Economic situation in England

The UK is in 10th place in the world in terms of GDP. The leading sector of the English economy is services, primarily in the areas of:

- banking;

- insurance;

- exchange transactions;

- high technologies.

The second most important sectors in the country's economy are the industrial sector and mining. British agriculture is one of the most highly productive and mechanized in the world.

Average salary in England

Even the average income in Britain significantly exceeds the salaries of Russian citizens. Its level is 28 thousand pounds sterling per year. If you recalculate this amount into Russian rubles, you get approximately 2.5 million. And it is worth noting that the level of average income in the UK increases quarterly by approximately 1.5-2.1%.

At the same time, residents of England are required to pay income tax (20-45%), as well as insurance premiums. And the price of food, clothing and medicines here is much higher than in Russia.

Let's look at some professions and their annual income levels as of 2021

Data from the UK Statistical Office is used as a basis, and the most popular areas of activity are presented:

- Accountant - £38,692.

- Lawyer - £73,425.

- Dentist - £40,268.

- Teacher - £32,524.

- Nanny - £19,630.

- Journalist - £23,825.

- Loader - £18,792.

- Driver - £20,173.

- Programmer - £40,748.

- Nurse - £26,252.

- Seller £15,748.

The figures are for Britain as a whole. In London, like in any other capital, the average annual income is higher. Also, a lot depends both on the manager of a particular enterprise and on the efforts of the employee. If you don’t try, then neither having a diploma nor experience will help you grow to a higher salary.

What determines the size of the salary in the UK?

The country's key economic indicators are holding at a high level, thanks to the flexible economic policy of the British government. Of course, not all citizens of Foggy Albion are happy with how much they earn in England, but wages are gradually increasing.

The salary of a particular employee depends on the level of qualifications and length of work experience in the specialty. According to ONS research, English men earn 8.6% more than women, and a few years ago this figure was twice as high.

Companies with a small staff pay lower salaries than large companies employing tens of thousands of people.

Salary rates

Salaries in England are calculated at an hourly rate. At the same time, employees who are forced to spend the night at work, for example, hospital medical staff, are not required to pay the employer for the time when they are not actually working.

Minimal salary

The minimum wage in England depends on the age of the employee. From April 2021, the lower limit of hourly wages, according to Labor Law, is for persons:

- 16-18 years old employed in unskilled labor - £4.35;

- 18-20 years old—£6.15;

- 21-24 years old - £7.70;

- 25 years and over - £8.21.

During an apprenticeship, an employee under 19 years of age must receive a minimum of £3.90 per hour. The same rule applies to persons who have already turned 19 during the first 12 months of the internship.

average salary

The size of an Englishman's earnings in a given period depends on many factors. First of all, it depends on the hourly payment and the number of working hours.

The phrase “average salary in Great Britain” is not entirely correct. It would be more accurate to determine the amount of average earnings in a specific field of activity.

| Speciality | Average salary per year |

| Lawyer | £73500 |

| Doctor | £69500 |

| Engineer | £41300 |

| Programmer | £40700 |

| Dentist | £40250 |

| Builder | £40200 |

| Police officer | £38720 |

| Accountant | £38700 |

| School teacher | £32500 |

| Electrician | £30300 |

| Worker | £27000 |

| Nurse | £26200 |

| Welder | £24800 |

| Journalist | £23800 |

| Driver | £20100 |

| Nanny | £19600 |

| Loader | £18700 |

| Salesman | £15700 |

The average salary in England by profession depends on the education received. Specialists who received a diploma in the UK are valued higher.

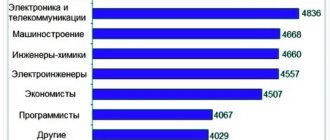

By industry

The highest paid specialists work in the following areas:

- jurisprudence;

- healthcare;

- finance;

- construction;

- IT technologies.

As the data in the table shows, law enforcement officers and teachers receive fairly high salaries.

