Canada is a country with a developed economy and a high standard of living. The percentage of labor migrants is growing every year. There is a state program for foreigners, where the most in-demand professions and quotas are stated. A large diaspora of Russians and Ukrainians has formed here, who left for permanent residence. This is due to the competitive salaries that a sought-after employee can receive. The minimum wage is $12 per hour, but this varies from province to province.

Average salary in Canada

The local economy is growing rapidly. Many areas and industries are growing faster in the country than in the United States, which is reflected in the needs of the labor market. Every year the government reviews the minimum rates, so there is an increase in payments at the state level. According to Statistics Canada, the average employee's income last year was C$986 per week and C$3,944 per month. According to the Bureau of Labor Statistics in the United States, the official average salary is 865 Canadian dollars before taxes. The result is about 3,460.

Monthly wages depend on the employee’s skill level, specialty and province. The salary is determined based on several factors:

- duration of the working day;

- employee age;

- areas of activity;

- education, experience, etc.

The main indicator of the formation of wages is the region of residence. Average earnings in Canada in 2021 by province in CAD:

- Alberta - 62,300;

- British Columbia - 51,200;

- Manitoba - 49,600;

- New Brunswick - 48,600;

- New Foundland and Labrador - 55,800;

- Nova Scotia - 47,200;

- Ontario – 54,200;

- Prince Edward Island - 44,300.

- Quebec - 49,300;

- Saskatchewan - 54,700;

Over the past year, the largest increase in wages has been observed in the hotel and service industries. In these sectors, profits rose by 6.1% to CAD 20,400 per year. Salaries in other industries increased by 3.9% over the past 12 months.

According to Statistics Canada (Stats Can), the average salaries by economic sector in 2021 are:

- Accounting, insurance, finance – 72,600;

- Research staff, equipment – 72,400;

- Government agencies - 67,500;

- Wholesale sales – 64,700;

- Education sector – 56,600;

- Medicine and social protection – 48,200;

- Retail sales – 30,800;

- Hotel and restaurant business – 22,400.

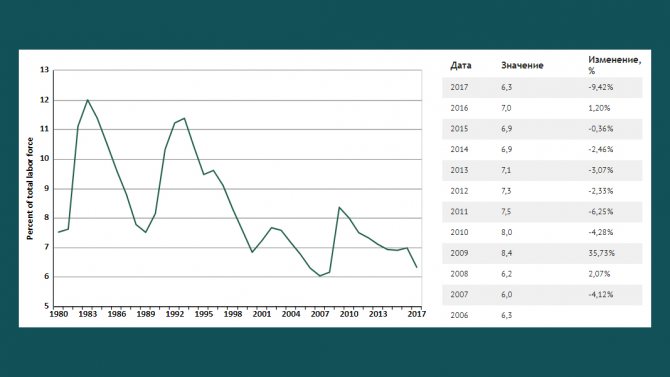

Unemployment rate chart in Canada

Chef salary in Canada

Cook positions typically pay $14-16 per hour. This is slightly more than the minimum wage ($11.4).

Chefs in expensive restaurants earn many times more. But to get a position you will have to prove to the employer your high status in the culinary world.

According to Canadian law, the working day should not exceed 8 hours (40 per week). At the same time, most cafes and restaurants work all week, so on average the cook should get 6 hours a day , and exceeding the work schedule will be paid additionally at a higher rate.

Chefs typically earn between $14-$16 per hour. Photo: pixabay.com

In fact, the owners of various establishments get out of the situation in a simple way - they enter into an agreement for payment per day, quite officially extending the cooks’ schedule to 10, or even 12 hours, paying overtime at the regular rate.

How labor is paid in different sectors of the economy

Payment is based on an hourly rate. On average, this figure for the country is 26 Canadian dollars or 19 American. Before taxes, monthly earnings are Canadian 5,700 or American 3,900. The hourly rate varies by age, gender, period and length of employment of the employee.

Key indicators of salary formation:

- Age: from 14 to 25 = 14, 26-55 = 28, 56 and older = 27;

- Gender: men = 26, women = 23;

- Working hours: full time = 27, part time = 19;

- Duration of employment: permanent = 25, temporary = 20.

The hourly rate is adjusted annually depending on changes in the consumer price index.

