published: 11/24/2017

Residents of the Russian Federation are recognized as individuals who are actually in the Russian Federation for at least 183 calendar days over the next 12 consecutive months (clause 2 of Article 207 of the Tax Code of the Russian Federation). Accordingly, non-residents are considered to be individuals who stay in the Russian Federation for less than 183 calendar days over the next 12 consecutive months.

By virtue of Art. 7 of the Tax Code of the Russian Federation, if an international treaty of the Russian Federation establishes rules and norms other than those provided for by the legislation of the Russian Federation on taxes and fees, then the rules and norms of international treaties are applied. This means that an international agreement may, among other things, establish a different procedure for determining residence. For example, if we talk about Monaco, there is no international treaty with the Russian Federation establishing other rules for determining resident status.

As such, there is no procedure for obtaining resident status; resident status is considered received automatically upon the 183rd day. Before obtaining resident status, an individual is recognized as a non-resident. Conversely, resident status is considered lost if over the last 12 consecutive months an individual has stayed in the territory of the Russian Federation for less than 183 calendar days (before receiving non-resident status, an individual is recognized as a resident).

You may be interested in the service: Consultation with a tax lawyer.

Length of stay on the territory of the Russian Federation to determine residence

The period of stay of an individual on the territory of the Russian Federation, according to Art. 6.1 of the Tax Code of the Russian Federation, begins from the next day after his arrival in the territory of the Russian Federation and ends on the day of departure from the Russian Federation.

The dates of departure and dates of arrival of individuals on the territory of the Russian Federation are established according to the access control marks in the citizen’s identity document.

In this case, 183 days of stay must be determined within twelve continuous months (the course of such a year also begins on the next day from the moment of entry into the territory of the Russian Federation, the calculation period is not tied to the beginning or end of the calendar year and is not tied to the calendar year).

Thus, to determine the status of an individual, any continuous 12-month period is taken into account, including those that began in one calendar year and continued in another.

Kazakhstan residency for individuals

For Kazakhstan, the concept of resident, as well as tax resident, is identical to the understanding of the term in the Russian Federation and most other countries of the world. It is defined for individuals in the Tax Code of the Republic of Kazakhstan, Clause No. 1, Article 189.

According to this document, the following individual will be recognized as a resident:

- continuously staying on the territory of the Republic of Kazakhstan;

- not permanently located in the Republic of Kazakhstan, but at the same time the center of the citizen’s vital interests is in the Republic of Kazakhstan.

Going deeper into the matter, permanent residence is relevant to the current tax period.

A citizen will be considered a resident of the country if during a year, or, more precisely, 12 continuous months, he spent at least 183 days on the territory of the Republic of Kazakhstan. Arrival and departure days are also counted. This is stated in Paragraph 2 of the Tax Code of the Republic in Article 189.

This is what the IIN of Kazakhstan looks like for non-residents

The procedure for reflecting non-resident status in the financial statements of a Russian employer.

In this case, it is necessary to decide how the work is carried out (remotely or not). In accordance with Art. 312.1 of the Labor Code of the Russian Federation, remote work is the performance of a labor function determined by an employment contract outside the location of the employer, its branch, representative office, other separate structural unit (including those located in another area), outside a stationary workplace, territory or facility directly or indirectly under the control of the employer , subject to the use of public information and telecommunication networks, including the Internet, to perform this job function and to carry out interaction between the employer and employee on issues related to its implementation.

Income from performing work outside the Russian Federation refers to income from sources outside the Russian Federation (clause 6, clause 3, article 208 of the Tax Code of the Russian Federation). Therefore, such income received by non-residents is not taxed in the Russian Federation, regardless of who made the payment (Letter of the Ministry of Finance of Russia dated October 16, 2015 N 03-04-06/59439). At the same time, it should be taken into account that this position is not confirmed (or refuted) by established judicial practice.

If the work is not carried out remotely, then such income is recognized as paid from sources in the territory of the Russian Federation and is subject to taxation (personal income tax) according to the general rules.

In this case, the employee, a foreign citizen, receives from the Russian organization only income in the form of wages (wages). The date of his actual receipt of such income is recognized as the last day of the month for which he was accrued income for work duties performed in accordance with the employment contract (clause 2 of Article 223 of the Tax Code of the Russian Federation). Accordingly, the organization determines the tax status of an employee on the last day of each month.

You may be interested in: Obtaining a work permit for a HQS.

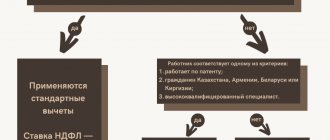

As long as the employee is recognized as a tax resident, personal income tax is withheld at a rate of 13%; after the employee becomes a non-resident, tax is paid at a rate of 30%, and amounts previously paid in a given calendar year are also recalculated.

