the payment of taxes to the budget of a given state. For foreign citizens located on the territory of a foreign state, the legislation establishes the mandatory payment of income tax.

For correct taxation and accounting of payments to a foreigner, it is very important to know his legal status. The status of a foreigner can be confirmed through various documents, depending on the situation (for example, a residence permit).

Bottom line

A foreign citizen has the right to act on the territory of the Russian Federation as an individual entrepreneur. But the main condition will be the presence of a temporary residence permit or residence permit in the region chosen to start commercial activities. But at the same time, a foreigner does not have the right to register a legal entity.

When collecting documents to submit an application for registration, you will need to pay attention to some nuances.

Otherwise, the rights of a foreign citizen to engage in business are no different from the rights of a citizen of the Russian Federation.

Features of individual entrepreneur registration for foreign citizens

- Civil passport, photocopy of this document. If documents are submitted using postal services, then the passport must be photocopied, the photocopy flashed, and only then sent to the Federal Tax Service.

- TIN is an individual number assigned to a tax payer. The certificate can be issued at the tax office or on the official website.

- A receipt confirming payment of the state fee. The amount is 800 rubles.

- Application for state registration. It is compiled by every potential entrepreneur - Russian, foreigner, and stateless person.

- Application for the taxpayer to switch to the simplified tax system. Its preparation allows you to switch to a convenient tax system, which allows you to reduce tax time and simplify the preparation of reports.

Should a foreigner open a current account in 2021 in order to operate as an individual entrepreneur? The rules for conducting business as a businessman are the same for foreigners and citizens of the country, therefore, opening a current account is not mandatory.

Features of the status of individual entrepreneurs in Russia

An individual entrepreneur is something like an intermediate link between an individual and a legal entity. Most often, this form is used for running a small business. A person who has registered an individual entrepreneur receives the right to conduct business activities with all the ensuing consequences:

- can open bank accounts and take out loans for business development;

- has the right to its own seal and trademark;

- can hire employees by concluding civil contracts with them;

- has the right to participate in tenders for the execution of government orders;

- has the right to use government programs to support small businesses.

Along with the rights, an individual entrepreneur also acquires certain responsibilities, including:

- timely payment of taxes;

- obtaining the necessary licenses, if necessary (the list of activities requiring licensing can be found here);

- compliance with safety standards and regulations;

- bearing responsibility for assumed obligations;

- payment of pension insurance contributions for hired employees.

A number of obligations are imposed on individual entrepreneurs in Russia

This video is unavailable

After the adoption of Federal Law 422, many entrepreneurs began to think about how to use this innovation to their advantage. There are different tax optimization schemes. Today we will discuss just one very simple, but on the verge of a foul. Self-employed citizens are used instead of hired employees. It is legally prohibited to use as self-employed people who have been on your staff for the last 2 years.

5 points that should not be forgotten: 1. There are no social guarantees. 2. You pay self-employed people for the end result. 3. There are no job descriptions or positions. 4. There is no need to provide working conditions for the self-employed. 5. The self-employed is not obliged to comply

We recommend reading: Sample commercial proposal for cargo transportation

Taxation of a foreign worker in 2021

1 Article 207 of the Tax Code of the Russian Federation). The employing organization as a tax agent is entrusted with calculating and withholding personal income tax. In order to understand what tax rate to charge, you must first figure out whether he is a tax resident. Let us remind you that an employee, regardless of citizenship, will be considered a tax resident if he has been in Russia for at least 183 days during the last 12 months.

For more information about all the changes to the KBK that will take effect from 2021, read our material. By order of June 20, 2021 No. 90n, the Ministry of Finance of the Russian Federation introduced changes to the instructions on the procedure for applying the budget classification of the Russian Federation, approved by order of the Ministry of Finance back in 2021 No. 65n.

Taxes under a contract with a foreign citizen

- Preamble. This is the introductory part of the contract, which presents the identifying data of the counterparties. In this section, it is necessary to indicate the citizenship of the foreign worker, as well as details of documents giving the customer the right to use foreign labor, and the foreign contractor to work in the Russian Federation.

- Subject of the agreement. This is one of the mandatory sections, which determines the composition and scope of work for the execution of which the transaction is concluded.

- Deadlines. With regard to the start and end periods of work, the section is mandatory.

- Rights and obligations of counterparties.

