What documents will you need?

When filling out the form, you will need to enter data from other documents. Therefore, if you prepare them in advance, you can greatly facilitate the process of drawing up the document. So, to fill out you will need:

- Passport or other document serving as identification.

- Registration document in case of missing information in the passport.

- If an authorized person will contact the tax service, then a document certifying his authority (for example, a power of attorney) is required.

- Directory on “Types of taxpayer identification documents” (available on the Internet).

- All-Russian Classifier of Countries of the World, abbreviated as OKSM (can be found on the Internet).

How to obtain a TIN for an individual?

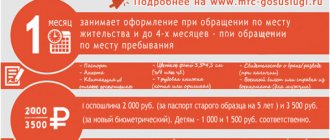

To obtain a TIN you need to take 2 simple steps:

- Fill out an application in form 2.2 “Application from an individual for registration with the tax authority”;

- Submit your application to the tax authority at your place of residence. This can be done in person, by mail or through a representative.

This application form is an appendix to the order of the Federal Tax Service of Russia dated August 11, 2011 No. YAK-7-6/488. It is this application form that is currently used to obtain a TIN (2014).

When going to the tax office to submit an application, do not forget to take the following documents with you.

What documents are needed to obtain a TIN:

|

What must be provided to obtain a TIN for an individual?

There is another simple way to register a TIN - through the service of the Federal Tax Service. Using this service, you can fill out an application for a TIN online and then send it to the Federal Tax Service. After the TIN certificate is ready, you will need to come to the tax office at your place of residence and receive it.

Where can I get an application?

If you plan to fill out a form at the tax office immediately before submitting your application, the form will be provided to you on site.

If you decide to draw up an application in advance, saving time, or send a request by mail, then the application form 2-2 can be found on the Internet.

For example, on the website of the Federal Tax Service. The same service makes it possible to fill out an electronic version of the questionnaire, but the service is available only to registered users who have an electronic signature.

Basic rules for filling out the application form

Filling out the form for assigning a TIN is regulated by the rules of paragraph 5 of article 84 of the Tax Code of the Russian Federation. According to this document, data can be entered using printing technology or handwritten.

There are also several general rules:

- each sheet of the questionnaire must be printed on a separate sheet of paper;

- Do not fasten sheets in ways that could damage the paper;

- Marks and corrections are not allowed;

- dates are written in numbers only;

- When filling out the form on the computer, select the font “Courier New”, size 16.

Can I fill out the form by hand and with what type of pen?

As noted above, the application can be completed by hand. But the pen should be a ballpoint pen, and the color of the paste should be blue or black. In addition, the following rules must be observed:

- You should start filling out the field from the first familiar place (square);

- All information is entered in printed capital letters only.

A blank form for obtaining a TIN for an individual.

Step-by-step instruction

Let's consider the points of each of the sheets of the application form (there should be 3 of them), according to their location, from top to bottom.

First page:

- Code of the tax office where you plan to file documents.

- Full name must be indicated; if there is no middle name, then enter “1” in the column.

- If the documents are not provided in person (via mail or a proxy), then in a special field (below on the right side) the number of attached sheets with copies of the submitted papers is indicated.

- In the block on the accuracy and completeness of information, numbers may be indicated: 5 – if the application is submitted by the taxpayer personally, in this case his full name, telephone number (numbers are written in a row), signature and date of the application are indicated again; 6 – documents are submitted by a representative; his data is indicated in the following columns (full name, telephone number, signature).

- If the application is submitted by an authorized representative, then in the column confirming the authority of the representative, the corresponding type of document is indicated, the original and a copy of which must be presented along with other documents.

The remaining columns are filled in by tax officials.

Second page:

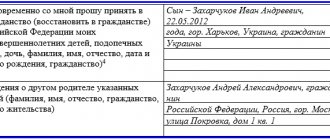

- At the top we write the initials and surname of the person submitting the application.

- Below you must enter information about the change of last name, first name or patronymic if the procedure was carried out after the specified period (1996).

- Gender is indicated in numbers: 1 for male, 2 for female.

- Date and place of birth - data indicated corresponds to what is recorded in the passport. If information is missing from the identity document, it is taken from the birth certificate.

- The type of document that serves as identification. The passport has code 21. Information about other types of documents can be found in the directory on “Types of taxpayer identification documents.” Then the document data is entered.

- Then the citizenship field is filled in. It is necessary to indicate: 1 - if the individual is a citizen of the Russian Federation; 2 – the individual is not a citizen of the Russian Federation.

