A Taxpayer Identification Number, or TIN, is assigned to each individual. They are indicated in the citizen’s certificate, which is issued upon registration as a taxpayer. This code is required for employment and a number of banking transactions.

Real situations indicate that this number is not always known to the citizen due to various circumstances. Various unusual situations arise when the notification, for example, was not delivered to the place of residence, or tax inspectors did not notify the person as required.

Even with notification, documents may be lost or a person may simply forget his TIN. The important thing is that the identification number can be recovered without much effort. Moreover, you don’t even need to leave your home if an Internet connection is available.

Where to go to find out your TIN number?

Despite the fact that the TIN does not belong to the section of confidential information and obtaining it online is a legal way, nevertheless, only two federal-level resources have the right to provide it.

Official website of the Federal Tax Service of the Russian Federation. This source provides complete information regarding tax issues. Another more universal source is the government services information portal.

Accessing any third-party resources is fraught with consequences - your personal data may be used for other purposes. Therefore, it is worth understanding the level of responsibility when choosing one or another official source in order to find out the TIN.

Deadlines for payment of payments to the budget for individual taxpayers

Federal Law No. 320 of November 23, 2015 established (from 2021) the deadline for paying taxes for individuals on December 1 of the year following the expired tax period. Thus, taxes (land, property and others) for 2021 will have to be paid by individuals before December 1, 2021. Accordingly, among the data on debt until December 1, 2021, you can see information for 2015 and earlier; data for 2021 will appear only after December 1, 2017.

Payment must be made after receiving a notification from the Federal Tax Service of the Russian Federation about the amount of accrued taxes (must be sent no later than a month before the payment deadline). Without notification, payment is made through the Federal Tax Service website.

In the absence of a notification from the tax office, the taxpayer must send a message to the Federal Tax Service by December 31. In case of failure to submit such a letter, an individual will be fined in the amount of 20% of the amount of unpaid tax (Order of the Federal Tax Service of the Russian Federation No. BS-4-21/5840 dated March 29, 2017). Deferment of tax payment (up to a year) is possible only if there are valid reasons (according to clause 2, article 64 of the Tax Code of the Russian Federation).

What to prepare to submit a request to receive information about your TIN number?

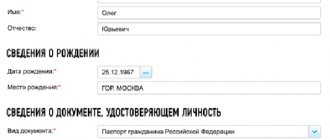

To submit a request in the recommended format, you will need to enter your passport details into the online form. This rule is equally applicable for any of the two specified official sources.

In the form recommended for filling out, you must enter information from your civil passport. Indicate the applicant's full name, passport number and series, day, month and year of birth, as well as where the passport was issued - date and place.

There are also alternative options for providing a source for entering information. This may be a registration certificate of temporary stay in the Russian Federation, or a birth certificate. Other documents containing the information necessary for the request.

Foreign representatives also have the right to make a request, who can provide data from their passport to obtain information, or use information from their birth certificate for this purpose.

What information about yourself do you need to provide to find out about possible debt?

Data on non-payment of taxes is strictly confidential information that is not publicly available. To receive them, you need to identify yourself. This can be done using TIN, passport data or using SNILS.

What is TIN

All Russian individual taxpayers must have a personal identification number - TIN. This number consists of 12 digits:

- 2 digits – the Russian region where the taxpayer operates;

- 2 digits – number of the corresponding tax department;

- The next 6 digits are the personal taxpayer number;

- and the last 2 digits are the verification code.

The TIN is assigned once and allows the state to control the taxpayer (payment of taxes, contributions to the Pension Fund).

A citizen's knowledge of his TIN is required when:

- getting a job;

- registration on State Services;

- processing loans and credits;

- opening an individual entrepreneur;

- request for tax arrears;

- declaration of income.

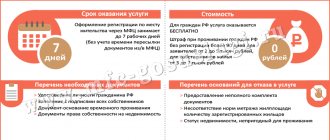

An individual can register with the tax service and obtain a TIN in three ways (Article 83 of the Tax Code of the Russian Federation):

- personally visit the territorial office of the Federal Tax Service and submit an application (form No. 2-2);

- send an application by registered mail;

- fill out an application online on the Federal Tax Service website ().

Passport data: what is it?

