Currently, the most popular forms of doing business in the Russian Federation are LLC (Limited Liability Company) and IP (Individual Entrepreneur).

Since an LLC is the most complex form in terms of doing business, submitting reports, preparing primary documentation, and also arouses more interest from the tax authority, many try to register an individual entrepreneur to conduct business activities.

Migrants from different countries work on the territory of the Russian Federation and not everyone wants to work under labor and civil law contracts; many want to carry out entrepreneurial activities. Let us consider in detail the registration of an individual entrepreneur as a Belarusian in Russia.

Documents for registering an individual entrepreneur for a citizen of Belarus

- Application for registration of individual entrepreneurs according to form No. P21001;

- Original and photocopy of a Belarusian passport (a notarized translation of a foreign passport is not required, since a Belarusian passport already has a translation into Russian (similarly for registering an individual entrepreneur for a citizen of Ukraine);

- Receipt of payment of the state fee for registering an individual entrepreneur (in the event that we submit documents to the registering authority in person);

- TIN (required if available);

- SNILS (if we submit documents to the registration authority in electronic form using an electronic digital signature);

- A document confirming the right to long-term stay of a Belarusian on the territory of the Russian Federation - a temporary residence permit or residence permit (the most important document for registering an individual entrepreneur for a citizen of Belarus in the Russian Federation)!

Step-by-step instructions for registering an individual entrepreneur via the Internet

Before you do so, you should register an account on the Federal Tax Service website. Registration can be done here.

Then proceed according to the instructions:

- Go to the “Individual Entrepreneurs” tab on the Federal Tax Service website.

- Select the “Submit a new application” button.

- Give your consent to the processing of your personal data. And among the required application forms, select P21001

- Fill out the registration field at your place of residence.

- Insert your individual taxpayer number. If you don’t remember it, then after filling out the remaining fields, you can click “Find out TIN”, the number will be added automatically. If you do not have a TIN, the field remains empty.

- Fill out basic information about yourself.

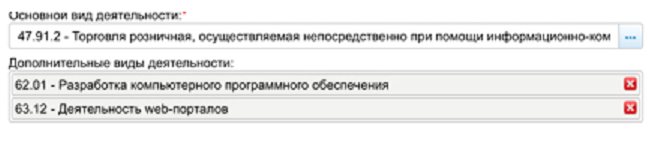

- Select your main and additional activities.

Click "Next". - Three ways to obtain documents will appear. Select the method you prefer and click “Next”.

- The service will independently check the information. When it confirms that the verification was successful, click Next.

- After this, you must pay a state fee. (Keep the receipt for submission to the tax authorities).

If you want to pay in cash, select “Generate payment document”.You can pay this receipt at any Sberbank branch.

To pay online, select the logo of your bank or payment system.

When you have made the payment, fill in the “date of payment” and “Bank BIC” fields.

Click “Next”.

- As a method of submitting an application, you must select “Electronically, without an electronic signature.”

- Click Next.

- Click "Submit"

That’s it – the electronic application for registration of an individual entrepreneur has been submitted. Within three working days, the applicant will receive an invitation from the tax service to the email address specified when registering on the website. When visiting the tax office, you must have originals and copies of the above documents with you.

Find out more about registration.

Documents giving the right to long-term stay of a Belarusian on the territory of the Russian Federation

There are 2 types of documents according to which foreign citizens (not only citizens of Belarus) can stay on the territory of the Russian Federation for a long time (so to speak, reside in Russia), namely:

- Temporary residence permit (TRP);

- Residence permit (residence permit).

For these documents, foreign citizens must contact the Migration Service of the Russian Federation.

