In our difficult times of crisis, it is rare that a foreign employee does not work in an organization. Especially many citizens from the Eurasian Economic Union are employed in Russia. Let us recall that the Eurasian Economic Union (hereinafter referred to as the EAEU) includes four countries: Belarus, Kazakhstan, Kyrgyzstan and Armenia, and the Treaty on the EAEU itself was signed on May 29, 2014.

This article will focus on personal income tax (NDFL), which the employer withholds and transfers to the budget, including payments to foreign employees who are citizens of the EAEU countries for the performance of their work duties.

First of all, it should be recalled that the income of employees who are recognized as tax residents of the Russian Federation is subject to personal income tax at a rate of 13 percent (clause 1 of Article 224 of the Tax Code of the Russian Federation). In this case, tax residents are recognized as individuals who are actually in the Russian Federation for at least 183 calendar days over the next 12 consecutive months (clause 2 of Article 207 of the Tax Code of the Russian Federation). But the majority of income of non-residents of the Russian Federation is taxed at a rate of 30% (clause 3 of Article 224 of the Tax Code of the Russian Federation).

However, we are interested in employees who are citizens of the EAEU, so you should definitely pay attention to the provisions of Art. 7 of the Tax Code of the Russian Federation, which establishes the priority of the rules and norms of international treaties of the Russian Federation containing provisions relating to taxation and fees over the norms of the Tax Code of the Russian Federation and normative legal acts on taxes and (or) fees adopted in accordance with it.

On January 1, 2015, the Treaty on the Eurasian Economic Union (hereinafter referred to as the Treaty) came into force.

Article 73 of the Treaty provides that where one Member State, in accordance with its legislation and the provisions of international treaties, is entitled to tax the income of a tax resident of another Member State in connection with employment carried out in the first-mentioned Member State, such income taxed in the first Member State from the first day of employment at the tax rates provided for such income of individuals who are tax residents of that first Member State.

The provisions of this article apply to the taxation of income in connection with employment received by nationals of Member States.

In other words, the income of a foreign employee from the EAEU countries is taxed at a rate of 13% from the first day of work in a Russian company, regardless of whether or not he has the status of a tax resident of the Russian Federation.

In this case, no confirmation of the employee’s status is required from the tax authorities of the Russian Federation (Letters of the Federal Tax Service of Russia dated June 10, 2015 No. OA-3-17 / [email protected] and dated April 30, 2015 No. OA-3-17 / [email protected] ).

However, it is important to note here that having the status of a tax resident of the Russian Federation is fundamental in the case when an employee has the right to tax deductions. From the moment the status of a resident of the Russian Federation is received, the tax begins to be calculated taking into account tax deductions, and the tax itself is calculated on an accrual basis from the beginning of the year (clause 3 of Article 210, clause 1 of Article 224, clause 3 of Article 226 of the Tax Code of the Russian Federation) .

If the tax status of an employee has changed during the year, it will be necessary to recalculate personal income tax based on the new status (clauses 1, 3 of Article 226 of the Tax Code of the Russian Federation) taking into account deductions, while the tax rate in this case remains the same 13 percent (clauses 1, 3, Article 224 of the Tax Code of the Russian Federation).

Let's look at this with an example.

From January to June, an employee - a citizen of Kazakhstan (non-resident of the Russian Federation) received a salary of 35,000 rubles. per month, from which personal income tax was withheld at a rate of 13%. For six months, the amount of tax withheld amounted to 27,300 rubles. (RUB 35,000 x 13% x 6 months).

In July, the employee became a tax resident of the Russian Federation. The employee has two children, and therefore he claimed a standard deduction of RUB 2,800. per month (RUB 1,400*2).

The organization will calculate personal income tax when paying salaries for July in the following order.

1. The organization will calculate the tax base on a cumulative basis for 7 months (from January 1 to July 31 inclusive), taking into account the provided deduction:

35,000 rub. x 7 months — 2,800 rub. x 7 months = 245,000 rub. — 19,600 rub. = 225,400 rub.

Total: tax base = 225,400 rubles.