On the other hand, the Ministry of Finance explains that if the status of an employee changes during the current tax period, then the recalculation of personal income tax amounts cannot be done immediately, but:

- after the date from which the employee’s tax status in the current year (tax period) cannot change (for example, if the employee has been outside the Russian Federation since January 1, 2021, then this date will be July 1, 2021);

- at the end of the year (as of December 31);

- on the date of dismissal of the employee.

Accordingly, the status may constantly change during the calendar year depending on the movement of an individual outside the Russian Federation and back. In this regard, it is necessary to determine the status at the time of payment of income, at the time of termination of the employment relationship, at the end of the calendar year. In this case, the tax is paid (recalculated) depending on the result obtained.

You may be interested in: Preparation of a legal opinion on tax issues.

The concept of resident in the international aspect

In international law, the concept always applies to financial and tax legal relations of persons and states in which they are registered.

In most countries of the world, any person or organization is considered under the prism of residency. But there are some countries where only foreign citizens and enterprises qualify for the concept.

If we take the Russian Federation as an example, residents are considered to be everyone who has lived in the country for at least a year. These can be both its citizens and foreigners. At the same time, some Russian citizens who have been living outside of Russia for more than a year are not residents of the Russian Federation.

As for legal entities, if they are created in accordance with Russian Legislation, they are also considered residents of Russia. Branches of such enterprises located abroad are also residents of the Russian Federation.

There is another actively used concept – tax resident. In most countries, it applies to individuals who have spent more than 183 days on the territory of the state for 12 consecutive months, as well as to legal entities belonging to the country's tax system.

Military personnel serving abroad, as well as government officials sent outside the country, are an exception and remain residents regardless of the amount of time they spend outside their state.

Documents confirming residence

After the expiration of the established period, the tax service, if the issue is resolved positively, issues the applicant a document confirming that he is a resident of the country. It can also be an electronic document that is posted on the Internet resource of authorized bodies.

A certificate confirming residence can be drawn up in the form of an authorized body, or in accordance with the requirements of the competent authorities of foreign states.

Sometimes a decision is made to refuse citizens who apply. The basis for it is always non-compliance with the conditions listed in Article 217 of the Tax Code of the Republic of Kazakhstan.

If an individual or legal entity has lost a document issued by the tax authorities, upon repeated application within 10 days, a duplicate will be issued.

Legal entities – residents of Kazakhstan

What legal entities are considered residents of the Republic of Kazakhstan is stated in paragraph 5 of Article 189 of the Tax Code. These are legal entities that became such in accordance with the legislation of the Republic of Kazakhstan or legal entities whose place of effective management is located on the territory of Kazakhstan.

Individuals and legal entities who are non-residents of the Republic of Kazakhstan

The place of effective management refers to the place where a company holds its meetings and where its board of directors meets.

This means that, no matter where the facilities of a certain organization are located, in Turkey, Germany, Great Britain, etc., if strategic decisions related to its development, management and control of activities are made on the territory of Kazakhstan, the enterprise is considered as its resident.

Completing reports for non-residents in 2019

In Certificates 2-NDFL (approved by Order of the Federal Tax Service dated October 2, 2018 No. ММВ-7-11/ [email protected] ) submitted for non-resident employees, it is necessary to correctly indicate the status of this employee. For example, in a Certificate issued for a non-resident foreign worker working under a patent, status 6 must be indicated.

- Can a Russian Citizen Be a Resident of Ukraine

- Resident status for a citizen of Ukraine in Russia

- Citizen of Ukraine in Russia Resident Or Not

Citizen of Ukraine Working in Russia Resident Or non-Resident

How to determine status (resident or non-resident) for personal income tax purposes

- contracts with medical (educational) institutions for treatment (training);

- certificates issued by medical (educational) institutions indicating the completion of treatment (training) indicating its time;

- copies of passport pages with special visas and border control stamps on border crossings.

Situation: how to take into account days spent on business trips and vacations abroad when determining tax status (resident or non-resident) for the purposes of calculating personal income tax?

The status of an income recipient is determined by the number of calendar days that a person was actually in Russia over the next 12 consecutive months.

Citizen of Ukraine Resident or Non-Resident in Russia

The tax rate is set at 30 percent in respect of all income received by individuals who are not tax residents of the Russian Federation

Article 73 of the Treaty on the EAEU states that the income of citizens of the countries party to the EAEU Treaty from the first day of employment is taxed at the same rates as the income of individuals who are tax residents of the state in whose territory foreign citizens carry out labor activities.

Example Masha is a citizen of Ukraine.

She first came to Russia in May 2021, immediately applied for a temporary residence permit for marriage, and already received it in July. Is Masha a resident? No, because Masha spent less than 183 days in Russia over the past 12 months. Who is a resident and non-resident

A tax non-resident of the Russian Federation is a person who has been in Russia for less than 183 calendar days over the next 12 consecutive months (clause 2 of Article 207 of the Tax Code of the Russian Federation). In addition to directly determining who is a resident and non-resident of the Russian Federation, the Tax Code of the Russian Federation contains a number of differences in the taxation of their income.