- Price and payment procedure. In accordance with the Law “On Currency Regulation and Currency Control” dated December 10, 2021 No. 173-FZ, a list of cases in which legal. persons can make payments to foreign employees in cash, is limited (part 2 of article 14). In this regard, the procedure for settlements under a contract with a foreigner, as a rule, provides for the transfer of funds to a current account.

- Signatures and details of the parties.

- If the contractor is a resident of the Russian Federation, that is, lives in Russia for at least 183 days continuously during the year on the date of receipt of income (clause 2 of Article 207 of the Tax Code of the Russian Federation), the amount of income tax is:

- for residents - 13%;

- for non-residents - 30%.

- If the contractor is a citizen of a country that is a member of the Eurasian Economic Union, then personal income tax for him is calculated at a rate of 13%, even if he is not a resident of the Russian Federation (Article 73 of the Treaty on the EAEU). Members of the EAEU, in addition to Russia, are:

- Belarus;

- Kazakhstan;

- Armenia;

- Kyrgyzstan.

- An income tax of 13% is also established for the following categories of foreigners:

- highly qualified specialists;

- refugees;

- received temporary asylum in the Russian Federation;

- working under a patent.

- If there is an application from the contractor and a notification from the tax authority, the amount of personal income tax for patent workers can be reduced by the amount of payments for the patent paid in the current year (clause 6 of Article 227.1 of the Tax Code of the Russian Federation and letter of the Federal Tax Service dated March 22, 2021 No. BS-4 -11/ [email protected] ).

Insurance premiums from foreigners in 2021 - 2021

1. Annual payment for compulsory pension insurance for income not exceeding 300,000 rubles. for the year, will be equal to 29,354 rubles. in 2021. If the income turns out to be more than 300,000 rubles, an additional 1% will be charged on the amount exceeding 300,000 rubles. The total amount of payments cannot be more than 8 times the fixed annual payment 29,354 × 8 = 234,832 rubles. in 2021.

We recommend reading: How the northern pension is calculated when traveling to the south

1. Neither paragraph 1 of Art. 7 of the Law “On Compulsory Pension...” dated December 15, 2021 No. 167-FZ, establishing the need for compulsory pension insurance (OPS) for all persons working both under contracts (labor or civil employment) and as individual entrepreneurs, except those temporarily in the Russian Federation highly qualified specialists.

Can a foreign citizen open an individual entrepreneur in Russia?

In the case of a positive decision, the foreigner will receive a certificate of state registration; in the case of a negative decision, a decision on refusal indicating a specific reason: such and such a document is missing; application P21001 was filled out incorrectly; documents were submitted to the wrong registration authority; there is no notarization, etc. It happens that registration of an individual entrepreneur of a foreign citizen is impossible, because the court previously deprived him of such a right. There may be other problems.

An unjustified refusal of state registration can be challenged in a higher tax office or court, but it is better to immediately approach the issue of preparing documents with full responsibility. A good way is to use our free service for registering an individual entrepreneur.

What to do after registration?

After registration, a foreigner must choose a taxation option (classical system or simplified). You will also need to open a bank account. If a trading company is opened, a cash register is also registered.

Choosing a tax system

With a small number of employees, the individual entrepreneur is faced with the choice of a system: the simplified tax system “Income”, which is beneficial for everyone with a small amount of expenses, or the simplified tax system “Income minus expenses” for large expenses of the individual entrepreneur. When working under the simplified tax system, they submit a declaration and pay a single tax.

To switch to the simplified tax system:

- Submit a notification to the tax office within a month after registration (a sample can be downloaded here).

- Get confirmation of your choice from the tax office.

If there are a large number of employees, they apply for a UTII system, which is reduced by insurance premiums. To switch to UTII, a notification is also submitted to the tax office, but in a shorter period of time - within 5 days (a sample can be downloaded here).

Foreigners with a residence permit also choose the patent tax payment system (PSN). This is a convenient way, especially for those who do not plan a long-term stay in Russia. According to PSN, there may be restrictions in the form of types of activities, premises size and other business conditions.

Features of PSN:

- Buy a patent for up to a year and not pay taxes at all. The patent system is chosen if the individual entrepreneur has less than 15 employees and an annual income of no more than 60 million rubles.

- Notification to the fiscal authorities is not required. Submit an application to your tax office (a sample can be downloaded here).