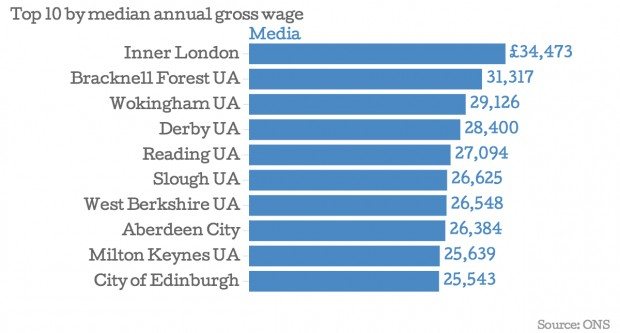

By city

The salary level depends on the specific city. As in many countries, people earn more in the capital of Great Britain than in the provinces. The average salary in London, the economic powerhouse of the United Kingdom, is almost twice as high as in the country's most economically backward cities.

Urban agglomerations with the highest salaries according to 2021 data:

- London - £727;

- Reading - £655;

- Crawley - £633.

In the last places of the city:

- Brackenhead - £428;

- Huddersfield - £424;

- Southend - £413.

The situation is explained by the location of large companies in the economic centers of the country and primarily in London. They pay good salaries and hire only highly qualified specialists. In turn, in the most backward regions, the majority of the population does not have higher education.

There is a definite divide between regions of the UK. According to statistics, the average monthly salary in England is approximately £2,850, and in Wales - £2,350. The lowest salaries are in the north of the country.

Economic situation in the country

Britain's financial situation is quite stable. It is the third largest in Europe. This became possible thanks to a well-developed agricultural sector, coal, natural gas, and oil reserves. In recent years, after several crises, GDP growth rates have been steadily increasing. More workers are entitled to the UK minimum wage. This amount allows you to live decently and is 7.5 pounds per hour.

There is a direct dependence of the salary level on length of service and experience, but at the same time, even a novice specialist can be sure that he will not be left without a livelihood. Work in London for Russians is rarely paid very highly: everyone who wants to work and earn good money should not be lazy, have the appropriate education and recommendations, and have a good command of the national language.

Top 10 highest paid professions in the UK

The work of specialists in the leading sector of the country's economy is best paid.

- The London Stock Exchange is one of the largest in the world, so it is not surprising that brokers topped the ranking of highly paid specialists.

- Presidents of companies and government officials of the highest category.

- Heads of marketing and sales departments.

- Aircraft and flight personnel.

- Financial managers.

- Banking and insurance managers.

- Doctors.

- Employees of law firms.

- Air traffic controllers.

- Heads of IT departments.

The British ranking of highly paid professions reflects the level of economic and industrial development of the country.

Tax system of the country

UK taxation has two components:

- income tax;

- compulsory insurance contributions.

Income tax is levied on the income of individuals, including social benefits. The UK has double taxation agreements with most countries, including the Russian Federation.

Minimum tax-free amount

The amount of non-taxable income is indexed according to current inflation. This is currently £11,850 per year. Municipal authorities impose additional fees on citizens for commercial real estate, parking, and maintenance of city infrastructure. There are other categories of state fees, including:

- for capital gains;

- registration of inheritance;

- stamp duty;

- VAT;

- transport tax for car owners.

Paying all taxes “eats up” up to 50% of the income of the British.

Income tax

The United Kingdom has a progressive income tax rate. The higher the earnings, the greater the percentage of it that must be paid.

| Annual income amount | Bid |

| Up to £43,000 | 0.2 |

| £43000 — £150000 | 0.4 |

| Over £150,000 | 0.45 |

There is no income tax in England on National Lottery winnings and initial profits up to £4,250 for renting out rooms in your own home.

The Englishman makes social payments independently. Workers with wages between £155 and £815 per week pay 12% of their income, those with weekly earnings above £815 pay 14%. English people earning less than £8,060 in a year are not required to pay social security contributions, but they will not be eligible for state benefits.

Bonus tax

A bonus is an additional remuneration provided by an employer for its employees, for example,

- service housing;

- transport;

- gasoline for the worker’s personal car at the expense of the company;

- medical insurance.

