In our article, we talk in detail about what a TIN is and whether foreigners need a TIN, as well as how a foreign citizen is registered with the tax authorities of the Russian Federation. In the article you will find a sample application for a TIN for a foreign citizen and official instructions for filling them out.

To move around the page more conveniently, you can use the navigation:

- What is the TIN of a foreign citizen?

- Does a foreigner need a TIN and why?

- TIN and patent for work (without TIN the patent cannot be renewed)

- Where can a foreigner get a TIN?

- How to get a TIN for a foreigner

- What does a foreign citizen need to obtain a TIN?

- List of documents for obtaining a TIN for a foreign citizen in Russia

- Application for obtaining a TIN for a foreign citizen (sample)

- How to fill out an application form for tax registration of a foreign citizen in the Russian Federation

- What does the TIN of a foreign citizen look like?

- What does a certificate of registration of an individual (foreign citizen) with the tax authority look like?

- How to find out the TIN of a foreign citizen

- Is it possible to find out the TIN of a foreign citizen from a passport online?

- How to find out the TIN of a foreign citizen using a patent

What is the TIN of a foreign citizen?

TIN of a foreign citizen (taxpayer identification number) is the personal number of each foreign citizen registered with the tax authorities of the Russian Federation.

The assignment of a TIN to a foreign citizen in the Russian Federation, as well as to citizens of the Russian Federation, occurs only once and is forever assigned to an individual, becoming his personal identifier in the tax authorities.

The fact that a foreign citizen has received a TIN is confirmed by the issuance of a certificate of registration of an individual (foreign citizen) with the tax authority. The certificate must include the following information:

- Full name of the foreigner registered with the tax office;

- number of the tax authority that issued the TIN to the foreigner;

- series and document number.

Get an Inn for Armenian citizens in 2021

An identification document, which is usually a passport. If this document is drawn up in a foreign language, then a notarized translation is also required.

If a foreigner is already working at any enterprise, then the employer is obliged to issue a TIN for the foreigner within 30 days from the date of registration for work and report this to the Federal Migration Service of the Russian Federation.

The list of situations when the assignment of an identification number to a foreigner is a mandatory event is prescribed in legislative acts, so it is logical to refer to them.

As noted above, a taxpayer identification number (TIN) is an individual identifier for a specific citizen (individual) or organization (legal entity) in the tax authorities of the Russian Federation. It is assigned once and remains forever in the databases of the Federal Tax Service (FTS) as a personal identifier of a person or organization.

The form is issued free of charge. A set fee is charged for receiving notifications by mail. A huge disadvantage of the registration is that information about the arrival is entered into the computer only after the FMS has received and processed the postal item (and this sometimes takes more than 3 weeks).

A foreign citizen may be denied an individual number in the rarest cases:

- incorrectly completed application;

- if the package of documents is not complete;

- fake documents provided.

The TIN of a foreign citizen, his taxpayer identification number, looks exactly the same as the TIN of citizens of the Russian Federation - these are numbers that are the personal identifier of a foreigner in the tax authorities of the Russian Federation. These numbers are indicated in the tax registration certificate of the foreigner.

The rules for registering foreigners are described in the Federal Law on Migration Registration No. 109 of July 18, 2006.

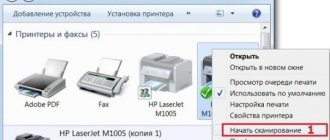

There are several ways to submit an application and then receive a certificate of registration: by personally contacting the territorial tax office; by mail; in electronic form via an online form on the Federal Tax Service website.

Does a foreign citizen need a TIN and why does a foreigner need a TIN?

Many people wonder whether foreign citizens receive a TIN in Russia and, if so, which foreign citizens are assigned a TIN in the Russian Federation?

A TIN is needed to record income and taxes paid by a foreign citizen.

In accordance with clause 7 of Article 83 of the Tax Code of the Russian Federation, as well as with clause 7 of Article 13 of Federal Law No. 115 “On the Legal Status of Foreign Citizens in the Russian Federation”, foreign citizens - individuals must register with the tax authorities according to place of residence, at the location of their real estate and vehicle, as well as on other grounds provided for by the legislation of the Russian Federation.

Thus, registration of a foreign citizen with the tax office and obtaining a TIN by a foreigner in the Russian Federation are mandatory if:

- A foreign citizen intends to live and work in the Russian Federation and earn income, and he needs to obtain a work permit or a labor patent to work in the Russian Federation.