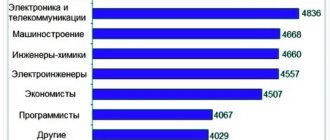

Average wage level by economic sector (Canadian dollars per month):

- Oil production sector – 5,300;

- Housing services – 4,200;

- Government structures, management – 4,100;

- Science and technology – 4,200;

- Art, culture – 3,100;

- Finance, investments – 3,900;

- Industry, metallurgy – 3,800;

- Construction – 3,800;

- Production activity – 3,400;

- Education sector – 3,200;

- Logistics, transport – 3,100;

- Real estate rental, leasing – 3,600;

- Medicine, social services – 3,700;

- Wholesale, retail trade – 3,300;

- Entertainment, recreation – 2,900;

- Catering sector – 1,100.

The most popular professions

- Senior managers: PM (Project Manager), branch manager, department director, etc.;

- Oil industry employees: drillers, engineers, etc.;

- IT specialists: programmers, system administrators and architects, web engineers, software testers, webmasters, etc.;

- Health care workers and healthcare professionals: physiotherapists, nurses, anesthesiologists, neurologists, pediatricians, surgeons, family doctors, etc.;

- Researchers: professors, candidates of sciences;

- Education: teachers, kindergarten teachers, nannies, educators;

- Employees of the financial sector of the economy: bankers, tax inspectors;

- Technical workers: engineers, aircraft builders, mechanics, welders;

- Service personnel: maids, administrators, cooks, housekeepers.

Definitely, the salary for migrant workers depends on education, qualifications, profession, as well as the province of employment and the employer. Doctors in private clinics receive salaries of up to 7,000 CAD, nurses - 4,000, teachers - 5,000, and IT specialists can earn up to 9,000 CAD.

Senior managers

Employees for management positions are in great demand. They earn more in Canada because there are many international companies in the country. For example, a Senior Manager in Toronto earns about CAD 105,000 per year before taxes, in Ontario - CAD 92,000, and in Alberta - CAD 75,000. This amounts to approximately 350 thousand rubles/month.

Oil industry

In oil refining, gas and minerals production, an employee earns up to CAD 200,000. These professions are considered life-threatening, which affects the overall salary. For example, a Petroleum Engineer earns CAD 116,000, leaving CAD 97,000 after taxes. Pay may be higher in different companies.

IT specialists

The IT technology sector is one of the most in demand in the country. People with the position of IT specialist have an income of 89,000 per year, after taxation remains 75,000. Approximately 250 thousand rubles per month. International companies are interested in young and promising foreigners, so there is always a demand for them.

Medicine and healthcare

The field is considered quite in demand, so doctors here receive an average of 67,000 CAD. Nurses earn 46 thousand. Orderlies and pharmacists - 42,000. The highest wages are in Toronto and Ontario, where an experienced neurologist earns 8,000 - 13,000 CAD per month. The rates are higher in private clinics. Dentists, surgeons and cardiologists are highly paid specialists. Their income can reach 92,000 per year.

Educational field

Teachers, educators, educators are popular professions for employment. Many immigrants are involved in the educational sector, since there are many vacancies in schools and kindergartens in Canada. Average earnings are about 73,000 annually. Nannies can earn up to 82,000. A high school teacher has an income of 68,000, a university professor has an income of 81,000, and a school counselor has an income of 64,000.

Financial sector of the economy

An accountant or banker can easily find a job for anyone in the company. Usually, there are several of them on staff. Each is responsible for a specific branch or branch of activity. Salaries in the finance sector are high, around CAD 89,000.

Technical workers

Engineers and blue-collar professionals are also in demand in Canada. A good specialist earns approximately 78,000 per year. High salaries for electricians and plumbers. On average, they have an income of 65,000 CAD.

How to get a medical job in Canada in 2021?

A Russian who has a medical diploma, regardless of his specialization (dentist, therapist or family doctor), is required to prove his own professional training.

You will have to confirm your Russian diploma. Photo: pixabay.com

A doctor with a narrow specialization (surgeon, gastroenterologist, cardiac surgeon) will have to spend 2-4 years to confirm his specialty. But the reward for patience will be a salary that no dentist can reach.