When filling out an application for PSN, select the patent term. Indicate also whether you will hire staff or not, and what their average number is. The rate for PSN is 6%, but if tax holidays apply, then 0%.

Notification of commencement of activities

According to Law No. 294-FZ, individual entrepreneurs, including those created by foreigners with a residence permit, are required to notify about the start of work. All trading companies, hotels, individual entrepreneurs providing services, carriers, clothing and footwear studios, producers of milk and other products, travel agencies and many others must notify about this.

Interesting article: Instructions for filling out the form for a residence permit in 2021

The notification is submitted before the start of the activity (a sample can be downloaded here). Attached to it is a copy of an extract from the register of individual entrepreneurs and a certificate of registration with the tax office. The notification can be submitted through the MFC (“My Documents”). No state fees are paid.

Opening a bank account

A foreigner can easily open a bank account. Money will flow into it, plus taxes and other expenses of the entrepreneur will be paid from it. When opening an account, show registration in the Russian Federation (at your place of stay or residence).

To open an account you need:

- passport and residence permit;

- OGRNIP and registration certificate.

An agreement to open an account is drawn up, access to the Internet bank is opened and the first amounts are deposited. If the entrepreneur has problems, seizures and penalties may be imposed on the same account.

When can registration of an individual entrepreneur with a residence permit be denied?

They will refuse in the case of an expired residence permit, incorrectly submitted documents, or a court decision banning a foreigner from carrying out certain activities on the territory of the Russian Federation. The decision to refuse always indicates the reason with reference to the law.

If desired, a foreign individual entrepreneur can appeal the refusal in court. If the decision is in his favor, the registration authority enters him into the register of entrepreneurs.

A foreigner with a residence permit can open an individual entrepreneur. He is subject to special requirements for crossing the border and the need to notify about his income and place of stay (residence) in the Russian Federation. The individual entrepreneur will exist exactly until the moment the residence permit exists.

Employment of foreign citizens: features of 2021

The invitation is issued within twenty days. Upon receipt, a fee of 800 rubles is also paid. Then a package of documents is submitted (usually it includes a photograph of the employee, a copy of his passport and a statement from the employer). After reviewing the application, the Ministry of Internal Affairs issues a permit, for which an additional 3,500 rubles are paid to the treasury. The invitation is then sent to the foreign worker.

It should be recalled that such unscrupulous actions can result in large fines for the employer and harm to his business. Therefore, one should not forget about the legal status of foreigners and the legal rules for their employment, taking into account the latest changes made to legislative norms.

How to register an individual entrepreneur?

Registration of an individual entrepreneur for a foreigner with a residence permit is practically no different from the standard procedure. Provide your residence permit, and otherwise the procedure is the same as for Russian entrepreneurs.

Interesting article: About temporary residence permits for citizens of Kazakhstan

Required documents

To register an individual entrepreneur, collect a small package of documents. Officials are mainly interested in the legality of staying in Russia.

To register an individual entrepreneur the following is provided:

- statement;

- residence permit;

- international passport;

- registration certificate;

- receipt of payment of state duty.

Where to contact?

The collected documents are submitted to the tax registration office at the place of stay or residence (for example, in the capital this is Federal Tax Service Inspectorate No. 46). You can also enter the package into the MFC (“My Documents”).

Filing an application

Completing the application is the most important stage of the process. Carefully and in Russian, enter information in each column, indicating your personal data, place of registration, type of business and all other information.

Don't forget to enter your email address. You will receive confirmation of registration.

The application can also be submitted through a notary office with certification.

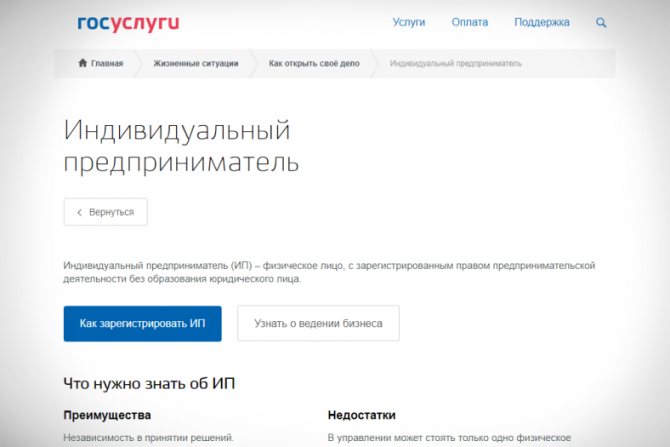

An individual entrepreneur can be registered via the Internet only if there is an electronic signature. To apply online:

- Go to the website gosuslugi.ru and select the section dedicated to entrepreneurship.

