Poland is a popular destination for labor migration among Ukrainians and Belarusians. Of all the countries of the post-Soviet space, it was the only one that was able to provide the population with a decent standard of living. Salaries increase annually. In the ranking of countries in the world by income level, Poland ranks 50th. For comparison, Russia – 66, Kazakhstan – 80, Belarus – 82, Ukraine – 103. The unemployment rate in the state is 6.3%, which is lower than in Germany and the Czech Republic.

At the beginning of 2021, the number of available workers was 117 thousand. By the end of the fourth quarter, 55 thousand were eliminated. In 2021, the average wage in Poland increased by 7.8% and was set at 4,840.44 zlotys, which is equivalent to $1,315 per month. Poland provides employment prospects followed by permanent residence for all legal foreigners.

Taxes in Poland

Taxes in Poland are calculated at progressive rates. In 2021, an adjustment was made to the calculation of personal income tax. The Tax Administration reduced the rate from 18% to 17%, but for the second stage the rate remained unchanged - 32%.

Compared to developed European countries, tax experts in Poland did not greatly divide the taxable income of their citizens and suggested using the following table to calculate Income Tax:

| Salary levels | Income range per year | Interest rate | Note |

| 1st | from 0 to 85,528 zlotys | 17% | Tax benefits in the amount of PLN 1,440 or more are applied individually |

| 2nd | from PLN 85,529 and more | 32% |

Additional conditions apply to persons under 26 years of age; they do not pay income tax if their annual earnings are below PLN 85,528.

Individuals with an annual income of PLN 1 million must pay a solidarity tax of 4%. This amount is sent to the State Fund for subsequent expenses related to national projects.

In addition to income tax, the following is withheld from a Polish employee:

- pension contributions – about 10%;

- contribution to disability insurance – 1.5%;

- for health insurance - about 2.5%;

- for health insurance – about 9%.

Also, separately for the employee, the employer contributes an amount to the state fund for the following items:

- pension insurance;

- disability insurance;

- insurance against accidents at work;

- to the Labor Fund;

- to the Guaranteed Payment Fund.

If you calculate your net salary using an online calculator, then 27-30% is withheld from the average salary. The rest is paid by the employer - about 20%.

“For example: from an average income of 7940.0 Polish zlotys (1776 euros), 2253.0 (504 euros) are withheld and the employee receives 5687.0 (1272 euros). The employer separately pays the amount to the state budget – 1626.0 (363 euros).”

Using the online calculator, it is also easy to calculate other taxes, for example, the cost of goods according to the net plus wat criterion.

Salaries in different sectors of the economy

The salary depends significantly on the field of activity, profession and knowledge of Polish. Fluency in the language is an advantage and provides an opportunity to find employment in state-owned companies and large corporations. Salaries differ in different sectors of the economy. Salaries by field of activity in Poland are (gross zł per month):

- Forestry and logging – 4,930;

- Fishing in sea waters – 5,420;

- Mining industry – 6,870;

- Food industry – 5,140;

- Production and supply of electricity, gas, steam, hot water and air for air conditioning systems – 5,670;

- Water delivery – 4,620;

- Disposal of wastewater and waste, as well as activities related to reclamation - 4,540;

- Construction – 5,430;

- Wholesale and retail trade – 5,130;

- Repair of vehicles, including motorcycles – 5,250;

- Transport and warehousing – 5,490;

- Public catering – 5,670;

- Information and communication – 6,100;

- Real estate – 5,400;

- Legal activity – 6,210;

- Hotel business – 4,890;

- Accounting – 5,260;

- Tax consulting – 5,950;

- Management and administration – 6,390;

- Architecture – 5,610;

- Advertising – 5,460;

- Education – 4,840;

- Healthcare – 5,120;

- Scientific and technical activities – 5,780;

- Service sector – 4,900;

- Culture, entertainment and recreation – 5,340;

- Repair and maintenance of equipment – 5,270.

The highest salaries are for specialists in the mining industry, information and communications, lawyers, managers and scientists. Water delivery and education workers earn the least. The difference between salaries in different areas is small. Actual salary depends on work experience and language proficiency.

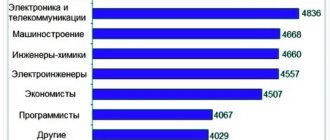

Average salaries in Poland for the most in-demand professions

The labor market in Poland covers manufacturing, information technology, telecommunications, tourism and agriculture, but experts say that there are even more niches in the country, which provide huge prospects for experienced and not so experienced entrepreneurs. For this purpose, more and more business incubators are being created in the country, which invest in new projects.

Summing up, it is reasonable to emphasize that Polish plans still include: market expansion, increased jobs, increased exports, but the implementation of plans is hampered by the low demographic situation. In 2021, the growth of the Polish population is reduced to 0.0%, and the number of working people has fallen sharply. To solve the problem, the state is increasingly recruiting foreigners from neighboring regions: Russia, Ukraine, Belarus, Moldova, and the Baltic states.

Average salaries are typical for certain professions, which we will analyze in more detail. Payment is made in local currency - Polish zloty, international currency - PLN.

Average salary of a doctor

Based on official reports, it can be concluded that doctors in Poland are paid above average salaries, while orderlies, midwives and nurses are paid at or below average. Government workers receive salaries 5-20% higher than doctors and orderlies in the private sector. On top of that, men earn 10% more than women.

