Who is a tax resident and who is a non-resident?

Statuses are determined by the Tax Code of the Russian Federation (Chapter 23) in order to determine the percentage tax rate for individuals. “Resident” status is granted to persons who are registered and reside in the country and comply with the requirements of the law.

Citizens included in a certain list approved by the legislative bodies of the Russian Federation have “resident” status:

- citizens of Russia (having a civil passport), if they do not live abroad for more than 365 days, as well as those who have received a residence permit of another country;

- staying in another state on a study/work visa;

- foreigners who have received a residence permit;

- officially registered legal entities;

- employees of consulates and diplomatic institutions located in other states;

- municipal bodies and their constituent entities.

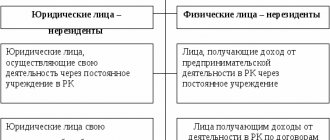

Non-residents are individuals/legal entities without a permanent place of residence (not residing on a permanent basis). Such citizens are those who stay less than 183 days in the country within 1 year.

It is important to understand the difference, because even having Russian citizenship, but at the same time being, for example, at work in another state, a person becomes a resident of another country.

Note! Determination of status is directly related to taxation, and also determines the portion of income that is subject to taxation. For a non-resident, the taxable part is the income that he receives in Russia.

Who is a resident

In Russian legislation, the status of resident or non-resident is important only when paying taxes. For citizens, we are talking about paying personal income tax - a tax on all income received on the territory of the Russian Federation.

For residents, the personal income tax rate is 13%, for non-residents - 30%. The difference of almost 3 times makes us think about how to pay the state less.

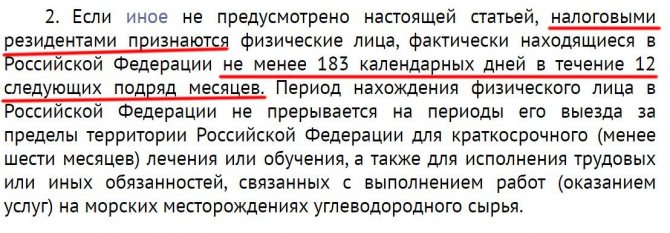

In Art. 207 of the Tax Code of the Russian Federation states that a resident is an individual who stays in the country for at least 183 calendar days (six months) in a row within 12 months. This period may or may not coincide with the calendar year, so it is calculated taking into account the dates of entry and exit from the country indicated in the documents when crossing the state border.

Excerpt from Article 207 of the Tax Code of the Russian Federation

- VRP

How to get a TIN using a residence permit

- Marina Danilova

- 28.12.2020

For example, a foreigner first came to Russia to work on September 10, 2021. If he does not leave within 183 days (until March 9, 2020), he will acquire tax status and will be able to pay personal income tax at a general rate of 13%. Moreover, the amount paid to the budget will be returned to him (recalculated).

If a citizen left the country and then came back and started working, for tax purposes they will determine from the documents whether the employee stayed in the Russian Federation for 183 days over the last 12 months. The employer determines the tax rate regularly on the date of payment of income.

The authorities made a small exception. Regardless of citizenship, people do not lose their tax status if they:

- went for short-term treatment (less than 6 months);

- went on short-term studies (less than 6 months);

- sent on business trips abroad to perform work duties.

It is interesting that foreign citizens - highly qualified specialists can be tax non-residents, but at the same time their income from work is taxed at 13%. If employers pay for their housing or compensate for other expenses, then such income is subject to personal income tax at a rate of 30%.

What does a residence permit provide?

Foreign citizens who want to live and work in Russia for a long time receive a temporary residence permit or a residence permit immediately. If there are grounds, the procedure for obtaining a temporary residence permit is skipped.

- VRP

What benefits can a foreigner with a residence permit claim?