Before obtaining a residence permit, you must first obtain a temporary residence permit. However, due to the close ties between Russia and Belarus, citizens of Belarus are allowed to immediately apply for a residence permit.

| Registration of individual entrepreneurs without trips to the tax office and without visiting a notary Cost - 5,000 rubles (all inclusive, no additional payments, selection and approval of OKVED codes, preparation of all required documents including an application for the transition to a simplified taxation system, online filing with the tax office, opening a bank account, making a seal, obtaining statistics codes and delivery of the finished kit) Guaranteed successful registration! (in case of refusal for any reason, we will re-submit for free). Registration period - 5 days Read more... |

When registering an individual entrepreneur in Russia, Belarusians often have a question: do they need registration in Russia? The answer is clear: it is necessary! Since it is indicated (prescribed) in the temporary residence permit and residence permit.

Which form of business to choose

The most common forms of entrepreneurship in Russia are individual entrepreneurs and LLCs. In the first case, the entrepreneur is an individual, in the second, a legal entity is formed. The easiest way is to register as an individual entrepreneur.

In addition to simplified registration, this form of organizing business activities, such as individual entrepreneurs, allows you to use the simplified taxation system (STS).

As for whether a Belarusian can open an individual entrepreneur in Moscow, there are some nuances of registering an individual entrepreneur in Russia for a non-resident. The second option for carrying out entrepreneurial activity is to open a limited liability company. An LLC is also quite easy to register, and it is possible to have only one founder. True, if such a founder is a foreigner, he can only be an individual. A foreign legal entity cannot be the sole founder of an LLC in Russia. Opening a company in Russia is as easy for a Belarusian as for a Russian. True, when opening an LLC you will have to submit more complex and detailed reports, but the prospects for this form of business are better.

Instructions for registering individual entrepreneurs in Russia for Belarusians

Before registering an individual entrepreneur, a Belarusian in Russia will need to take several steps.

- Select a registration method.

- Prepare the necessary documents.

- Choose a tax system.

We offer you step-by-step instructions to do everything right.

Step 1. Selecting a registration method

A Belarusian has the right to register as an individual entrepreneur in Russia in one of the following ways.

- Contact the Federal Tax Service/MFC department. You can appear yourself or a trusted person can do it. You arrive at the government agency, submit the required package of documents and after a while you receive a decision. In a similar way, you can transfer documents to the multifunctional center. However, the MFC does not make decisions and does not draw up paperwork. All documents are submitted to the relevant authorities, which carry out registration. After this, the papers are returned to the MFC and he hands them over to the applicant. The forwarding process adds several days to the waiting period.

- By mail. All necessary papers can be sent by Russian Post to the address of the Federal Tax Service at the place of registration of the individual entrepreneur. The method is convenient for those who are in other cities. However, in this case it will not be possible to quickly deliver the necessary paper and you need to check the package of documents especially carefully before sending.

- Through the Internet. Registration of an application for registration of an individual entrepreneur is carried out on the Federal Tax Service website https://www.nalog.ru/rn77/. However, it should be noted that this will be the registration of the application. It will help you avoid queues, but you will still have to visit the Federal Tax Service.

Filling out an application for registration on the Federal Tax Service website

You can register here: https://service.nalog.ru/static/personal-data. The following is the process:

- On the Federal Tax Service website, enter the folder intended for individual entrepreneurs.

- Select the option to submit a new application.

- Consent to the processing of personal data.

- Among the proposed application options, select form P21001.

- Fill out the registration window at your place of residence.

- Fill in the individual taxpayer number (TIN). This number can also be found on the website if you activate the “Find out TIN” button after filling out the remaining fields. It will either be inserted automatically, or the window will remain blank if you did not receive this number.

- Fill out the box with basic information about yourself.

- Select from the list the types of activities you plan to engage in.

- Select an option for issuing documents from the list.

- After the service confirms that the information has been verified, activate the “Next” button.

- Pay the state fee from your bank account or print a receipt and go to a bank branch. After payment, enter information about it.

- Select the option of submitting an application electronically without an electronic signature. Activate the “Next” and “Submit” buttons.

The site will send you a message within 3 days about the time and date of your appointment with the Federal Tax Service. Take all necessary documents with you.

Step 2. Preparing a package of necessary documents

Here's what you need to register an individual entrepreneur as a Belarusian:

- Application requesting to register you as an individual entrepreneur.