Doctors and dentists can expect an average salary of 9800-17700 PLN, and the minimum monthly salary is shown at 6500 PLN, 40-110 PLN per hour. Annual earnings range from 78,000-212,400 PLN, in euros – €17,500-47,500.

How are salaries paid?

In principle, remuneration in Poland is possible in all legal ways, from daily cash payments to monthly non-cash payments. However, in the vast majority of cases, bank transfers to cards . At the same time, by agreement between the employee and the employer, this can be one monthly payment or the usual division into an advance payment and the salary itself .

Salary payment terms in Poland

Polish laws stipulate that payments must be made at least once a month . In this case, the period during which it is necessary to pay is fixed at the limit from the day when all the work for the month has already been completed until the 10th day of the next month. In other words, from the last day of the month until the next 10th day.

The employment contract or additional agreement must indicate the exact dates of payments. Among other things, this is important when dismissing, since the final payment can be tied to such a date, regardless of the exact date of dismissal (for example, if you are dismissed on May 5, the payment may well be June 10).

How is work paid according to the Labor Code?

Pay attention to the references to the Labor Code. Let us remember that the only type of agreement between an employee and an employer is subject to it - the mind on the matter. In other cases, these parameters must be agreed upon at the time of signing the contract.

Payment for downtime

In this case, there is only one legal requirement. If the downtime is not due to the fault of the employee, the payment cannot be lower than the minimum wage in force at the time of the downtime.

On weekends and holidays

Payment for work on holidays and weekends, if the predetermined schedule does not imply employment at this time, occurs at a double rate, i.e. plus 100% to regular payment .

Pay for night work

Night hours are considered to be from 21:00 to 7:00 the next day. At this time, compensation of at least 20% of the minimum wage for each hour . You need to understand that this only applies to cases that do not fall under the definition of working on weekends and holidays.

Overtime work

If overtime work is one of the above types (night, holiday, weekend), then it is paid at their rates. In other cases, the surcharge must be at least 50% of the regular tariff .

Part-time work

If part-time work is permitted by law, then its minimum wage must be calculated relative to the minimum established by law in proportion to the time actually worked. In this case, the total time per month should be taken into account, and not per 1 working day.

Wage levels in Poland - complete list

| Professions in demand: | Average salary after taxes | |

| in rubles | In Euro | |

| Operator at the factory | 33 298 | 422 |

| Technician | 33 939 | 430 |

| Educator | 35 860 | 454 |

| Auto Mechanic | 55 070 | 698 |

| Sales Representative | 61 474 | 779 |

| Mechanic | 65 060 | 824 |

| Logistician | 68 262 | 865 |

| Vet | 78 829 | 999 |

| Engineer | 81 965 | 1 039 |

| Financier | 97 333 | 1 233 |

| Driver on a diesel locomotive | 99 649 | 1 263 |

| Foreign language teacher | 99 649 | 1 263 |

| Teacher at the university | 99 649 | 1 263 |

| Realtor | 105 877 | 1 342 |

| Marketer | 109 241 | 1 384 |

| Lawyer | 112 105 | 1 420 |

| Trader | 112 105 | 1 420 |

| Architect | 112 728 | 1 428 |

| Pharmacist | 123 221 | 1 561 |

| Oilman | 127 052 | 1 610 |

Summary

According to the methodology for calculating the national average (in the national economy), it is “the ratio of the sum of gross personal wages and salaries, fees paid to certain groups of employees for work under an employment contract, payments for profit sharing or balance sheet surplus in cooperatives, and additional payment annually for employees of structural units of the budget sector up to the average number of employees for a given period; after eliminating homeworkers and people working abroad. "

Average salaries of immigrants from Russia in Poland

Expats and immigrants from Russia and other CIS countries are divided into several categories:

- Highly qualified workers.

- Specialists in a narrow field.

- Workers without a higher education diploma.

The first category includes IT specialists, medical workers, foreign language teachers, and invited top managers. The average salary for Russians in such professions is set above average from 6000-10500 PLN.

The second category occupies a special niche in the foreign labor market; they understand specialists who are not in Poland, but are in demand. These can be specialized engineers, architects, designers, scientists, athletes, translators, etc. Their median salary is 7000-15000 PLN.

The third category includes truck drivers, hairdressers, salespeople, tourist guides, cooks, educators, and seasonal workers. Their remuneration can be a minimum of 2600 PLN or an average of 5400 PLN. Such professions are suitable not only for Russians, but also for Belarusians, whose cost of living and salaries are low, so they go to work in other countries.

How much do foreigners earn on average in Poland?

In Poland, citizens and migrants have equal opportunities to find a job. The salary of foreigners will be the same as that of local residents. The only limitation is related to the language: without knowledge of Polish, finding a well-paid job will be very difficult. Also, in order to get a good position, it is advisable to accredit your diploma.

The level of salaries of foreign citizens, as well as local residents, depends, first of all, on the chosen industry and profession. IT specialists, who earn an average of 7-8 thousand zlotys, and doctors, whose salaries reach 6-7 thousand zlotys, are in demand.

But most often, immigrants are hired for seasonal work, as well as professions involving heavy physical labor. This way you can earn 2.5-3 thousand zlotys per month.