As the name suggests, passport data is all the information that it contains. Today, many argue about what applies to them and what does not, arguing that Russian legislation does not have a clear definition of what should be classified as passport data.

The passport data unanimously includes only the number and series of the passport, the name of the authority that issued the passport, and the date of issue of the document. Meanwhile, Decree of the Government of the Russian Federation No. 828 (“Regulations on the passport of a citizen of the Russian Federation”) contains the entire list of such data:

- 3rd page of the document - information about the identity of the owner: full name, gender, information about place and date of birth (according to Article 4);

- the corresponding marks in the passport, determined by Art. 5: 5-12 pages – information about registration at the place of residence;

- 13th page – about military duty;

- 14, 15 pages – about marital status (marriage, divorce);

- 16, 17 pages – about the presence of children;

- Pages 18, 19 – about issued international passports and additional information (blood type and Rh factor, Taxpayer Identification Number, etc.).

Article 6 of the resolution stipulates that any other marks in the passport are illegal, moreover, they make the document invalid.

We recommend that you learn more about what applies to.

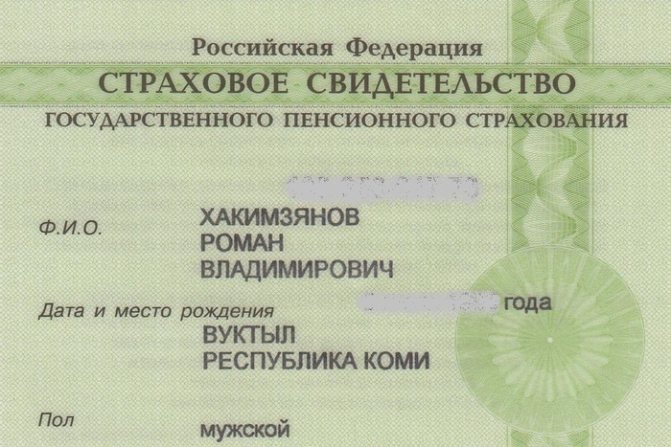

What is SNILS

In addition to the TIN, every Russian individual taxpayer must have a certificate (laminated green card) with the insurance number of an individual personal account - SNILS. Each number is unique (out of 11 digits, 9 are the document license plate, the last 2 are the verification code).

The card also contains information about its owner: full name, date and place of birth, gender, date of registration with the Pension Fund.

SNILS may be needed when:

- registration of social payments or benefits;

- registration on State Services;

- making online appointments with government officials or submitting applications online;

- request about the required length of service of the employee, pension payments, etc.

Read more information about why citizens of the Russian Federation need it.

You can obtain such a certificate:

- at the territorial office of the Pension Fund (appear in person, present your passport and fill out an application - if the citizen does not work);

- at the place of employment. Employees of the HR department of the enterprise/institution will complete all the necessary formalities and submit information for the employee.

>Read detailed information about .

Algorithm for making a request

To achieve results you will need a little time, attention and compliance with a number of rules. As a first step when making a request, you will need to select one of two federal sources.

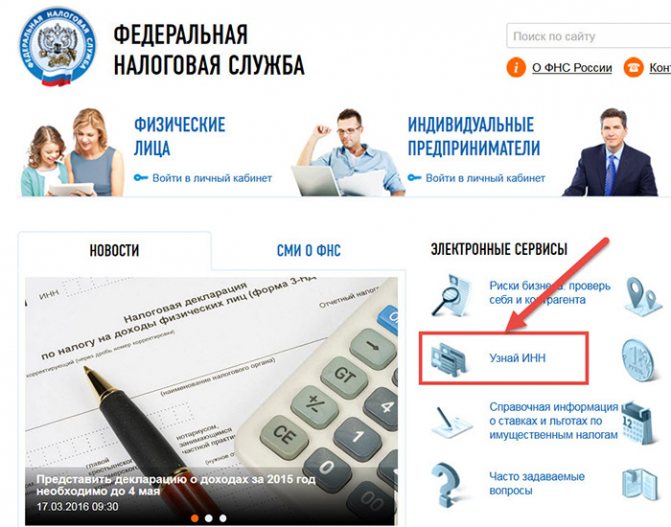

On the website of the Russian Tax Service (FTS)

If the request is supposed to be submitted using the Federal Tax Service website (nalog.ru), then you should activate the “Find out TIN” , it is indicated on the main page, in the “Electronic Services” .