- Alena Motroy

- 27.03.2020

A residence permit is a document allowing you to live permanently in the Russian Federation. It gives some privileges compared to foreigners who have a temporary residence permit. For example, such people can participate in local government elections. They and their children have access to free medical care. They can apply for some social benefits. And most importantly, they are not subject to employment quotas; they do not need to apply for or wait for any work permits. However, permits are not required from foreigners with a temporary residence permit.

The main differences between residents and non-residents

For individuals and legal entities recognized as residents, the tax rate is 13% (for individuals) and 20% (for legal entities). Non-residents pay tax at a rate of 30%. For some categories it may be reduced:

- 13% of personal income tax is for persons with the status of refugees, migrants, highly qualified specialists, as well as for crew members of sea vessels, workers who have issued a labor patent;

- 15% on income received from investment activities.

The main differences are as follows:

- different bet sizes;

- list of objects subject to taxation;

- different procedures for determining the tax base;

- the difference in the possibilities for providing deductions and calculating taxes.

Resident status obliges you to declare, and therefore pay, all types of income, while a non-resident pays taxes only on the income he received in the country.

How to become a tax resident with a residence permit?

The conditions for recognizing an individual as a tax resident are specified in paragraph 2 of Article No. 207 of the Tax Code of Russia. Obtaining a residence permit does not automatically change the status from non-resident to tax resident. In order to obtain a certificate of receipt of this status, you need to contact the appropriate department at the place of registration or registration.

In order to have the necessary documents, you need to submit an application to the Interregional Inspectorate of the Federal Tax Service of the Data Center (centralized data processing) of the Russian Federation.

What is the difference between a temporary residence permit and a permanent one?

As a rule, you can obtain a permanent residence permit after 5 years of legal stay in the country. As the name suggests, permanent residence permits permanent residence in the country and does not require renewal.

For example, if you received a residence permit in the Schengen area based on the purchase of real estate, for example, in Spain or Greece, then in order to maintain your resident status you cannot sell it for 5 years. However, once you obtain permanent resident status after the five-year period, you can already do this.

Another fundamental difference. If a temporary residence permit is obtained in several countries, then a permanent residence permit can only be obtained in one.

Permanent residence permits provide the same rights as citizenship, with the exception of the right to vote and be elected to government bodies.

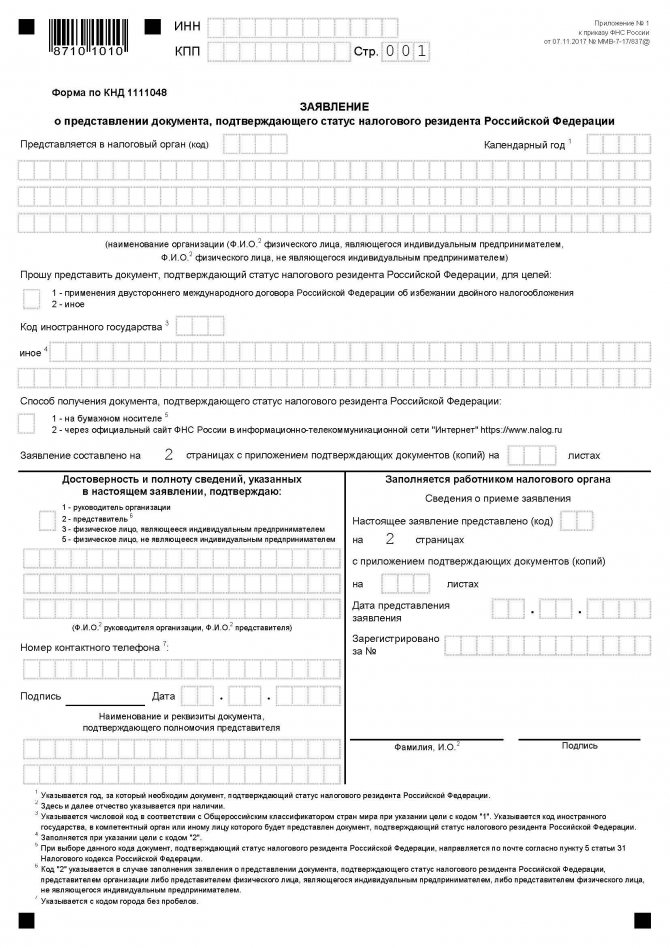

How to fill out an application?