- Identification document and its photocopy.

- A receipt stating that the state fee for opening an individual entrepreneur has been paid.

- Certificate of whether you have a criminal record. Required for certain types of activities. The document can be ordered through the diplomatic missions of Belarus in Russia, but it is usually easier to go home and receive it at your place of residence.

- Documents for the right to stay in Russia for a long time.

Let's look at some of the documents on this list in more detail.

Application for registration of an individual as an individual entrepreneur

To apply for registration of an individual entrepreneur, there is a standard form P21001. You can fill it out on your computer. When completing the document, you will need an individual taxpayer number. This application form and a sample of filling out the standard form are presented below:

Documents confirming the right to reside in Russia

For long-term residence of foreigners in Russia, two types of documents are provided:

- Temporary residence permit (TRP). Issued indefinitely. For most foreigners in Russia, obtaining this document is a necessary step before obtaining a residence permit.

- Residence permit (residence permit). Issued for 5 years and can be extended an unlimited number of times. Possession of a residence permit gives a foreigner in Russia almost the same rights as a Russian citizen, with the exception of some political rights and the opportunity to hold positions in areas of public service and related to secrecy.

The presence of any of these documents allows a Belarusian to register an individual entrepreneur. Accordingly, you can become an individual entrepreneur by temporarily registering in the form of a temporary residence permit. However, close ties between Russia and Belarus make a temporary residence permit not a mandatory document for Belarusians when obtaining a residence permit: citizens of Belarus can immediately apply for a residence permit.

Identity documents

Russia has legislative acts and international treaties that establish which documents confirm the identity of a foreigner in Russia. The fact is that the passport we are used to is called an identity card in many countries. With citizens of the Republic of Belarus everything is quite simple. Russia and Belarus entered into an agreement to create a union state. The text of this document contains information that before the creation of a single document of the union state, the parties undertake to recognize identity documents issued by one of the signatories on their territory. It seems that they have forgotten about the creation of a single passport, but the clause on the recognition of documents is being fulfilled. Thus, you can confirm the identity of a Belarusian in Russia:

- Passport. When registering an individual entrepreneur, you will need the document itself and copies of all its completed pages.

- Birth certificate. This document is not used when registering an individual entrepreneur, but it confirms the identity of Belarusian children in Russia.

You should know that, although the registration system was abolished in 1993 as not complying with the Constitution, it was replaced by a system of registration at the place of residence (analogous to permanent registration) or place of stay (analogous to temporary registration). Residence in the Russian Federation without registration is prohibited and is an administrative violation. Therefore, the registration stamp will have to be presented.

Legalization of documents of foreign citizens

Typically, in order to use their documents in Russia, a non-resident must undergo an apostille procedure. A stamp (apostille) is placed on documents and their copies and confirms the legality of the papers. Documents in a foreign language are translated into Russian, and an apostille is also subject to translation. The translation is certified by a notary.

For Belarusians, the apostille procedure is not mandatory. If the text of the document itself does not have a translation into Russian, the document will have to be translated by a notary.

Step 3. Selecting a tax system

There are two taxation systems: general and simplified. With a simplified taxation system, reporting to government agencies is much easier. However, certain restrictions are imposed on its use, primarily related to the volume of revenue. Under the simplified taxation system, tax rates are:

- if the calculation is based on income, 6%. Regions have the right to reduce it to 1%.

- if income minus expenses is taken into account, 15%. In the regions it can be reduced to 5%.

In addition, you need to be prepared to make payments to various funds. In total, these payments amount to about 30% of accrued salaries. Under the general taxation system, individual entrepreneurs pay:

- personal income tax – 13%;

- property tax -2%;

- VAT – 0, 10 or 18%, depending on what the entrepreneur does.

Decide on the possibility and feasibility of using one of the systems, and choose the one that suits you best. After you have completed all the necessary steps, all that remains is to submit documents to the Federal Tax Service, wait for the decision and register your individual entrepreneur in the Unified State Register of Individual Entrepreneurs ( USRIP

).