2. The organization will calculate the tax at a rate of 13%:

RUB 225,400 x 13% = 29,302 rub.

Total: tax = 29,302 rubles.

3. The organization will determine the amount of personal income tax payable taking into account the tax previously paid for this employee in the current year:

29302 rub. — 27,300 rub. = 2,002 rub.

Total: personal income tax payable for July for this employee = 2,002 rubles.

Rules for entry into Russia for citizens of Kazakhstan in Russia in connection with coronavirus in 2021

- From September 21, 2021, international flights from Russia to Kazakhstan and back have resumed. Russia has opened air borders with Kazakhstan.

- Citizens of Kazakhstan are allowed to fly to Russia without additional conditions and requirements and cross air borders.

- To arrive in Russia, Kazakhstanis and other foreigners must have a PCR test confirming the absence of coronavirus, which was done no later than 72 hours before entering Russia.

- The land borders of Russia and Kazakhstan remain closed to ordinary tourists. Officially, to cross the land border of the Russian Federation and Kazakhstan, you need to have grounds for entry into Russia; restrictions apply that were introduced in the spring and summer of 2021 in connection with the coronavirus.

Restriction of entry into Russia across the land border for citizens of Kazakhstan from March 18, 2021 due to coronavirus

Russia has introduced restrictions and a ban on entry for citizens of Kazakhstan, all foreigners and stateless persons into its territory since March 18 due to the emergency situation and the risk of the spread of the COVID-19 coronavirus. This was announced by Prime Minister Mikhail Mishustin on the official website of the Russian government.

Russia has closed all borders. Entry restrictions also apply to citizens of Belarus, Ukraine, other CIS countries and foreigners traveling through the land borders of the Russian Federation.

The exceptions are foreign persons:

- having the official right to permanently reside in the territory of the Russian Federation;

- international truck drivers;

- transit passengers who fly through airports to another country;

- persons traveling to a funeral;

- crews of aircraft and ships, international train crews;

- employees of diplomatic and consular institutions;

- close family members of citizens of the Russian Federation (parents, spouses, children, adoptive parents, adopted children, guardians and trustees);

- highly qualified specialists;

- persons entering the Russian Federation for medical treatment;

- participants of the State program and members of their families;

- athletes participating in professional competitions in Russia;

- persons entering the Russian Federation to visit sick close relatives in need of care.

The Prime Minister said that the closure of borders and the ban on entry into the Russian Federation is temporary and is related to WHO recommendations in connection with the acute situation due to the spread of the COVID-19 coronavirus.

What is the procedure for withholding personal income tax from an employee - a citizen of the Republic of Kazakhstan?

An employee’s departure from Russia not due to illness or study does not change her tax status, because at the time of payment of wages for January 2014, the employee is in Russia for a total of at least 183 calendar days over the next 12 consecutive months.

Federal Law No. 186-FZ of July 11, 2011 ratified the Agreement on the legal status of migrant workers and members of their families (St. Petersburg, November 19, 2010) (hereinafter referred to as the Agreement) between the governments of the Republic of Belarus, the Republic of Kazakhstan and the Russian Federation, which determines the legal status of workers -migrants and members of their families, as well as regulating the procedure for migrant workers to carry out labor activities and issues related to their social protection.

In accordance with Art. 4 of the Agreement, the labor relations of a migrant worker with an employer are regulated by the legislation of the state of employment, as well as the Agreement and are formalized by concluding an employment contract.

According to Art. 17 of the Agreement, the income of a migrant worker received as a result of labor activity in the territory of the state of employment is subject to taxation in accordance with the tax legislation and international treaties of the state of employment. State of employment - a state of one of the Parties in whose territory a migrant worker carries out labor activities on the basis of an employment contract (Article 1 of the Agreement).

Article 7 of the Tax Code of the Russian Federation determines that if an international treaty of the Russian Federation containing provisions relating to taxation and fees establishes rules and regulations other than those provided for by the Code and the normative legal acts on taxes and (or) fees adopted in accordance with it, then the rules and norms of international treaties of the Russian Federation.

