Foreign citizens often come to Russia to work. If entry into the country is carried out under a visa regime, for official employment you will need to obtain a work permit. And for those who crossed the border of the Russian Federation in a visa-free regime, a patent is provided. In both cases, the employer is obliged to withhold personal income tax from the foreigner’s wages, as if a Russian were working for him. We suggest finding out how to withhold personal income tax from foreign workers in 2021 (working under a patent).

How is a fixed down payment calculated?

Calculation and payment of income tax (NDFL) to the budget of foreign citizens is carried out in accordance with the instructions of Art. 227.1 Tax Code of the Russian Federation. Paragraphs 2 and 3 of this article state that the migrant makes advance payments for the period of validity of the patent issued to him in the amount of 1,200 rubles per month . The payment amount is adjusted taking into account the following coefficients:

| No. | Coefficient name | Coefficient value | Additional information |

| 1 | Deflator | 1,729 | Sets every year (1.729 is for 2021), see Order of the Ministry of Economic Development of the Russian Federation dated October 30, 2021 No. 595 |

| 2 | Regional | Depends on the subject of the Russian Federation, or 1 (if the region has not set its coefficient) | Approved by the majority of constituent entities of the Russian Federation, for a calendar year. The coefficient reflects the regional characteristics of the labor market. |

| Regional coefficient in regions (examples) | Calculation of fixed payment in the region | Fixed payment amount in the region | |

| Moscow – 2.4099 | 1200 rub. x 1.729 x 2.4099 | 5,000 rubles | |

| St. Petersburg – 1.8315 | 1200 rub. x 1.729 x 1.8315 | 3,800 rubles | |

| Nizhny Novgorod Region | 1200 rub. x 1.729 x 2.06 | 4,274 rubles | |

The migrant must pay fixed payments in the region in which he works under the patent. The duration of the patent is paid until the start date of the period for which the patent is issued/extended/reissued.

Let's consider a special case. Let’s say a foreigner filed a patent for the first time in 2021, made an advance payment taking into account the deflator coefficient, which was in effect throughout 2021. Then the Ministry of Internal Affairs extends the patent until 01/01/2019, and the document expires in 2021. It turns out that the validity period of the patent refers to different tax periods. In this case , the deflator that was in effect at the time of making the advance payment is used . There is no need to recalculate the amounts of fixed advance payments. See Letter of the Federal Tax Service dated January 22, 2021 No. GD-4-11/ [email protected]

Important! If the amount of the fixed contribution paid for a tax period turns out to be greater than the amount of personal income tax payable for a similar tax period (calendar year), the employer can take into account the resulting difference when reducing the amount of tax in the next month of the same tax period.

From January 27, 2021, the work patent fee for foreign workers throughout the country will change

How is the monthly payment for a work patent determined?

It is based on the basic value enshrined in the tax code more than five years ago - 1,200 rubles. It is multiplied by the deflator coefficient established annually by the Ministry of Economic Development of the Russian Federation. It is uniform for the entire country, its task is to neutralize the impact of inflation on the base value.

After this, regional authorities come into play and set regional coefficients that form the final cost of the patent.

Let us consider, as an example, the formation of the amount of a fixed advance payment for a patent in 2021 in St. Petersburg.

On October 21, 2021, the value of the deflator coefficient for 2021 became known - 1.813.

The intermediate fee for a patent in 2021 was 1200 x 1.813 = 2175.6 rubles.

Next, the Legislative Assembly of St. Petersburg joined in the formation of the final result, which, by its law dated November 26, 2019, established the value of the regional coefficient, reflecting the regional characteristics of the labor market of the city of St. Petersburg, in the amount of 1.83858.

Thus, the final amount of the fixed advance payment for personal income tax for foreign workers in St. Petersburg was 2175.6 x 1.83858 = 4000 rubles.

However, it remained final for only 27 days - until January 27, 2020, until the new order of the Ministry of Economic Development of the Russian Federation came into force, in which the ministry decided to change the deflator coefficient for 2021!

By Order of the Ministry of Economic Development of Russia dated December 10, 2019 N 793 “On amendments to the Order of the Ministry of Economic Development of Russia dated October 21, 2019 N 684 “On the establishment of deflator coefficients for 2020”, the value of the coefficient was changed from 1.813 to 1.810.

As a result, the Ministry of Economic Development mixed all the cards on the table, and the size of the fixed advance payment for personal income tax for foreigners changed throughout the country. In particular:

— in St. Petersburg, a patent from January 27 will cost not 4,000, but 3,993 rubles. - in Moscow - not 5350, but 5341 rubles.