The taxpayer submits an application of a certain sample to the authorized tax authority. You can submit it in person or through the Internet service of the Federal Tax Service.

Important! Pay attention to the “code” column. When applying in person, you must enter four zeros (0000), if you are sending an application by mail, tax authority code 9965.

The application must be filled out on a computer or manually (in black ink). All fields to be filled out must be written in clear, legible handwriting, without corrections or erasures.

To obtain resident status with a residence permit, the following documents are provided:

- copies of civil passport pages. It must be accompanied by a notarized translation;

- documents that can confirm that the individual was in the country during the period for which he wants to receive the document. A residence permit can serve as such a document; in addition, you can provide a foreign passport with marks of entry into the territory of the Russian Federation;

- certificates confirming income (copy of work book/contract, bank or accounting statement, etc.);

- rights to own real estate, payment of dividends, cash or payment checks, etc.

The application has the following form:

When submitting an application to an authorized person, it may be necessary to certify with the signature and seal of the tax authorities the form that is accepted in a foreign country. In this case, this form is adjusted to the above package of documents.

Residence permit - resident or non-resident in 2021

There are several intermediate steps between the position of a migrant who has just crossed borders and a full-fledged citizen. It is easy to get confused in the variety of these terms, especially since they relate to different areas of legislation and sometimes contradict each other. Let's try to understand a rather difficult question: is a person with a residence permit a resident or a non-resident?

What does a residence permit give?

The status gives the migrant great advantages. In his capabilities, he is practically comparable to a citizen, of the significant privileges he lacks, perhaps, only the right to vote (elections at the regional and federal levels are taken into account). Let's list what a residence permit in Russia gives:

- the right to long-term residence (subject to an annual visit to the UVM to renew the status);

- the ability to leave and return to the country an unlimited number of times (provided that the foreigner spends abroad no longer than 6 months per year);

- the right to enjoy all social benefits of a citizen;

- permission to work or study in the country.

After receiving a residence permit in Russia, a person does not lose the citizenship of his country.

Who can receive

All foreigners have this right provided they stay in Russia for a year on the basis of a temporary residence permit obtained under the quota. The requirement to issue a temporary residence permit is not mandatory for a number of categories, including:

- those who previously renounced Russian citizenship;

- Russian-speaking foreigners;

- asylum seekers and refugees;

- highly qualified specialists;

- participants of the State Program for the Return of Compatriots;

- citizens of Belarus and Kyrgyzstan.

These persons have the right to apply to the GUVM for a residence permit immediately after crossing the border.

Definition of concepts

In Russia, the term “resident” refers to several statuses. One of them is tax. The other is financial. In the first case, resident rights are granted to foreign citizens who spend more than 183 days in the Russian Federation during a tax year.

The number of days is obtained by summing all visits to Russia during a specified period of time. If a person spends less than 183 days, then he will not be considered a resident (Clause 2 of Article 207 of the Tax Code of the Russian Federation). In the second case, the presence of a residence permit plays a significant role.

Certificate holders are granted the rights of a financial resident.

The legislative framework

Resident status in the Russian Federation is regulated by the Tax Code (Articles 207, 224), Federal Law No. 173 of December 10, 2003 (on currency regulation and control). It is also recommended to remember the provisions of the basic laws for migrants: Federal Law No. 115 of July 25, 2002 (on the rights of foreigners) and Federal Law No. 62 of May 31, 2002 (on citizenship).

Does a migrant with a residence permit become a resident?

The concepts under consideration are independent of each other. A person with a residence permit can be a resident or non-resident in the Russian Federation. However, one of the conditions for a residence permit is to stay in the country for more than 6 months annually. Consequently, individuals who spend one tax season in their newfound status automatically become residents. Otherwise, they will lose their residence permit.