Clause 1 of Art. 15 of the Convention between the Government of the Russian Federation and the Government of the Republic of Kazakhstan on the Elimination of Double Taxation and the Prevention of Tax Evasion on Income and Capital (Moscow, October 18, 1996) (hereinafter referred to as the Convention) establishes that wages and other similar remuneration received by a resident of a contracting state in connections with employment are taxable only in that State, unless the employment is carried out in another contracting State. If the employment is carried out in this way, the remuneration received in connection therewith may be taxed in that other State.

Consequently, if a citizen of the Republic of Kazakhstan carries out paid work on the territory of the Russian Federation, then his income is taxed on the territory of the Russian Federation.

At the same time, paragraph 2 of Art. 15 of the Convention provides that remuneration received by a resident of the Republic of Kazakhstan in connection with employment carried out in the Russian Federation is taxable only in the Republic of Kazakhstan if:

- a) the recipient is in the Russian Federation for a period or periods not exceeding in the aggregate 183 days in any 12 months;

- b) the remuneration is paid by the employer or on behalf of the employer who is not a resident of the Russian Federation;

- c) the remuneration is not paid by a permanent establishment or a permanent base that the employer has in the Russian Federation.

Rules for entry into Russia

There is a visa-free regime between Kazakhstan and Russia, so you will not need a visa to visit the Russian Federation in 2021. If a resident of Kazakhstan stays on Russian territory for 30 days, then there is no need to fill out a Russian migration card.

At customs, a mark is simply placed in one of the border crossing documents, on the basis of which the time spent is counted.

This is what a stamp looks like in a Kazakh passport

If a Kazakh intends to stay in Russia for a longer period, then filling out the “migration form” is strictly necessary. It will be needed for migration registration and is an official document that gives the right to legally stay in the state for 90 days.

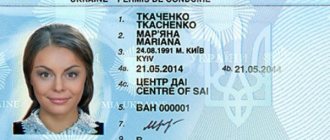

Adult Kazakhs will need an identity document. A national passport will also do. For minors, a birth certificate or passport, if available, is required.

The 90/180 rule also applies to residents of Kazakhstan, that is, they can stay in Russia for 90 days, then they are required to leave the country. The next visit is possible only after 3 months. The 90-day permitted period of stay in the country can be extended if there are legal grounds.

Migration registration

Only those citizens of Kazakhstan who plan to stay in the country for up to 30 days are exempt from migration registration. In any other situations this is a prerequisite. Migration registration should be completed at the territorial office of the Main Migration Department of the Ministry of Internal Affairs of the Russian Federation at the place of stay.

The allotted time for registering foreign citizens is 7 working days from the moment of entry into the country, but since Kazakhstan is a member of the EAEU, this period has been extended to 30 days.

Registration of a foreigner is usually carried out by the receiving party. This can be either an individual or an organization. The receiving party must be legally present in Russia. Recreation centers, sanatoriums, hotels and other similar institutions notify the authorized body of the arrival of a foreign guest within 24 hours.

To register citizens of Kazakhstan in Russia, it is necessary to provide the authorized territorial body with a migration card, an identity document, and a document on ownership (or other legal basis) for residential premises. After registration for migration, the citizen of Kazakhstan is returned the original documents, as well as the detachable part of the notification form with a mark.

This is what the Migration Map of Russia looks like

It is highly advisable to make copies of all documentation and store them in a separate place. If documents are lost, restoring them based on copies will take less time. Documents are restored when contacting the Kazakh consulate.

It is also better to carry all documents with you. If internal affairs or migration service officers require them, the foreign citizen must provide them at any time.

Important: only the Federal Migration Service of the Russian Federation (now the Main Directorate for Migration Affairs of the Ministry of Internal Affairs), but not the Embassy of Kazakhstan or Russia, can register foreigners for migration. It is also worth remembering that if a foreigner’s passport has expired, its renewal is handled by the Embassy of the country of which he is a citizen.