- Country code - indicate the country of which the person submitting the application has citizenship. The necessary information can be found in the All-Russian Classifier of Countries of the World. For Russia – 643.

- The address is indicated with: 1 – if the Russian Federation is a permanent place of residence; 2 – the Russian Federation acts as a place of temporary stay.

- The detailed address is indicated in accordance with the paper confirming registration, regardless of whether it is temporary or permanent.

You must also specify the index and region code.For those living in Moscow and St. Petersburg, the “district” and “city” columns remain blank.

- The signature of the applicant or authorized representative is placed at the bottom.

Third page:

- At the top, as on the previous page, initials and surname are indicated.

- Then you must specify the type of document that is used to confirm registration. This column is filled in in two cases: 1) a document that was presented as identification, not a passport; 2) the person submitting the application is not a citizen of the Russian Federation.

- The date of registration is indicated below. It must correspond to what is indicated in the document about the place of residence.

- The previous place of residence is indicated in the image of the current address (indicating the region, zip code and date of registration).

- The column indicating the country of permanent residence before arriving in the Russian Federation is required to be completed only for foreign citizens.

- It is necessary to indicate the address of the applicant’s actual residence if it is different from the place of registration. Mainly necessary if the application will be sent by mail.

- Below is the personal signature of the taxpayer or the person representing him.

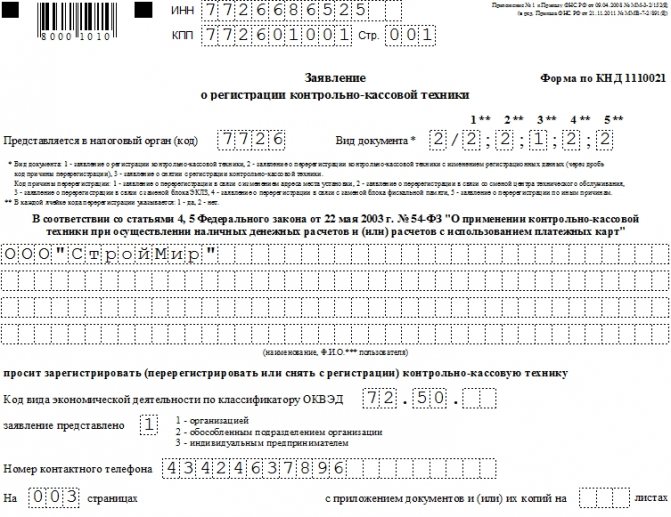

Sample application for replacement of ECLZ

Filling out the headers and footers

On each page in the header information about the organization that owns the cash register is indicated:

- her TIN,

- checkpoint

- and page number.

Filling out the title page

In the order of the cells to fill in the data, enter:

- tax authority code (this must be clarified with the territorial tax service),

- type of document: in this case, the number 2 is placed in the first cell, and then two twos, a one and two more twos (footnotes on how to fill out these cells are below and indicated with asterisks).

- Next, the document contains the full name of the organization that owns the cash register (indicating its organizational and legal status),

- type of activity according to OKVED (All-Russian Classifier of Types of Economic Activities - contained in the constituent papers of the company),

- applicant code (organization, its separate division or individual entrepreneur),

- contact phone number (in case tax officials have any questions for the owner of the ECLZ),

- number of pages in the application (3),

- number of application sheets (if any).

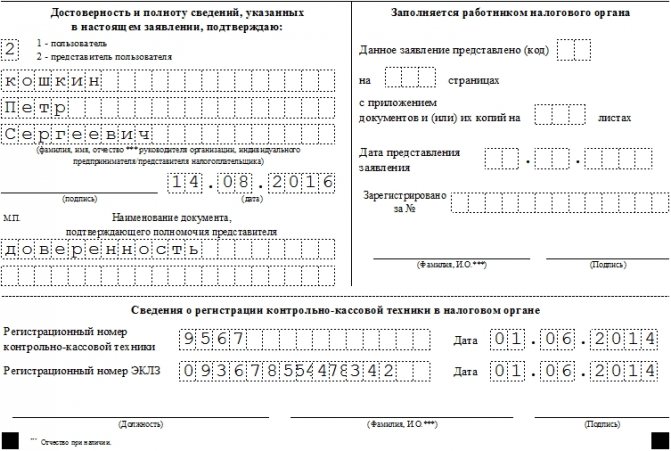

Fill in contact information

Conventionally, the second part of the title page is divided into two sections. The one on the left is filled out personally by the owner of the cash register and the EKLZ block or his representative authorized by a power of attorney. If the owner came to submit the application in person, then the number “1” must be put in the appropriate cell; if not, then the number “2”. After this, the last name, first name, and patronymic of the person filling out the document are entered into the form, as well as the current date. If the application is drawn up by a representative of the owner, below should be indicated the name and number of the document on the basis of which he is acting (power of attorney, instruction, order, etc.).