: Who is a tax resident and who is a non-resident

But this is due to the tax component. The concept of a resident may also apply to financial legislation. From this point of view, any foreigner without a residence permit will be a non-resident, regardless of the length of his stay in the Russian Federation. To finally understand: a person with a residence permit is a resident or not, you should understand the differences between the concepts.

What is the difference between resident and non-resident

Since both concepts relate more to tax and financial legislation, the difference is expressed precisely in money.

- A tax non-resident is required to contribute 30% of income to the state treasury. The resident pays the usual 13% (clauses 1, 3 of Article 224 of the Tax Code of the Russian Federation).

- Financial residents have every right to open deposits in foreign currency on the territory of the Russian Federation and carry out other banking operations. Non-residents are subject to significant restrictions.

As you can see, the question of whether a person with a residence permit is a resident is quite confusing. Let's figure out who and when is granted the status in question.

In what cases does a person receive resident status?

There are not so few grounds operating in 2021. In addition to the residence permit, other factors also influence the presence of resident status.

- All citizens of the Russian Federation are considered such, except for Russians living abroad for more than a year with a residence permit, on the basis of employment or for training purposes.

- Foreigners who stay in the Russian Federation for more than 183 days during the year also become residents and pay 13% personal income tax.

- Financial residents - foreigners are only persons with a valid residence permit.

- If we go beyond individuals, then all legal entities (companies) registered within the framework of Russian legislative requirements on the territory of the Russian Federation, as well as their foreign branches and other divisions, will be recognized as residents.

- Diplomatic bodies of the Russian Federation around the world have a similar status.

For residents and non-residents in Russia, there are different conditions for opening and servicing bank accounts, carrying out currency transactions, receiving/sending money transfers, many other banking operations and more.

Non-resident rights

There are practically no barriers imposed on persons with this status. The only thing is that they will be limited in their ability to carry out currency transactions with Russian banks.

Mortgage lending is closed to such persons.

However, non-residents with a residence permit can also enjoy all the benefits of the status, including the right to social grants, medical care and education for children.

Tax system

The main disadvantage of non-resident status is the need to pay personal income tax of 30%. However, immigrants under the State Program and highly qualified specialists are exempt from this (Article 224 of the Tax Code of the Russian Federation).

Resident status may affect whether a loan to a foreign citizen with a residence permit is approved or not. Non-residents are usually denied loans.

Bank employees treat foreigners with residence permits more leniently, but the conditions for them will still be stricter than for Russians:

- higher interest on the loan;

- mandatory presence of a guarantor from the Russian Federation;

- limited loan terms.

Many personnel departments, when employing a migrant, a priori register him as a non-resident (with 30% personal income tax), but after he has worked for six months (that is, spends the required 183 days in the country), they give him a tax refund (17%). This practice is generally accepted, so it is important for a foreigner with a residence permit to monitor the situation and, if necessary, be able to defend his rights.

Results

The main criterion for a resident is staying in the Russian Federation for 183 days. The main advantage of the status remains taxation at 13% instead of 30% for a non-resident. It is not necessary to have a residence permit, but after receiving it, the foreigner is guaranteed to become a resident, since the conditions of the status correspond to the requirements for a residence permit.

Source: https://emigrant.expert/vnzh/rezident-ili-nerezident

Where and how to obtain a document confirming the status of a resident of the Russian Federation?

The applicant can indicate the most convenient way to receive a document confirming receipt of resident status under a residence permit: in person, at the specified postal address, or by email.

One of the main goals of obtaining this status is to avoid double taxation. Documents are issued for 1 year, the one indicated in the application, but you can request data for previous years.

Important! If you need several copies of a document, please indicate the required number in the letter attached to your application.

The time period and procedure for considering the application are regulated by the Order. Confirmation of the status “tax resident of the Russian Federation” is issued no later than forty days after submitting the documents. In the case of a negative decision, when the resident status is not confirmed, the applicant receives a written notification indicating the reason for the negative decision.