Below we provide a table of the values of fixed advance payments for a patent until January 27, 2021 and after.

| Name of the Region of the Russian Federation | The amount of the advance payment, calculated based on the value of Coefficient. deflator 1.813 (valid until 01/27/2020) | The amount of the advance payment, calculated based on the value of Coefficient. deflator 1.810 (applicable from 01/27/2020) | |

| 01 | Adygea Republic | 3907 | 3901 |

| 02 | Bashkortostan Republic | 4100 | 4093 |

| 03 | Buryatia Republic | 6200 | 6190 |

| 04 | Altai Republic | 2944 | 2939 |

| 05 | Dagestan Republic | 3481 | 3475 |

| 06 | Ingushetia Republic | 3046 | 3041 |

| 07 | Kabardino-Balkarian Republic | 6527 | 6516 |

| 08 | Kalmykia Republic | 3263 | 3258 |

| 09 | Karachay-Cherkess Republic | 3481 | 3475 |

| 10 | Karelia Republic | 5687 | 5678 |

| 11 | Komi Republic | 4438 | 4431 |

| 12 | Mari El Republic | 4329 | 4322 |

| 13 | Mordovia Republic | 4029 | 4023 |

| 14 | Sakha (Yakutia) Republic | 9788 | 9772 |

| 15 | North Ossetia (Alania) Republic | 3220 | 3215 |

| 16 | Tatarstan Republic | 4134 | 4127 |

| 17 | Tyva Republic | 4162 | 4155 |

| 18 | Udmurt republic | 4134 | 4127 |

| 19 | Khakassia Republic | 4351 | 4344 |

| 20 | Chechen Republic | 0 | 0 |

| 21 | Chuvash Republic | 4351 | 4344 |

| 22 | Altai region | 3829 | 3823 |

| 23 | Krasnodar region | 4351 | 4344 |

| 24 | Krasnoyarsk region | 4443 | 4435 |

| 25 | Primorsky Krai | 5657 | 5647 |

| 26 | Stavropol region | 4025 | 4018 |

| 27 | Khabarovsk region | 5113 | 5104 |

| 28 | Amur region | 5924 | 5914 |

| 29 | Arhangelsk region | 3699 | 3692 |

| 30 | Astrakhan region | 3999 | 3992 |

| 31 | Belgorod region | 4717 | 4709 |

| 32 | Bryansk region | 4134 | 4127 |

| 33 | Vladimir region | 4395 | 4387 |

| 34 | Volgograd region | 3916 | 3910 |

| 35 | Vologda Region | 4765 | 4757 |

| 36 | Voronezh region | 4678 | 4670 |

| 37 | Ivanovo region | 3777 | 3771 |

| 38 | Irkutsk region | 6163 | 6153 |

| 39 | Kaliningrad region | 4569 | 4561 |

| 40 | Kaluga region | 4200 | 4193 |

| 41 | Kamchatka Krai | 6309 | 6299 |

| 42 | Kemerovo region | 4205 | 4198 |

| 43 | Kirov region | 4090 | 4083 |

| 44 | Kostroma region | 3381 | 3375 |

| 45 | Kurgan region | 4299 | 4292 |

| 46 | Kursk region | 5124 | 5115 |

| 47 | Leningrad region | 4000 | 3993 |

| 48 | Lipetsk region | 4351 | 4344 |

| 49 | Magadan Region | 0 | 0 |

| 50 | Moscow region | 5100 | 5092 |

| 51 | Murmansk region | 4786 | 4778 |

| 52 | Nizhny Novgorod Region | 4612 | 4605 |

| 53 | Novgorod region | 5004 | 4996 |

| 54 | Novosibirsk region | 4308 | 4301 |

| 55 | Omsk region | 3738 | 3731 |

| 56 | Orenburg region | 4003 | 3996 |

| 57 | Oryol Region | 3973 | 3966 |

| 58 | Penza region | 3916 | 3910 |

| 59 | Perm region | 3706 | 3700 |

| 60 | Pskov region | 4105 | 4099 |

| 61 | Rostov region | 3916 | 3910 |

| 62 | Ryazan Oblast | 4699 | 4692 |

| 63 | Samara Region | 4090 | 4083 |

| 64 | Saratov region | 4029 | 4023 |

| 65 | Sakhalin region | 6287 | 6277 |

| 66 | Sverdlovsk region | 5400 | 5391 |

| 67 | Smolensk region | 4045 | 4038 |

| 68 | Tambov Region | 4100 | 4093 |

| 69 | Tver region | 5585 | 5576 |

| 70 | Tomsk region | 4200 | 4193 |

| 71 | Tula region | 4719 | 4711 |

| 72 | Tyumen region | 5735 | 5725 |

| 73 | Ulyanovsk region | 3546 | 3540 |

| 74 | Chelyabinsk region | 5000 | 4992 |

| 75 | Transbaikal region | 4656 | 4648 |

| 76 | Yaroslavl region | 4134 | 4127 |

| 77 | Moscow | 5350 | 5341 |

| 78 | Saint Petersburg | 4000 | 3993 |