- Click “Apply” and fill out the online form.

- Sign the digital signature form and send it to the tax office.

Registration procedure

To register, follow a simple procedure:

- Submit the package of documents to the employees of the relevant authority.

- Pay the state fee.

- Get a receipt from the officials.

- In three days everything is ready. Information about a foreigner appears in the Unified State Register of Individual Entrepreneurs.

An individual entrepreneur receives his registration number (OGRNIP) and a registration certificate. These are his main documents for doing business.

What is your registration?

Registration at the place of residenceRegistration at the place of stay

Timing and cost

When registering as an individual entrepreneur, pay a state fee of 800 rubles. No further expenses are required. A record sheet from the Unified State Register of Individual Entrepreneurs stating that the individual entrepreneur is included in the database is received within three days.

Interesting article: How will a bank deposit help when confirming income for a residence permit?

Can a foreign citizen open an individual entrepreneur in Russia and how to do it

Another important nuance is that the application for state registration of individual entrepreneur status must be completed only in Russian. All other documents issued to a foreigner in the language of his country must be translated and certified by a Russian notary. This primarily applies to the applicant’s identity card and birth certificate, if the identification document does not contain information about the place and date of birth.

In some sources you can find information that in order to register a foreigner as an entrepreneur, a work permit is also required, but this is not the case. Permission must be obtained for work activities, and the activities of individual entrepreneurs are considered entrepreneurial. The Law “On State Registration” makes no mention of the need for permission.

Documents required for opening an individual entrepreneur for a citizen of Ukraine on the territory of the Russian Federation

According to Federal Law No. 129 “On State Registration of Legal Entities and Individual Entrepreneurs”, the following documents are required to open an individual entrepreneur:

- Filling out a registration application in Russian. The application must be completed in form P21001;

- copy of the passport;

- a copy of the birth certificate;

- document confirming registration of place of residence on the territory of the Russian Federation;

- consent of parents or guardians, if the citizen registering the individual entrepreneur is a minor;

- a receipt confirming payment of the state duty.

Documents must be translated into Russian and certified by a notary.

Patent cost for foreign citizens in 2021

A patent is required for official employment by hiring persons without Russian citizenship from individual entrepreneurs or enterprises, as well as from individuals. Involvement of citizens from abroad in labor activities is available only to those business entities for which there are no existing regulations on bringing to administrative responsibility for the illegal exploitation of the labor of foreigners.

To implement such a mechanism for reimbursement of paid fixed payments, the employer must have confirmation from the Federal Tax Service about the possibility of returning a certain amount of tax (the basis for applying the deduction is an application from an individual and a notification from the tax authority).

Documents for registration of individual entrepreneurs by a citizen of Armenia

Regardless of the field of activity, the procedure for creating an enterprise is carried out according to the same algorithm. It is required to collect official papers for the entrepreneur, submit an application to the tax authority and wait for a response from the authorized government body. The list of papers that will be required to register an individual entrepreneur for a citizen of Armenia includes:

- Application completed according to the original form.

- Confirmation of the right to reside in the territory of the Russian Federation - temporary residence permit, residence permit, migration card.

- The counterfoil of the notice indicating the place of residence in Russia, sent to the migration service. Similar notifications from the Federal Migration Service of the Russian Federation about a temporary address of residence, if a citizen is in the premises for less than 90 days, registration is required.

- Evidence of no criminal record - a certificate from the Ministry of Internal Affairs, or its cancellation due to the expiration of the statute of limitations, availability.

- A certificate of assignment of a TIN is optional; information is available from the tax service when preparing such a document earlier.

- An identity card issued by authorized bodies for citizens in Armenia, or a foreign passport.

- Receipt for payment of state duty in the original.

- When applying to the tax office, a power of attorney for the right to represent interests in government agencies. Authorizations are certified by a notary.

- In some cases, you may be required to provide birth certificates upon request from a tax official.

Expert opinion

It is possible to provide originals with copies, which are certified upon acceptance by specialists. For documents drawn up in a foreign language, a translation with notarization of the identity of the stated texts or approved by the Russian consulate with a translation into Russian is required.

Solodovnikov R.G., tax lawyer