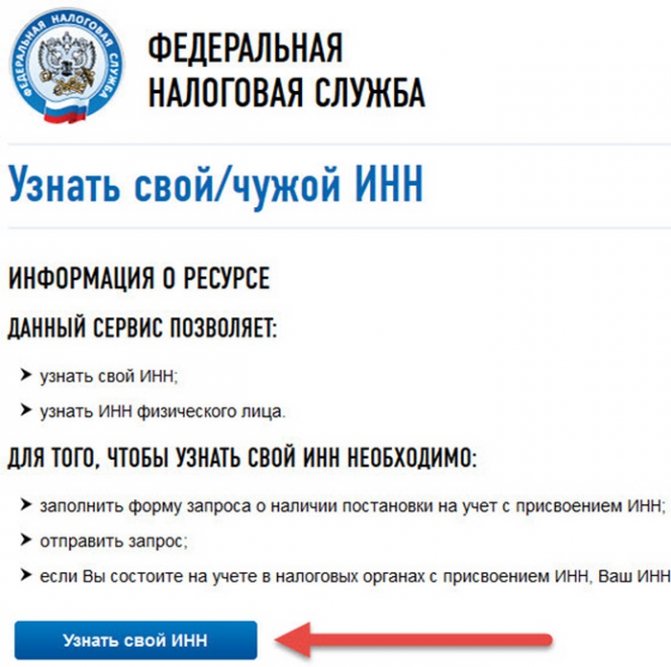

You should carefully read the terms and conditions of the information service. Ignoring information may result in incorrect completion of the form and, as a rule, refusal to receive information. After reading the rules, you can go to the “Find out your TIN” .

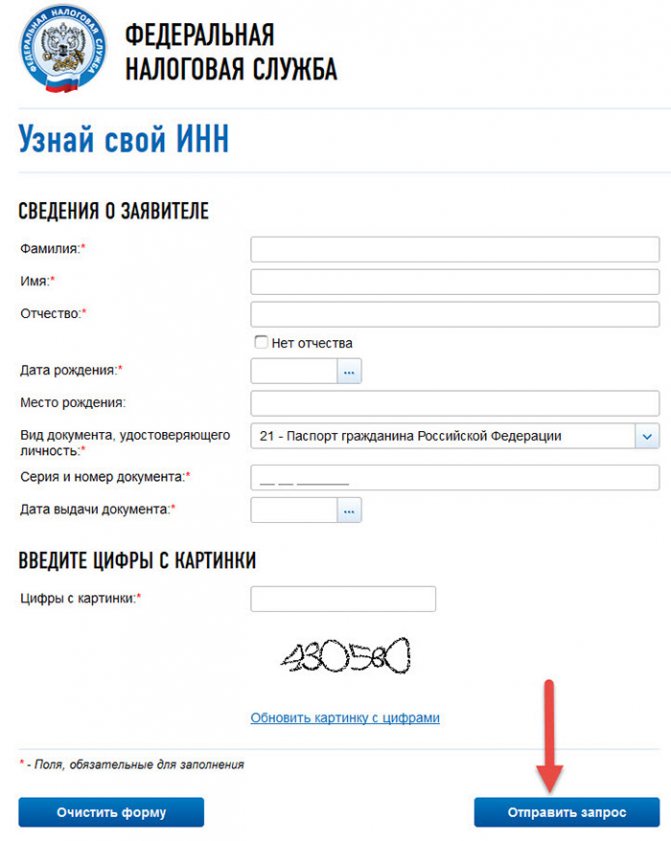

The next step in completing your request is to sequentially fill out the request form.

It is important to take into account some features of the procedure:

- The absence of a middle name is provided for in the system; you just need to make a mark in the corresponding field “No middle name”.

- To indicate the date and year of birth, you can enter the numbers manually through the calendar option.

- The field indicating the place of birth may be left blank - this is the only exception; the remaining fields are required to enter data.

- When data is entered not from the passport, you should do so by selecting the appropriate one from the list of possible ones. By default, the format for entering passport data of a citizen of the Russian Federation is activated here.

- When filling out the field about the date of issue of the identity card, the applicant also has the opportunity to choose to enter information - manually or using a calendar.

