The tax status of the employee (resident or non-resident), and therefore the rate at which income tax must be withheld (13 or 30%), depend on the length of his stay in Russia (). Moreover, the tax status of each employee will have to be determined at least twice: upon the first payment of income and after the end of the calendar year.

() clause 2 art. 207 Tax Code of the Russian Federation

When determining status, citizenship (lack of it), place of birth and place of residence are not determining indicators. That is, tax residents of Russia can be foreign citizens or stateless persons. At the same time, a Russian citizen may not be a tax resident.

It is especially important to monitor changes in the tax status of workers who arrived from other countries, as well as those sent outside Russia for a long period of time to perform work or provide services under concluded contracts.

If a person was in Russia for 183 calendar days over the next 12 consecutive months, then he is a resident and personal income tax must be withheld at a rate of 13 percent. In addition, he should be given tax deductions if he is entitled to them. If the employee is not a resident, his income from work must be taxed at a tax rate of 30 percent (with some exceptions) and he will not be able to take advantage of tax deductions (). Note that the tax resident status should be determined for each date of payment of income ().

() clause 4 art. 210 Tax Code of the Russian Federation

() letters of the Ministry of Finance of Russia dated October 28, 2010 No. 03-04-06/6-258, dated April 5, 2011 No. 03-04-06/6-74

The Tax Code does not contain a list of documents confirming the actual presence of individuals on the territory of the Russian Federation. According to the Ministry of Finance of Russia (), such documents, in particular, may be:

— a certificate from the place of work, prepared on the basis of information from the time sheet;

— copies of the passport with border crossing marks from border control authorities;

- hotel receipts.

() letters of the Ministry of Finance of Russia dated May 16, 2011 No. 03-04-06/6-110, dated March 16, 2012 No. 03-04-06/6-64

Moreover, as the Ministry of Finance of Russia points out, a mark on the registration of a foreign citizen or stateless person at the place of residence only confirms the right of his presence in Russia. She does not confirm the actual time of his presence in the country. Therefore, there must be other documents on the basis of which it is possible to establish the duration of the actual stay of an individual in Russia ().

() letter of the Ministry of Finance of Russia dated June 27, 2012 No. 03-04-05/6-782

Length of stay on the territory of the Russian Federation to determine residence

The period of stay of an individual on the territory of the Russian Federation, according to Art. 6.1 of the Tax Code of the Russian Federation, begins from the next day after his arrival in the territory of the Russian Federation and ends on the day of departure from the Russian Federation.

The dates of departure and dates of arrival of individuals on the territory of the Russian Federation are established according to the access control marks in the citizen’s identity document.

In this case, 183 days of stay must be determined within twelve continuous months (the course of such a year also begins on the next day from the moment of entry into the territory of the Russian Federation, the calculation period is not tied to the beginning or end of the calendar year and is not tied to the calendar year).

Thus, to determine the status of an individual, any continuous 12-month period is taken into account, including those that began in one calendar year and continued in another.

Confirmation of Russian tax resident status

An employee can confirm the status of a resident of the Russian Federation by presenting a document issued by the Federal Tax Service according to the form from the Federal Tax Service order dated November 7, 2017 No. ММВ-7-17/ [email protected] This document confirms the status for the calendar year.

The Federal Tax Service website now has a special service for confirming status.

In addition, you can confirm your stay in the Russian Federation with border service marks in your passport (letter from the Ministry of Finance dated May 18, 2018 No. 03-04-05/33747). If you don’t have a passport, other documents will also be suitable, such as (letters from the Ministry of Finance dated January 13, 2015 No. 03-04-05/69536, Federal Tax Service of Russia dated September 19, 2016 No. OA-3-17 / [ email protected] , dated December 30, 2015 No. ZN-3-17/5083):

- time sheet;

- migration cards;

- registration of a person at the place of residence or stay in the Russian Federation.

Keep in mind that, according to the explanations of the Russian Ministry of Finance, the fact of having a migration card with marks of entry into Russia of a tax resident is not yet confirmation of the actual presence of a person in the Russian Federation after the date of entry (letter of the Ministry of Finance of the Russian Federation dated December 29, 2010 No. 03-04-06 /6-324).

The procedure for reflecting non-resident status in the financial statements of a Russian employer.