| 79 | Jewish Autonomous Region | 4612 | 4605 |

| 83 | Nenets Autonomous Okrug | 5313 | 5304 |

| 86 | Khanty-Mansiysk Autonomous Okrug - Ugra | 4921 | 4913 |

| 87 | Chukotka Autonomous Okrug | 5439 | 5430 |

| 89 | Yamalo-Nenets Autonomous Okrug | 9275 | 9259 |

| 91 | Republic of Crimea | 3468 | 3462 |

| 92 | Sevastopol | 4786 | 4778 |

Reduction of personal income tax for a fixed advance payment (personal income tax for foreign workers on patent)

Important! A foreign employee himself pays an advance payment for personal income tax (NDFL) at the time of obtaining a work patent for the first time or when re-issuing a document. The employer does not have the right to assume such a responsibility, in accordance with paragraph 1 of Art. 45 Tax Code of the Russian Federation, clause 1, art. 227.1 of the Tax Code of the Russian Federation, instructions of the Letter of the Ministry of Finance of Russia dated April 2, 2015 No. 03-05-05-03/18346.

In accordance with paragraph 1 of Art. 13.3 of the Federal Law of July 25, 2002 No. 115-FZ, the employer has the right to hire only foreign citizens who arrived in the Russian Federation on a visa-free basis, who are in Russia with the status of temporary residents and who, before official employment, have issued a patent (a document authorizing employment, approved by Order of the Federal Migration Service of December 8, 2014 No. 638).

The employer (and his accountant, in particular) needs to take into account the fact that the patent has a limited validity period, which is longer, the longer the foreigner has paid a fixed advance payment for personal income tax over a longer period (clause 5 of article 13.3 of the Federal Law of July 25, 2002 No. 115-FZ, clause 2 of article 227.1 of the Tax Code of the Russian Federation). Payment is made in proportion to full months. And the amount of the payment varies depending on the subject of the Russian Federation, on the territory of which the foreigner draws up a document and intends to find employment (clause 3 of Article 227.1 of the Tax Code of the Russian Federation).

The employer, at the time of paying wages to a foreign employee and calculating the amount of personal income tax, can take into account the advance payment made by his employee when registering/renewing a patent and reduce the amount of personal income tax. In this case, only the advance payment that was paid by the migrant during the validity period of the patent relating to the current calendar year is taken into account, i.e. current tax period . This is stated in Art. 216 of the Tax Code of the Russian Federation, paragraph 6 of Art. 227.1 of the Tax Code of the Russian Federation, in Letter of the Federal Tax Service of Russia dated March 16, 2015 No. 3N-4-11/4105.

Important! Since 2015, regardless of the length of stay of a foreign citizen in Russia, his income must be taxed (personal income tax) at a rate of 13% if he is employed on the basis of a patent. See paragraph 3 of Art. 224 Tax Code of the Russian Federation, Art. 227.1 Tax Code of the Russian Federation.

The registration of such a “deduction” for personal income tax is carried out in accordance with the following algorithm:

| Stage | Actions on the part of the employer | Clarification |

| 1 | Ask a foreign employee to prepare a tax deduction application (free form) | If an employer constantly hires foreign workers on a patent, it is advisable to develop an application form and issue a “blank” if necessary (see the table below for an example of an application). |