- A foreign citizen received a temporary residence permit in the Russian Federation.

- A foreign citizen in Russia owns property that is subject to taxation, including a car or real estate.

- A foreign citizen carries out transactions in the Russian Federation that are subject to taxation.

How to obtain citizenship for citizens of Kyrgyzstan

Our legislation does not provide for any special simplifications in the process of obtaining citizenship for the Kyrgyz. Therefore, we advise you to read in detail a separate article devoted to aspects of obtaining a Russian passport. Like other foreigners - except Belarusians - citizens of Kyrgyzstan can:

- naturalize, that is, live for about 5 years in the Russian Federation, fulfilling a number of requirements;

- undergo an accelerated procedure that takes a year and a half.

As you understand, the second option requires special grounds - marriage to a citizen of the Russian Federation, participation in the state resettlement program, etc. The general procedure for citizens of Kyrgyzstan consists of the following stages:

- registration for migration;

- obtaining temporary residence permit status;

- obtaining a residence permit;

- submission of documents for citizenship.

It is important to note that to obtain a Russian passport you will have to renounce your Kyrgyz citizenship. If you follow the general scheme, you don’t have to rush to renounce citizenship: you will need to submit an application for this at the very last stage. At the same time, some of the simplified schemes imply an initial renunciation of Kyrgyz citizenship - for example, it will be required almost immediately if you intend to participate in the resettlement program.

How can a foreign citizen obtain a TIN and register for tax purposes in Russia?

In order to obtain a certificate of registration with a tax authority (TIN) in Russia, a foreign citizen must contact the tax authority at his place of residence with an application to register an individual in the prescribed form.

The list of documents for obtaining a TIN by a foreign citizen depends on the reason for which the foreigner is in Russia.

In addition to the application, you must provide one of the following documents:

- RVP in Russia with a mark of registration in the Russian Federation;

- an identity document of a foreigner with a mark of registration at the place of residence in Russia;

- an identification document of a foreign citizen and a detachable part of the Notification of Arrival form with a mark or a migration card with a mark of registration at the place of temporary stay.

How to issue a TIN for a citizen of Kyrgyzstan in Russia in 2021: deadlines for issuing a TIN

A certificate of registration of an individual with the tax authorities, regardless of whether he is a Russian or a foreigner, is issued after 5 working days . The deadline for the tax authorities to complete the document is counted starting from the date the applicant accepts the set of documents for the application for the issuance of a TIN.

Important! If the information presented in the documents submitted to the specialist is not confirmed through interdepartmental interaction channels, or there is a suspicion that the information is unreliable, the time frame for completing the document may be delayed until the circumstances of the case are clarified.

After the specified period, the tax service issues a certificate of the established form (form 2-3-Accounting), in accordance with Order of the Ministry of Finance of the Russian Federation dated October 21, 2010 No. 129n, or sends the document by registered mail.

Documents required for obtaining a TIN for a foreign citizen

Thus, a foreign citizen needs the following documents to obtain a TIN:

- application form for registration of an individual with the tax authority;

- passport (identity document);

- notarized translation of the passport;

- migration registration form with registration at the place of stay;

- migration card.

Documents for TIN for a foreign citizen with a temporary residence permit

- Applications for registration of an individual (foreigner) with the tax authorities.

- Residence permit in the Russian Federation with a mark of registration at the place of residence in Russia.

How to get a TIN if you don’t have a Moscow (St. Petersburg) registration?

A TIN can be obtained not only at the place of residence (registration) but also, according to the Order of the Federal Tax Service dated June 29, 2012, at the actual location of the real estate or vehicle. Regarding the vehicle, it means that it must be registered in Moscow or the Moscow region (the same applies to St. Petersburg and other Russian cities).

In accordance with the Agreement between the Russian Federation and the Republic of Kyrgyzstan dated June 19, 2015, citizens of Kyrgyzstan may not register for mandatory registration within thirty calendar days from the date of entry into the territory of the Russian Federation.

Important! Mandatory registration for citizens of Kyrgyzstan on the territory of the Russian Federation has not been abolished, but only postponed by legislative norms for thirty days. During the specified period after crossing the border, they may not register at their place of stay.

The beginning of the thirty-day period is considered to be the date of actual entry on the migration card.

Application for registration of a TIN for a foreign citizen

An application for obtaining a TIN for a foreigner (application for registration with the tax authority of an individual - a foreign citizen) contains 3 pages, which look like this:

applications for registration of a foreign citizen with the tax authority for obtaining a TIN for a foreigner can be found here.