Duration of stay of Kazakhstanis in 2021

The period of stay in Russia for citizens of Kazakhstan depends on the legal grounds and purposes.

| Goals | Duration of stay in the Russian Federation |

| Travel, business meetings, visiting relatives, friends, other purposes | No more than 90 days. Next you need to leave the country. You can return back only after 3 months. |

| Full-time training, treatment. Foreigners who have applied for a temporary residence permit and have a residence permit. | It is possible to extend the stay for the period of existing legal grounds. |

| Employment | If a resident of Kazakhstan has an employment contract with an employer, he has the right to stay in the Russian Federation for the entire period for which this document is signed. This right also applies to members of his family. |

| Termination of contract with employer | If the employment contract between the parties is terminated, the foreign citizen can find a new job within 15 days and enter into a contract with a new employer. In this case, the foreigner has the right to stay in Russia and carry out work activities. If a job is not found within the allotted time, you will have to leave the country. |

It is important to remember that in order to find employment in Russia, you must indicate “Work” in the “migration” section as the purpose of visiting the country. Otherwise, you won’t be able to work legally.

Since Kazakhstan and Russia are member countries of the EAEU, citizens of these states can work under common labor conditions. There is no need to obtain a work permit; a concluded agreement with the employer is sufficient. The income tax for Kazakhs is the same as for Russians – 13%. For comparison, most recently this rate was 30%.

EAEU citizen status

Article 73 “Taxation of personal income” of the Treaty on the EAEU provides a special rule, according to which in the EAEU member countries (Belarus, Kazakhstan, Armenia, Kyrgyzstan and the Russian Federation), income from the first day of work is taxed at the same rate as for citizens a state in which citizens of other EAEU states are employed.

Thus, when working in Russia, EAEU citizens pay personal income tax, like Russians - tax residents, at a rate of 13% and have a privilege compared to foreigners from other countries - non-residents, whose income is taxed at a rate of 30%.

Registration at the place of stay

Registration at the place of residence is a mandatory procedure for citizens of the Republic of Kazakhstan. This does not apply to Kazakhs who stay on Russian territory for up to 30 days. Foreigners can register in the following ways:

- upon a personal visit to the territorial body of the Main Directorate of Internal Affairs of the Ministry of Internal Affairs of the Russian Federation;

- through the MFC;

- by post.

A sample of the detachable part of the notification form for the arrival of a foreign citizen in the Russian Federation is as follows:

What mandatory contributions are withheld from the earnings of citizens of Kazakhstan working in Russia?

Foreign citizens (including Kazakhs) working in the Russian Federation are subject to compulsory insurance. As is customary, mandatory contributions for them, where necessary, are paid by the employer.

The procedure for withholding mandatory contributions largely determines the actual status of a foreigner on the territory of Russia. We are talking about permanent, temporary residence or temporary stay.

An important role is also played by the type of contract that the employer enters into with a foreign worker during employment. (click to expand)

| Type of agreement concluded with a Kazakh | Withheld contributions from the earnings of a citizen of Kazakhstan |

| GPC agreement | For Kazakhs permanently (temporarily) residing in the Russian Federation: compulsory medical insurance, compulsory medical insurance, compulsory medical insurance For temporarily staying Kazakhs: OPS Injury contributions are paid only when provided for in the agreement |

| Contract of employment | Permanently (temporarily) residing citizens of Kazakhstan: compulsory compulsory social security contributions, compulsory medical insurance, compulsory social insurance |

For temporarily staying persons, as is customary, the employer pays the mandatory OPS and OSS contributions. Kazakh entrepreneurs pay their own contributions for compulsory health insurance and compulsory medical insurance.

As is customary, required contributions are withheld from the earnings of a citizen of Kazakhstan in the same manner as is provided for Russian citizens. The amounts of deductions are calculated at the same rates. Moreover, the actual status of a Kazakh does not affect the amount of tariff rates.

Documents for stay in the Russian Federation

Citizens of Kazakhstan, like other foreigners, have the right to stay in Russia only if they have official permits. These include:

- Migration card.

- Employment contract + migration card.