Passing commissions, exams and residency takes at least 3 years . Therefore, immigration to work as a doctor often leads to a change in specialization, and sometimes even profession.

However, by investing effort, money and patience, any Russian dentist or even Russian nurse will have the opportunity to work at the official level, receiving decent wages (a doctor receives an average of $100,000 per year) and a full social package.

A Canadian doctor who trained at a local medical school is protected by the state healthcare system, which, on the one hand, helps to receive a decent salary, and on the other, plays against labor immigration.

Therefore, Russian doctors strive to obtain the right to practice in Canada, because this guarantees a special status in society and a comfortable existence, despite the difficulty of obtaining a license.

What professions are most in demand in Canada?

All sectors of the economy are rapidly developing in the country, so employees are needed in any industry. Finding a job for a person with higher education, good qualifications and experience is not difficult. The most difficult thing is to get a job in government agencies, since the percentage of vacancies is lower compared to private entrepreneurship. Every year, 200 thousand new companies appear in Canada and hire staff. According to Canada's migration program, not all professions are in demand this year. The current list includes:

- Engineers of all directions;

- Financial and investment analysts;

- Geologists and oceanographers;

- Aerospace Engineers;

- Mechanics;

- Environmental Protection Inspectors;

- Speech therapists;

- Physiotherapists;

- Anesthesiologists;

- Medical laboratory staff;

- Ultrasound and X-ray technologists;

- Sonographers;

- Cardiologists.

Quotas with a limited number of jobs are issued for these professions.

What does it take to become a chef in Canada?

Photo: pixabay.com A Russian person who decides to move to a Canadian province may consider working as a cook if he has:

- Education. The quality of education in this case does not play too big a role. For example, if you received a diploma from an average vocational school, then you have every chance of finding a job in a roadside diner or small cafe. If you are interested in chef vacancies, you will need to fill out a lot of forms and clearly prove your level of skill;

- Experience . Without it, you won’t be able to get a normal job even with a good education. However, if in your home country you have worked for 3-4 years in your profession, and even in Russian, European or exotic cuisine, then finding a job will be much easier, because employers are interested in qualified applicants;

- Knowledge of the language . The minimum requirement to get a job as a cook in Canada is knowledge of English at an intermediate conversational level. Please note that Canadian English is very different from that taught in Russian schools, so before sending a request to a Canadian employer, improve your own speaking skills in special courses.

Where do migrants work and their average earnings?

Canada has the largest Ukrainian and Russian diaspora. Over 5 million people have moved to the country over the past 10 years. The level of labor immigration is constantly increasing because the unemployment rate is very low. Even without knowledge of the language and specialized education, you can find adequate work.

What do foreigners usually do and their average salary per year in CAD:

- Executives and managers – 74,000;

- Nurses and doctors - 73,000;

- Engineers – 93,000;

- Employees of schools and universities - 79,000;

- Lawyers - 90,000;

- Realtors – 95,000;

- Chemists - 78,000;

- Researchers and biologists - 73,000;

- Builders – 72,000;

- Police – 74 00;

- Financiers and bankers – 79,000;

- Marketers and sales managers – 75,000.

Popular professions among immigrants also include social workers, service personnel, scientists, cultural and artistic figures. Salary also depends on narrow specialization. For example, a family doctor receives 4,000 per month, and a surgeon - 7,000 CAD. This also applies to qualifications in the field of education, where a primary school teacher earns 3,000, and a senior teacher - 5,000. Almost 15% of foreigners are employed in the hotel and restaurant business, and not everyone works in the service sector. Many of them own their own establishments.

Features of taxation and pension contributions

Canada uses a flexible tax system. The amount of deductions is set at the administrative level, where a certain percentage of wages is charged. The rate depends on annual income. The income tax percentage in 2021 is:

- 0 to 46,000 – 15%;

- 46,000 to 93,000 – 20.5%;

- 93,000 to 144,000 – 26%;

- 144,000 to 205,000 – 29%;

- 205,000 and above – 33%.

Contributions to the Pension Fund are provided in the amount of 9.9%. They are divided equally between the employer and employee – 4.45% each. The insurance premium is 4.5%. The employee pays 1.9%, the employer – 2.6%. Taxation and pension contributions are the same for all legally employed citizens.