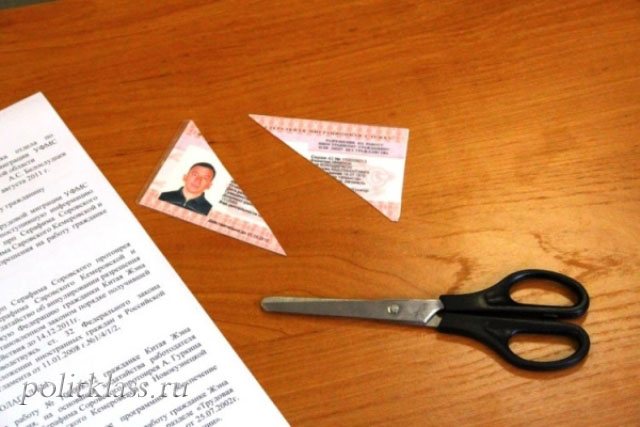

| 2 | Take paid receipts from the foreign employee and photocopy them | First, copies of receipts will be the basis for the deduction. Secondly, the presence of receipts will give confidence in the authenticity of the patent. |

| 3 | Contact your “native” Federal Tax Service, submit an application for the need to receive a notification that confirms the possibility of reducing the amount of personal income tax by fixed payments in the current year | The application should be written in the form recommended by the tax authorities (see Appendix No. 1 to the Letter of the Federal Tax Service dated February 19, 2015 No. BS-4-11/2622). It is recommended to submit the document when the employee’s application and receipts are available (it is better to attach copies of them to the application). |

| 4 | Wait for a special notification from the Federal Tax Service allowing the deduction (notification approved by Order of the Federal Tax Service dated March 17, 2015 No. ММВ-7-11/ [email protected] ) | If the following 2 conditions are met, the notification will be sent within 10 business days. days from the date of application:

(clause 6 of article 227.1 of the Tax Code of the Russian Federation, clause 6 of article 6.1 of the Tax Code of the Russian Federation) |

| 5 | Make a personal income tax deduction for the next payment in favor of a foreign employee | Until a notification is received from the Federal Tax Service, the law does not allow advance payments to be counted! |

An application from a foreign employee for a deduction for personal income tax on account of advance payments made when registering/renewing a patent may look like this:

General Director of UniSand LLC

Emelyanenko P.R.

from Murodov Sodikjon Alizhonovich

STATEMENT

I ask you to reduce the personal income tax withheld from my salary for 2019 by the amounts of fixed advance payments I pay based on the submitted receipts for payment of the patent for the period of its validity in 2021.

Date July 15, 2021 Signature ______________ (S.A. Murodov)

How many months in advance can you make a fixed advance payment for a work patent?

According to current legislation, a foreign citizen must renew his migration registration every time he pays an advance payment for a patent. That is, every time a foreign citizen makes another payment for a patent, he must renew his migration registration.

Since this procedure is quite troublesome, the question arises: is it possible to pay for a patent several months in advance so that you don’t have to renew your migration registration every month?

According to the law, a foreign citizen can make a fixed advance payment of personal income tax on a patent for a period of 1 to 12 months. That is, you can pay for the patent in advance. At the same time, migration registration is extended for the paid period. For example, if a patent is paid for 3 months, then migration registration is extended for 3 months. That is, only after 3 months will there be a need to return to this issue.

Important! It will not be possible to pay for a patent for a period of more than 12 months, since a patent is issued only for a year from the date of issue.

Thus, if a foreign citizen has paid for a patent for 15 months, the patent will still be valid for only 12 months, and the rest of the payment will simply go to the state account and will be lost.

Accordingly, the maximum period for paying for a patent is 12 months.

You can find out how to renew a patent after 12 months without leaving Russia in this article.

Thus, fixed advance payments for a foreign citizen’s patent can be made 12 months in advance, or paid monthly.

An example of reducing personal income tax due to advance payments for a patent

An employer from St. Petersburg signed a GPC agreement with a foreigner for the period of validity of the patent. The foreign employee's patent was issued for a period from April 1, 2019 to June 30, 2021 . The amount of the fixed advance payment was 3800 rubles. x 3 months = 11,400 rubles . The employee's salary is 42,000 rubles .

| Month | Salary | Personal income tax (2 x 13%) | Balance of advance payment at the beginning of the month | Personal income tax payable (3-4) | Remaining AP, transfer to next month (4-3) |

| 1 | 2 | 3 | 4 | 5 | 6 |

| 04.2019 | 42 000 | 5460 | 11400 | 0 | 5940 |

| 05.2019 | 42 000 | 5460 | 5940 | 0 | 480 |

| 06.2019 | 42 000 | 5460 | 480 | 4980 | 0 |

Cancellation of a patent in case of violation of the deadline for payment of personal income tax under the patent

Currently, the patent payment accounting system is fully automated, so the absence of a fixed advance payment for a specific date will lead to automatic cancellation of the patent in the database of the Main Directorate for Migration of the Ministry of Internal Affairs of the Russian Federation.