Who needs

If you just came as a tourist or to visit friends, then you do not need to obtain a TIN, because you do not have any income in the country. But you will have to get it if you:

- You work in the country as a foreign specialist.

- You live in the Russian Federation, even temporarily.

- An individual entrepreneur or a legal entity that does business in Russia.

- Are you planning to obtain a labor patent in the Russian Federation?

- You have objects in Russia that are subject to taxation.

- You make any transactions from which you receive income, including with securities.

In addition, a foreigner who receives a temporary residence permit must obtain a number.

How to find out the TIN of a foreigner using a patent

It is no secret that foreign guests planning to stay in Russia must complete a lot of migration documents. One of them is a patent, which gives the right to work in our country. There are many features and nuances of obtaining this document, including: duration and territory of validity, categories of recipients, renewal procedure, and so on.

So, a patent is issued so that you can get a job. Naturally, we are talking about official employment, when both the employer and the employee are on friendly terms with the law. This means that the first one pays taxes and insurance premiums in good faith, and the second one honestly prepares migration documents. Often, the employer independently tries to find out whether a potential foreign employee has a TIN, and the easiest way to do this is on the Federal Tax Service website. However, you need to keep in mind that, alas, it is impossible to find out the TIN of a foreign citizen using a patent online. The fact is that the tax department’s online resource can identify a taxpayer only using an identification document. But a patent, like a work permit, is not one of these.

Although this should not be a problem, since there is hardly a desperate employer who would hire a person who does not have a single identification document. On the Federal Tax Service website you can find out the TIN of a foreign citizen by residence permit, passport, temporary residence permit, birth certificate or certificate of temporary asylum.

What is a TIN? Who needs it and why?

For citizens, four digits at the beginning allow them to identify the tax authority, the next six are a unique code assigned to a person for his individualization in the tax system.

Then enter the verification code below and click on the “Find out TIN” button. If you did everything correctly, you will see the inscription below: INN was found for patent No. XX XXXXXXXX: XXXXXXXXXXXX Request on the Federal Tax Service website to find out the INN. According to the Tax Code, it is impossible to work or own real estate and vehicles in the Russian Federation without this number. What does a foreign citizen need to obtain a TIN? Like Russians, he can appear at the tax office at his place of residence/stay and submit an application for tax registration and the issuance of the appropriate certificate.

If a citizen of the Republic of Armenia arrived in the Russian Federation for more than 30 (thirty) days, he is obliged to register with the migration authorities and obtain registration. Also, if he plans to stay on the territory of the Russian Federation for more than 90 days, then he must enter into an employment contract with the employer and “extend” his registration for up to 1 year.

We invite migrant workers and construction companies to settle in hostels and hostels in Moscow.

The combination of numbers is not formed by selecting random numbers, but is divided into groups, each of which has its own meaning. So, the first two digits indicate the code of the subject of the Russian Federation (in other words, they talk about the region where the person is registered with the tax authorities).

However, a person’s failure to receive such a certificate after registering with the tax authority does not mean that he has not been assigned a tax ID.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

However, a person’s failure to receive such a certificate after registering with the tax authority does not mean that he has not been assigned a tax ID.

To obtain information about the TIN of an individual, you will need to fill out a special form in which you must enter all passport data (full name, date and place of birth, number and series of the identity document, when and by whom this document was issued). After this, the service will ask you to enter a captcha (numbers from the picture), and then provide the information of interest.

Many people are interested in how to find out the TIN from their passport. In the first half of the nineties, such a concept as a taxpayer identification number was introduced in Russia.

The TIN number for identification has the form of a regular code consisting of 12 digits. Upon careful examination, each of them has its own, specific meaning for those who are thinking about how to find out the code.

Of course, tax ID helps citizens too. Thus, it allows you to avoid confusion when paying taxes from persons with the same personal data. The same situation occurs when receiving benefits and tax deductions. In addition, the taxpayer number allows you to control your debt for mandatory payments to the budget.

With the second method, you need to submit an application to the tax service, for your place of residence with a passport, as well as a receipt for payment of the state duty in the amount of 100 rubles.

The processing of personal data in this law means actions (operations) with personal data, including collection, recording, systematization, accumulation, storage, clarification (updating, changing), extraction, use, transfer (distribution, provision, access), depersonalization, blocking , deletion, destruction of personal data.