All additional premiums are taxable. Each person is obliged to report receipt of profit to the fiscal authorities as quickly as possible. The employer reports bonuses paid at the end of the tax year. Late payment of tax will not remain without consequences for the debtor.

As for the tax on bonuses, which banks were forced to pay for bonuses to leading managers, it was abolished back in 2010.

Tax system

It is two-level. The first is for local governments, the second is for the central government of the United Kingdom. Local governments rely on grants, commercial property taxes, local taxes, and other revenues (such as street parking fees). Central - financed by VAT, corporate and income taxes, compulsory insurance payments, excise taxes on fuel, tobacco and alcohol products.

Income

This is the main type of tax in this country. It is levied on different sources of income:

- from salary;

- from pension;

- from renting out objects;

- from dividends;

- from property.

Salary taxes in the UK in 2021 are progressive and depend on the citizen’s salary level. The higher the income, the higher the tax burden imposed on it. There is a tax-free amount of £9,205 per year. Income up to £34,370 is taxed at 20%, if earnings are not higher than £42,450 - 40%. Salaries exceeding £150,000 are subject to taxation at 45% of income.

Tax on bonuses

This was a one-time tax introduced by the government in 2009 on the income of bankers and ceased to operate as it did not live up to expectations in 2010. Typically, at the end of the year, top managers of banks and large financial companies receive bonuses for the previous year. The tax applied to bonuses exceeding £25,000. Moreover, his banks paid, not his employees.

Read also: Standard of living in England In England, Schengen or not

Salary to living expenses ratio

The higher the income, the more expensive goods and services are. On average, an English family spends up to 80% of their money on housing, transport and essential goods:

- food - £300-£450;

- housing rental - £1000;

- utilities - £120;

- Transport - £100.

In fact, the average salary in Britain, after paying all taxes, covers only the basic needs of a working Englishman. It is almost impossible to save regularly.

Unemployment rate and prospects for migrants

According to ONS statistics, there are 1,388,000 unemployed citizens in Britain. This is a record low figure over the past 20 years. There is a shortage of highly qualified workers in the labor market and many companies are ready to accept foreigners. Legal work in England for Russians, in case of independent search, begins with registration on the UK government portal. A prerequisite is confirmation of a diploma and certification of knowledge of the English language. A specialist with a Russian diploma will receive less than his English colleague.

Summing up

Employment in England, at first glance, seems very attractive. But each applicant must:

- speak English at a level of at least C1;

- order confirmation of a Russian diploma from the National Academic Recognition Information Center;

- have start-up capital for moving and living in the country (until your first salary).

And most importantly, you need to soberly assess your professional capabilities and not trust dubious intermediaries who promise mountains of gold after employment in the UK.

English tax system

Taxes in the UK are levied on wages in the form of income deductions and compulsory insurance contributions. And it is paid on income that exceeds the minimum non-taxable amount. Income tax is established on income from rent, pensions, salaries and other types.

Minimum tax-free amount

This is earned income on which you don't have to pay taxes. For 2019, this amount was 10 thousand pounds per year. People who were born before 1948 have a larger amount of this income.

If an employer pays taxes on behalf of his employee, this fact is automatically taken into account by the tax authorities. After deducting the non-taxable amount and possible benefits, income tax is calculated from the remaining income.

When working simultaneously and renting out, the tax is calculated on the amount of all income received. Some benefits are also subject to income taxes in 2019.

It is very important to immediately notify the tax office about changes in the process of living in the country.

Process of paying income tax from salary

Taxes in England are paid by the employer for his employee using a certain scheme - PAYE - Pay As You Earn. The Tax Service assigns a personal code, with the help of which the taxes of a particular person are calculated. When income or circumstances change, this figure also changes, about which an alert is sent. This data should be saved, just like salary papers.

Bonus tax

Bonuses that an employer may provide are also subject to taxes in the UK. For example, providing a car, gas, health insurance or housing. To avoid becoming a debtor to the state, you should immediately notify the tax office about everything.

It must be borne in mind that the employer provides this information only at the end of the year, so in your own interests, it is worth doing this earlier. Watch this video about the advantages of the tax system in England.