Therefore, if the fixed advance payment is made at least one day later than the due date, the patent will be automatically canceled.

Common mistakes on the topic “Withholding income tax from foreign workers in 2021”

Error: The employer submitted an application to the Federal Tax Service to issue a personal income tax deduction for a foreign employee on account of the advance payments he made when “purchasing” a patent. Without waiting for notification of permission to make deductions, the employer reduced the personal income tax from the migrant’s next salary.

Until the Federal Tax Service Inspectorate sends a notification about the possibility of a tax deduction, the employer of a foreign employee does not have the right to reduce the amount of personal income tax from the migrant’s wages. Even if the notification does not arrive for a long period of time.

Error: An employer whose enterprise is registered in St. Petersburg hires a foreign citizen who has issued a patent in the Moscow region.

A foreign citizen must carry out labor activities in the territory of the region in which he issued the patent. If the work is found in another subject of the Russian Federation, the patent will have to be reissued.

Monthly payment for a patent - how much to pay for a patent in 2021

Compared to 2021, in 2021 the patent payment amount has changed due to a change in the deflator coefficient, which is taken into account when calculating the monthly amount for a patent.

The Ministry of Economic Development approved the deflator coefficient for 2021 in the amount of 1.729 (in 2021 it was 1.686 - author's note).

Accordingly, the patent fee has increased. Below is the monthly cost of a work patent for a foreign citizen for each region of Russia. You will find exactly how much you need to pay for a work patent in 2021 in the last column of the table.

You can download this table from the link .

Violation of deadlines or unpaid patent: consequences

In a situation where documents are not submitted on time, first-time violators will have to pay a fairly significant fine. Subsequently, if he violates it again, he will have to forcibly leave Russia.

More to read -> What is the Additional Pay for a Veteran of Labor in the Moscow Region for 2021

Changes to the labor patent

- Payment frequency: every thirty days (at least three days must remain before the patent expires);

- A foreign citizen can pay for a patent either every month or for the entire period for which the patent is issued;

That is, if a foreign citizen pays for a patent one month in advance, then he will need to renew the registration for the patent for 1 month. And a month later, everything starts again: first, pay a fixed advance payment of personal income tax on the patent for the next period, then immediately after paying for the patent, renewal of registration.

We answer: the amount of payment for a patent will change compared to 2021, since the deflator coefficient for 2021 for a patent has been changed, based on which the monthly patent tax for a foreign citizen is calculated.

Many foreign citizens already know about changes in the cost of a patent for 2021, and therefore everyone is very interested in the question of whether it will change much and how much they need to pay for a patent.

That is, for example, if your first fixed advance payment for a patent was made on December 10 (date on 1 check), then you need to make the next payment to the patent no later than January 10. At the same time, it is better to pay for the patent a little earlier, on January 8 or 9, so that by January 10, the entire amount of the fixed advance personal income tax payment for the work patent will already be credited to your account.

A patent is an official confirmation of the right to engage in labor activity for a foreign national within the region where it was received and in the profession specified in it. From a legal point of view, the purpose of the form is to legalize the process of employment of non-residents and control the situation on the vacancy market. The document is required for those who came to Russia under the visa-free regime.

More to read —> Taxation deadlines for the sale of donated property up to 1 million 2021

Correct and timely payment for a patent means a foreigner’s legal stay in Russia. Payment for a patent makes it possible to renew the registration. To extend the validity period of a patent, it is necessary to pay an advance tax payment on it monthly. There are certain rules for paying tax payments.

Patent for foreign citizens in 2021: how to pay

Even if the scanner was unable to read the image, you won’t have to fill everything out manually. The document generated through the online service has a unique index, and if you specify it in the appropriate section on the terminal screen, you can count on automatic completion of payment details.

May 06, 2021 uristgd 96

Share this post

- Related Posts

- Special Pension Supplements in 2021 for Pensioners in Kazakhstan

- Sample payment order for dividends to the founder in 2021

- New Travel Rules for Pensioners of the Leningrad Region in 2021

- NPF Transneft Increase in Corporate Pension in 2021

Date of payment of advance personal income tax payments for a patent in 2021

Payment of the fixed payment this year should occur in advance - approximately 3-5 days before the date reflected in the first check for payment of the labor patent.

For example, if the first advance payment was made on September 10, then the next time payment should be made no later than October 10. Payment should be made a little earlier, so that subsequently, by October 10, the payment amount will be in the personal account.