In this case, it is necessary to decide how the work is carried out (remotely or not). In accordance with Art. 312.1 of the Labor Code of the Russian Federation, remote work is the performance of a labor function determined by an employment contract outside the location of the employer, its branch, representative office, other separate structural unit (including those located in another area), outside a stationary workplace, territory or facility directly or indirectly under the control of the employer , subject to the use of public information and telecommunication networks, including the Internet, to perform this job function and to carry out interaction between the employer and employee on issues related to its implementation.

Income from performing work outside the Russian Federation refers to income from sources outside the Russian Federation (clause 6, clause 3, article 208 of the Tax Code of the Russian Federation). Therefore, such income received by non-residents is not taxed in the Russian Federation, regardless of who made the payment (Letter of the Ministry of Finance of Russia dated October 16, 2015 N 03-04-06/59439). At the same time, it should be taken into account that this position is not confirmed (or refuted) by established judicial practice.

If the work is not carried out remotely, then such income is recognized as paid from sources in the territory of the Russian Federation and is subject to taxation (personal income tax) according to the general rules.

In this case, the employee, a foreign citizen, receives from the Russian organization only income in the form of wages (wages). The date of his actual receipt of such income is recognized as the last day of the month for which he was accrued income for work duties performed in accordance with the employment contract (clause 2 of Article 223 of the Tax Code of the Russian Federation). Accordingly, the organization determines the tax status of an employee on the last day of each month.

You may be interested in: Obtaining a work permit for a HQS.

As long as the employee is recognized as a tax resident, personal income tax is withheld at a rate of 13%; after the employee becomes a non-resident, tax is paid at a rate of 30%, and amounts previously paid in a given calendar year are also recalculated.

On the other hand, the Ministry of Finance explains that if the status of an employee changes during the current tax period, then the recalculation of personal income tax amounts cannot be done immediately, but:

- after the date from which the employee’s tax status in the current year (tax period) cannot change (for example, if the employee has been outside the Russian Federation since January 1, 2021, then this date will be July 1, 2021);

- at the end of the year (as of December 31);

- on the date of dismissal of the employee.

Accordingly, the status may constantly change during the calendar year depending on the movement of an individual outside the Russian Federation and back. In this regard, it is necessary to determine the status at the time of payment of income, at the time of termination of the employment relationship, at the end of the calendar year. In this case, the tax is paid (recalculated) depending on the result obtained.

You may be interested in: Preparation of a legal opinion on tax issues.

Who is a resident of the Russian Federation

An individual is recognized as a tax resident of the Russian Federation if he stays in Russia for at least 183 days over the next 12 consecutive calendar months. In addition, in 2021, a tax resident of the Russian Federation is considered an individual who:

- is in our country from 90 to 182 calendar days inclusive in the period from January 1 to December 31, 2021;

- submitted an application to its tax office in any form indicating its last name, first name, patronymic and tax identification number until April 30, 2021 inclusive.

Tax residents of the Russian Federation pay personal income tax both on income received from sources in Russia and on income from outside the Russian Federation - in contrast to non-residents under personal income tax, who pay tax only on income from sources in the Russian Federation.

Basic information about statuses

Many people confuse the definition of a citizen of a country and its resident. More precisely, people believe that these words are identical and are synonyms. This is an incorrect judgment. A person can be a Russian citizen and at the same time not be a resident, as in another combination - “stateless resident”. Let's take a closer look.

Article 207 of the tax code of the Russian Federation mentions that the status of “resident of the country” is available to people who live here for at least 183 days within twelve consecutive months. It is important to understand that these twelve months are not necessarily a calendar year, since the countdown can go from April of one year to April of the next, for example. Citizens traveling abroad for short periods of time will not lose their status. The maximum for continuous absence from the country is six months, and even then only for education or treatment. Also, offshore workers extracting hydrocarbons may be absent for six months.

Security officials, government officials and municipal government officials can leave Russia for up to a year without losing their resident status.

In these situations, citizens must be prepared to provide official documents confirming the purpose of their visits abroad and their duration. In the case of improving health, these will be special treatment (medical) visas in the foreign passport, contracts with foreign medical institutions. The situation is similar with obtaining an education - agreements with educational institutions and other supporting documents must be in hand. Moreover, both medical and educational organizations must have the appropriate licenses.