For residents and non-residents, the Tax Code of the Russian Federation establishes a different list of income subject to personal income tax. Unlike those who are residents, non-residents withhold tax only from income received from sources in Russia (Article 209 of the Tax Code of the Russian Federation).

Does a foreign citizen with a residence permit become a resident?

Important! Taxation policy is closely related to this area. Depending on the status of the person, it is determined which part of the income will be subject to taxes. If a person located on Russian soil is a non-resident, then taxes will be levied only on that part of his income that he receives in the territory of the country of residence.

All of the above benefits that a foreigner receives by applying for a residence permit indicate that the person intends to live permanently in the territory of the Russian Federation. Still, having a document does not guarantee that an immigrant has resident status.

The key factor determining resident status, other than the residence permit, is the time spent within the country's borders. Provided that a person does not live outside the Russian state for more than 183 days in one year, he will be a resident.

Who is a resident and non-resident of the Russian Federation

On January 1, 2018, amendments to the law came into force, according to which all Russian citizens, regardless of the length of stay abroad, are currency residents. But at the same time, individuals who permanently reside abroad for more than 183 days within 12 months are exempt from restrictions of currency legislation and are not required to inform the tax authorities about their accounts in foreign banks. Determining this status is important. For example, for residents of the Russian Federation, personal income tax (NDFL) is levied at a rate of 13%, for non-residents - 30%.

When distinguishing between the concepts of “resident of the Russian Federation” and “non-resident of the Russian Federation,” you can often hear that any Russian citizen is considered a Russian resident. In fact, such a status is assigned based on the length of time a person stays on Russian territory.

A person with a temporary residence permit is a resident or non-resident

- Citizen of the Russian Federation, with the exception of permanently residing in a foreign state for more than a year (residence permit) or temporarily staying on a paradise or study visa for a period of at least a year;

- Foreign citizens permanently residing on the basis of a residence permit.

If a foreign citizen has a temporary residence permit in Russia, for example, for three years (there is no residence permit), is he a resident or non-resident?

- Currency resident - as in Russian law - a citizen of the Russian Federation, except for those permanently residing for more than a year in a foreign state; foreign citizen with a residence permit.

Read about Russian-Ukrainian relations:

- Can a Citizen of Ukraine Fly Abroad from Russia?

- Privatbank Ukraine How to Withdraw Money in Russia

- How to Register a Land Plot for a Citizen of Ukraine in Russia

- Permanent residence in Ukraine and registration in Russia

- Customs clearance of goods from Russia to Ukraine Cost

Attention!

Due to recent changes in legislation, the legal information in this article may be out of date! Our lawyer can advise you free of charge - write your question in the form below.

What is the difference between resident and non-resident

Since both concepts relate more to tax and financial legislation, the difference is expressed precisely in money.

- A tax non-resident is required to contribute 30% of income to the state treasury. The resident pays the usual 13% (clauses 1, 3 of Article 224 of the Tax Code of the Russian Federation).

- Financial residents have every right to open deposits in foreign currency on the territory of the Russian Federation and carry out other banking operations. Non-residents are subject to significant restrictions.

In what cases does a person receive resident status?

There are not so few grounds operating in 2021. In addition to the residence permit, other factors also influence the presence of resident status.

- All citizens of the Russian Federation are considered such, except for Russians living abroad for more than a year with a residence permit, on the basis of employment or for training purposes.

- Foreigners who stay in the Russian Federation for more than 183 days during the year also become residents and pay 13% personal income tax.

- Financial residents - foreigners are only persons with a valid residence permit.

- If we go beyond individuals, then all legal entities (companies) registered within the framework of Russian legislative requirements on the territory of the Russian Federation, as well as their foreign branches and other divisions, will be recognized as residents.

- Diplomatic bodies of the Russian Federation around the world have a similar status.

For residents and non-residents in Russia, there are different conditions for opening and servicing bank accounts, carrying out currency transactions, receiving/sending money transfers, many other banking operations and more.

Non-resident rights

There are practically no barriers imposed on persons with this status. The only thing is that they will be limited in their ability to carry out currency transactions with Russian banks. Mortgage lending is closed to such persons. However, non-residents with a residence permit can also enjoy all the benefits of the status, including the right to social grants, medical care and education for children.

What is meant by the center of vital interests?

In the Tax Code of the state, in Paragraph 3 of Article 189, the concept of “center of vital interests” is deciphered. This is considered to be:

- citizenship of the Republic of Kazakhstan;

- residence permit in the Republic of Kazakhstan;

- close relatives or family of an individual live in Kazakhstan;

- on the territory of the Republic of Kazakhstan there is real estate available for living and the right of ownership to it is held by an individual or members of his family.

If the listed signs are present, an individual can be considered a resident of the Republic of Kazakhstan.