- Temporary residence permit (TRP).

- Residence permit (residence permit).

- Treatment and training are also confirmed by relevant documents.

Lack of documents is not only a reason for a fine, but also for deportation and restriction of entry into the country.

By the way, minor children whose parents are legally in the Russian Federation can receive the same permits for stay that their representatives have.

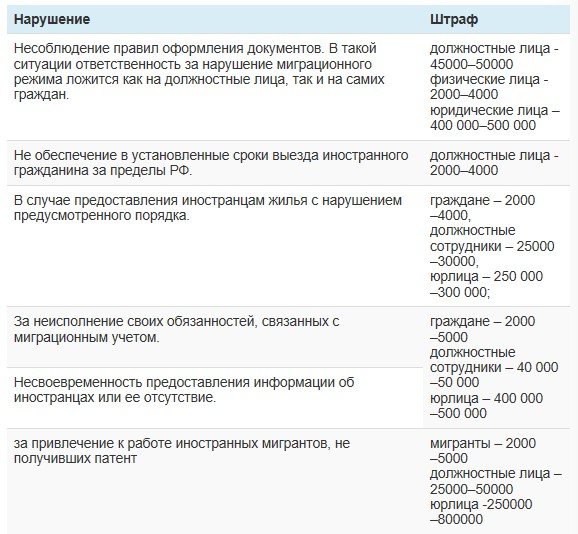

Violation of migration laws

Any violations of the conditions of entry, terms and grounds of stay, as well as employment on the territory of the Russian Federation entail penalties. The punishment of the violator depends on the degree and type of illegal actions. The following penalties are possible:

- Deportation of foreign citizens from Russia.

- Imposing a fine on a citizen of Kazakhstan in the amount of 2 to 10 thousand rubles.

- Expulsion and temporary/permanent ban on crossing the Russian border.

Penalties are also imposed on the receiving party if it employs a foreigner who does not have the right to stay in the Russian Federation, or if the conditions for the legalization of a foreign citizen were not met.

Impressive fines are imposed on a legal entity that violates the law - from 250 to 800 thousand rubles.

Is the fact of the employee's residence at the end of the year important for the tax rate?

Agree, this is a strange question, because having just analyzed the norms of the Tax Code of the Russian Federation and the Treaty, we came to the conclusion that for the purpose of calculating personal income tax, the status of a tax resident of the Russian Federation does not matter for such employees.

It was not there, the Ministry of Finance of Russia in May 2021 issued a Letter in which it explains that based on the results of the tax period, the company’s accountant must determine the final tax status of an individual depending on the time of his stay in the Russian Federation in a given tax period. If, at the end of the year, employees from the EAEU have not acquired the status of tax resident of the Russian Federation, then their income is subject to personal income tax at a rate of 30 percent. And the income of those recognized as such continues to be taxed at a rate of 13 percent (Letter of the Ministry of Finance of Russia dated May 23, 2018 No. 03-04-05/34859).

What does this mean? It turns out that if an employee is hired, say, in October, he physically cannot yet obtain the status of a resident of the Russian Federation, having spent 183 days in the territory of the Russian Federation, since he only managed to work for three months before the end of the year, therefore, at the end of the year, the tax for such an employee must be recalculated according to 30% rate?

By the way, the Ministry of Finance issued similar explanations earlier, for example, in Letter No. 03-04-06/34256 dated June 10, 2016.

Common violations of foreigners

Common violations of migration legislation include:

- Late registration.

- Exceeding the period of stay in the country due to ignorance of the rules or deliberate planning.

- Illegal employment.

- Fake documents.

- Hiring illegal immigrants for the purpose of cheap and powerless labor.

Government authorities carefully monitor migration processes and regularly identify violators. Therefore, it is better not to contradict the law, as the punishment may be too serious.

Common mistakes when employing a citizen of Kazakhstan in Russia

Error 1. The employer has the right not to register a citizen from Kazakhstan working for him with the Pension Fund of the Russian Federation. This is possible provided that the Kazakh has previously registered as a payer of mandatory Pension Fund contributions. A similar situation usually occurs if a citizen of Kazakhstan has already worked in the Russian Federation. Accordingly, he has a certificate of an insured person from the Pension Fund of Russia.