Article No. 11 of the Tax Code of the Russian Federation also states that resident status is obtained by:

- Citizens of the country who are registered at their place of permanent residence or location.

- Foreigners who have received a residence permit in Russia.

- Foreigners who have permission from an employee of the Ministry of Internal Affairs for continuous stay in the Russian Federation.

- Workers from other countries who have an employment contract for a period longer than 183 days.

It is logical that residential status cannot be achieved by individuals living in the country for less than the specified number of days or months that have passed between them. Regardless of the length of stay in the country (even if it exceeds 183 days), the status of “resident” cannot be obtained:

- refugees and foreigners who have received temporary asylum in the country;

- highly qualified foreign specialists invited to work/service.

The status of non-residents is characterized by a number of nuances:

- Persons who do not have resident status, but receive income in the country, are required to pay personal income tax.

- Even when paying income tax, non-residents cannot claim tax deductions: property, social, standard.

- Non-residents are required to submit a declaration to the Federal Tax Service when they receive profit in Russia.

- On each date of payment of such income, non-resident status is calculated and confirmed again.

Most often, citizens of the Russian Federation who rarely leave their homeland are its residents

Important differences

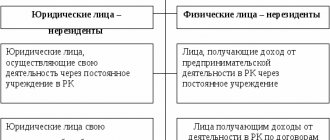

To figure out who is a tax resident of the Russian Federation, you can study the signs of this status. For organizations they are expressed as follows:

- A company conducting its activities must be registered in Russia.

- Or it may be a foreign organization that has the status of a tax resident of the Russian Federation, in accordance with the current international treaty.

- This category also includes foreign companies managed from the Russian Federation.

In addition, tax residents of the Russian Federation are individuals who meet certain requirements:

- Stay in the country for a certain period of time - at least 183 consecutive days.

- Military personnel who are abroad due to their professional activities, government officials on a business trip retain their status, regardless of the duration of their stay abroad.

It is important to note that for individuals, the period of stay on the territory of the Russian Federation is not separately interrupted when leaving for study or treatment abroad for a period of less than six months.

Below we present in the table the conditions under which individuals and organizations are tax residents of the Russian Federation in 2021.

| Tax residents of the Russian Federation are (clause 1 of article 246.2, clauses 2, 3 of article 207 of the Tax Code of the Russian Federation) | |

| organizations: | individuals: |

| — Russian organizations | — actually staying in the Russian Federation for at least 183 calendar days within 12 consecutive months*; |

| - foreign organizations recognized as tax residents of the Russian Federation in accordance with the international treaty of the Russian Federation on taxation issues - for the purposes of applying this international treaty; | - Russian military personnel serving abroad, as well as employees of state authorities and local governments sent to work outside the Russian Federation, regardless of the length of stay abroad |

| — foreign organizations whose place of management is the Russian Federation, unless otherwise provided by an international treaty of the Russian Federation on taxation issues | |

Status confirmation

If a person at a given time requires confirmation of the status of a tax resident of the Russian Federation, for this it is necessary to draw up a corresponding application. Typically, such a procedure is associated with payments, but if the situation is not related to these processes, then the law does not oblige you to confirm your existing status, although you can do this at your own request, if for some reason it is necessary, this option is not prohibited.

The certificate is required to avoid double taxation; this is its main purpose. The application must also be accompanied by documents that can serve as evidence of receipt of income in another state. Copies of documents are allowed, which must have a seal and signature. The confirmation may be an agreement or a decision on the payment of dividends or other similar options. If it is necessary to prove residence status for a period exceeding three years, then additional evidence of payment of taxes may be required. An application submitted in accordance with all requirements is considered for 30 days, after which a decision can be made on it.

To confirm the status of a tax resident of the Russian Federation, a sample application will be a convenient opportunity to see how this document should be drawn up and filled out. If you have any doubts, you can look at how exactly the data is indicated in the sample. It is important to fill out the form correctly and provide all the necessary information in order to receive a positive decision on status confirmation. However, if an individual does not submit the necessary documents, then he cannot be considered as a resident, so care should also be taken to ensure that all papers are in order, especially those containing information about the payment of taxes.