There is no need to touch the right side of the application - all data is entered into it by a tax inspector.

Filling in information about CCP

At the bottom of the page there are two lines in which you need to enter the registration number of the CCP, EKLZ, as well as the date of their registration (you can find this information in the registration card).

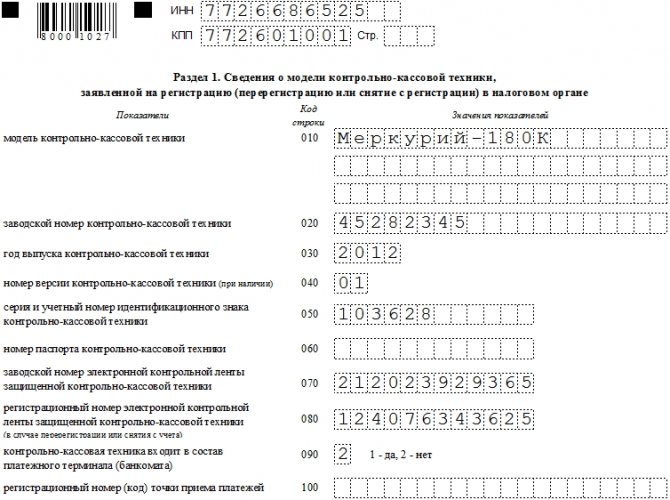

Filling out section 1

The second page of the application consists of section 1 and contains all the necessary data about the cash register, the EKLZ of which needs to be replaced. In the corresponding lines enter here

- cash register name,

- Production year,

- number assigned to it by the manufacturer

- and model number.

All this can be found both in the personal document of the cash register and on it itself.

In addition, the cash register passport contains the registration and serial identification number (but it should be noted that not all models of cash register equipment have this data, so if the tax authority requires you to fill out these cells, you will have to purchase an identification number).

Since there is still no legally approved sample passport for cash register equipment, line 060 does not need to be filled out .

Lines 070, 080 concern the ECLZ itself. Information for line number 070 is in the EKLZ passport (at the same time, there are more digits in the number than the number of cells in the standard application form, so you should simply skip the first digit and enter all the rest in order) The EKLZ registration number (080) can be found in cash register passport.

in line number 090 (provided that the cash register is not used in a payment terminal and lines numbered 100-120 are filled in in the same way (i.e. only when installing the cash register in a PT).

The name and TIN of the company servicing the cash register can be found from the agreement with it, as well as all other information entered in lines numbered from 130 to 150 inclusive.

Information about the registration and individual number of the seal brand, as well as the number and year of issue of SVK SO and SVK GR for the last year (they are pasted in the form of holograms, SO stands for “service”, GR - as “state register”) can be found on the box office itself.

Completing section 2

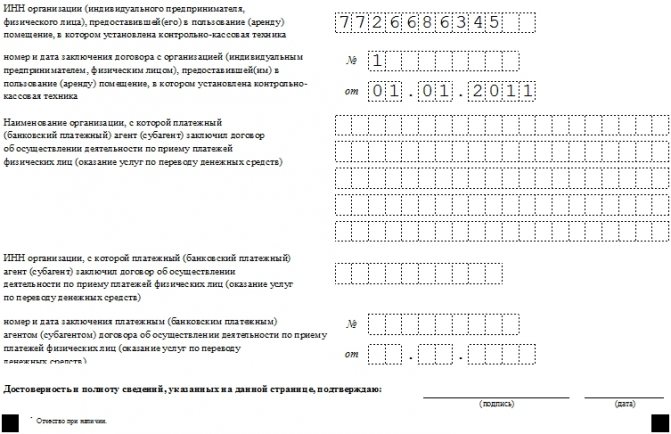

The final sheet of the application includes information about where exactly the cash register was located, incl. designation of the installation location (store, sales department, office, tent, etc.) and data from the rental agreement.

If the building, office or premises in which the cash register is located is owned by the applicant, then the rental lines can be ignored.