- The last step is to enter the digital code indicated in the “numbers from the picture” field. This step eliminates the need for the robot to fill in the data. In case of illegibility, the number series can be changed by pressing the update button at the bottom of the code.

If errors are identified, the form can be cleared to go through the procedure again. After checking the data, you will need to send a request by clicking the button with the appropriate inscription. If everything is done correctly, the TIN will be displayed in the resulting result field.

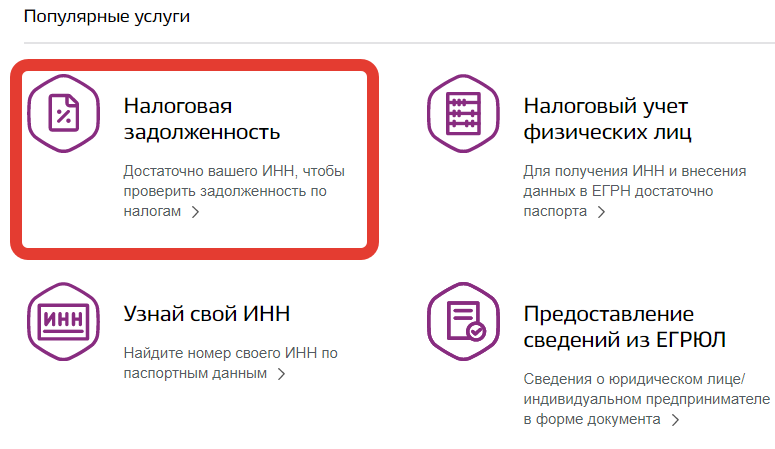

Find out taxes by TIN on the tax service website

Find out on the government services portal

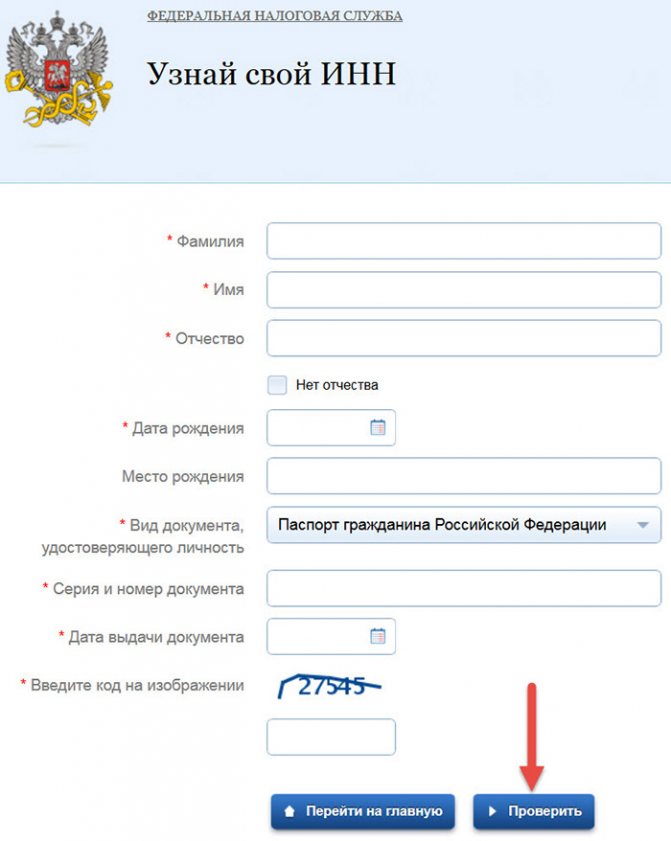

Using a similar algorithm, you can submit a request on the government services portal.

In this case, you need to find “Find out your TIN” , then go through the entire request process and click the button to receive the “Check” . As a result of the search, the system will display: “Data received successfully. Your Taxpayer Identification Number is ХХХХХХХХХХХ.”

Find out taxes by TIN on the government services portal

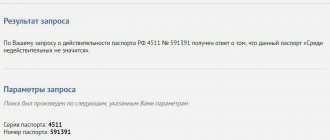

However, in practice an undesirable result may be obtained and the information will not be provided. Let's consider the reasons for this option based on the results of the TIN request. In what cases is information requested by TIN not provided?