Error 2. The following rule applies to working Kazakhs (as well as to all foreigners). The Russian Federation uses its own Russian labor book standard. Therefore, when applying for a job, foreigners are given a Russian-style labor report.

Methods for obtaining Russian citizenship for citizens of Kazakhstan

It is no secret that many foreigners want to obtain Russian citizenship by any means. This also applies to citizens of Kazakhstan. In fact, there are enough ways to become a full citizen of Russia. And Kazakhs can get it even in a simplified manner. One of the following reasons is suitable for this:

- The candidate was born on the territory of the RSFSR.

- The foreigner is disabled, but he has capable children who are citizens of Russia.

- Marriage with a Russian citizen living on the territory of the Russian Federation (the duration of the marriage must be at least 3 years).

- The foreigner is a WWII veteran.

- The candidate has a child who is a citizen of Russia, and the 2nd parent is missing, deprived of parental rights or incapacitated.

- If there is an incompetent child, but nothing is known about the second parent or he has been deprived of parental rights.

- One of the parents is already a citizen of the Russian Federation.

- There is a diploma of education that was issued later than 2002.

- A person applying for citizenship has lived or currently resides in one of the constituent entities of the union, but does not have their citizenship.

- Participants of the “Resettlement of Compatriots” program.

Within the framework of the Federal Law of April 24, 2020 No. 134-FZ, which came into force, the procedure for obtaining Russian citizenship for citizens of the Republic of Kazakhstan is simplified, since it is no longer necessary to renounce existing citizenship, reside in the Russian Federation for a period of 5 years from the date of issuance of a residence permit and confirm the presence legal source of income.

In addition, the above law provides for the possibility of obtaining Russian citizenship in a simplified manner by persons who are married to a citizen of the Russian Federation with common children. But here it is necessary to comply with the condition that the spouse, who is a citizen of the Russian Federation, resides on the territory of the Russian Federation.

Is it possible to argue?

If the employee does not become a tax resident of the Russian Federation at the end of the year, then the Organization will have to decide whether it will recalculate personal income tax at a rate of 30%.

We already know the Ministry of Finance’s views on this issue, but we believe this situation can be looked at from a different angle. Let's figure it out. In Art. 73 of the Treaty on the EAEU, which was discussed above, there are no conditions on the need to recalculate the tax based on the results of the tax period. According to Art. 73 of the Treaty, the income of an employee from an EAEU country is taxed at a rate of 13 percent from the first day, regardless of the presence or absence of resident status. The Federal Tax Service of Russia agrees with this. So in the Letter dated November 28, 2016 No. BS-4-11/ [email protected] controllers from the tax service with reference to Art. 73 of the Treaty noted that a tax rate of 13 percent is applied starting from the first day of work in the territory of the Russian Federation by EAEU citizens, regardless of the tax status of these persons.

Moreover, this position is confirmed by the opinion of the highest courts. Thus, the Constitutional Court of the Russian Federation in its Resolution No. 16-P dated June 5, 2015 noted that the provisions of the Treaty on the Eurasian Economic Union reached an agreement on the unconditional extension to individuals who are tax residents of the member states of the Eurasian Economic Union, national tax regimes in terms of application tax rates for income received in connection with employment in other member states of this Union.

Therefore, taking into account the above norms of international legislation, the Tax Code of the Russian Federation, as well as the position of the Constitutional Court of Russia, we believe that the Organization has the right not to recalculate personal income tax at a rate of 30 percent regarding payments to foreign employees, citizens of the EAEU, who have not received the status of tax resident of the Russian Federation at the end of the year.

However, it is possible that local tax inspectorates, following the explanations of the Russian Ministry of Finance, will insist on applying the personal income tax rate in the case under consideration in the amount of 30 percent. The organization must be prepared to defend its position in court. Taking into account the position of the Constitutional Court of Russia, we believe that she has every chance of this.