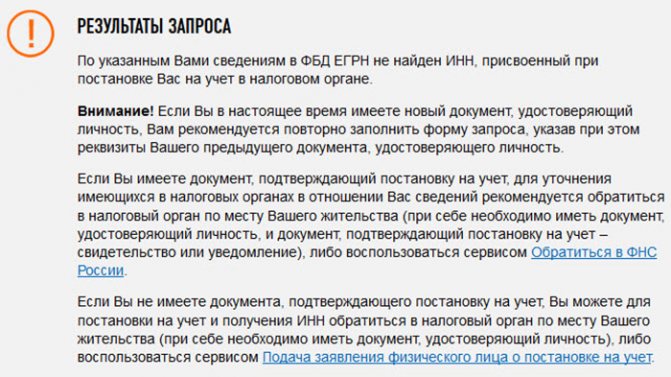

There is an alternative in which, instead of the TIN, it is indicated that according to the data specified when filling out the request, the TIN was not found. This is reported automatically.

In addition to the message about the absence of a TIN, a message is issued that will help the applicant adjust his further actions. What could be the reason for the impossibility of obtaining the information of interest?

- Possible typos, negligence, errors when filling out the request.

- Availability of updates in documents.

- Lack of taxpayer number.

The first and second cases are solved simply - you need to fill out the form again and eliminate possible errors and typos. The third option - the absence of a TIN will require a personal visit to the tax services to obtain a certificate of registration with the Federal Tax Service. You will need to have your ID with you. However, even in this case, you can obtain a certificate through federal websites online.

Find out about tax debts on the State Services website

If you have free time, you can find out information about debts on the website of the Unified Portal of Public Services, but registration is required.

How to check tax debts on the government services website:

- on the “Government Services” website on the main page, you need to click on the right side of the “Login to government services - log in or register” window;

- click on the “register” button;

- enter your first name, last name, phone number and email address;

- Enter in the window the code that came in the SMS to the specified phone number.

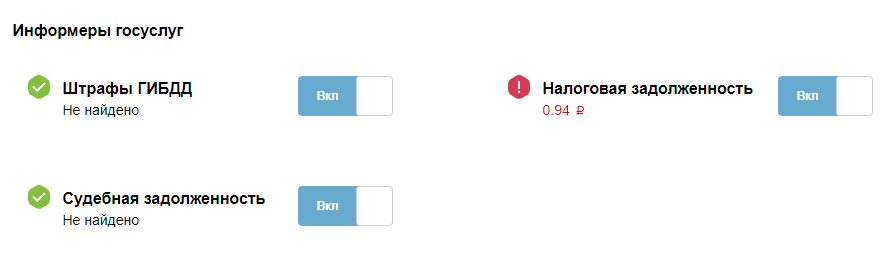

After registration, on the main page on the right there will be a window “Auto fines. Tax debt. Judicial debt." If there is a debt, the column will be highlighted in red; if not, it will be highlighted in green.

How to find out the TIN number via the Internet by last name?

Official services do not provide information about the TIN of an individual based on reporting only the last name. You need to go through the entire request procedure with entering your passport data.

An exception is left for citizens with the status of “individual entrepreneur”. Obtaining a TIN for these citizens is carried out in a simplified manner. To obtain information, you need to enter the personal data (full name) of the entrepreneur and indicate the region of his residence.

The tax office provides upon request additional information on individual entrepreneurs, for example, economic activity codes. This information is not confidential; it helps to obtain reliable information about the reliability of partners.

What can you find out about a citizen by knowing his TIN number?

Data on individuals based on TIN are not reported in official sources. An exception is also the category with the status of individual entrepreneur. Using the TIN or registration number (OGRNIP), it is possible to find out his place of registration and full name. This information is available on official resources and is absolutely legal. It serves to protect the interests of participants in the field of entrepreneurship.

You can find out your TIN without leaving home. It is enough to correctly enter the data into the request form on one of the above federal websites on the Internet. Compliance with the request algorithm and eliminating errors leads to the desired result, the TIN becomes known.

Ordinary citizens are protected from obtaining information by third parties, since knowledge of all passport data will be required. An exception is made for persons with the status of individual entrepreneurs, since they act as participants in economic relations and the information helps to check the partners’ level of legal capacity.