Each identity document is unique. This is necessary to avoid confusion or errors when citizens carry out various actions, confirm the identity of the owner, etc. However, not only the series and number characterize each paper that is important to the owner. There are some notation systems that have been developed by individual services and authorities. The passport code for the tax office is a special combination of numbers that has a specific purpose.

Why are document codes needed?

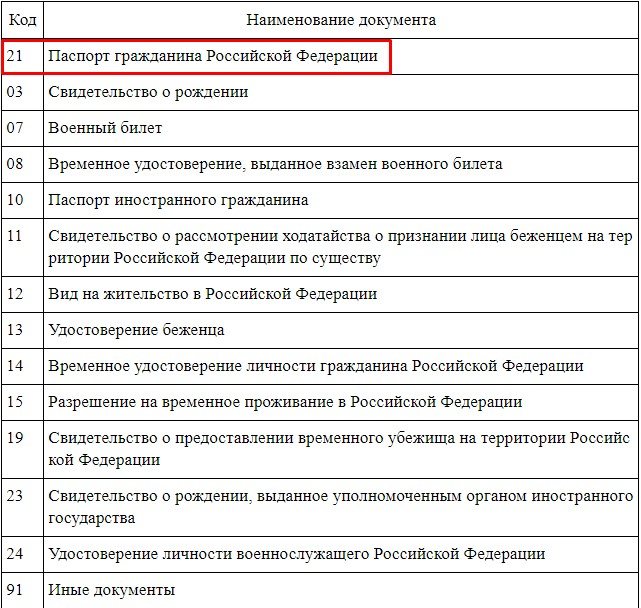

A whole system of codes has been developed to identify each document. They allow you to designate a specific type of paper with one number when filling out some tax returns. This greatly simplifies the design process and brings the entire system to a single, unified look.

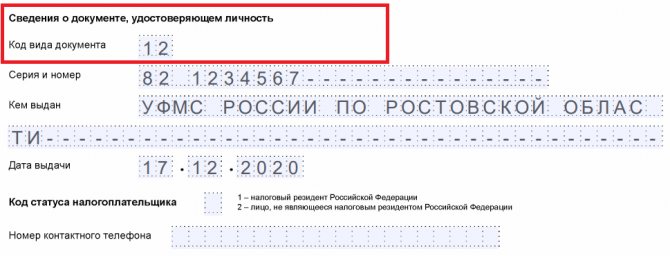

The document type code - a passport of a citizen of the Russian Federation is included in tax returns according to the rules for filling them out. For example, the 2-NDFL declaration is filled out according to the rules established by the Order of the Federal Tax Service dated October 30, 2015 No. ММВ-7-11/485, which states that it must contain the “document code” field. It contains the corresponding figure specified in Appendix 1. To correctly designate the code required in a particular case, you can use the table given in the Appendix or consult with an employee of the Federal Tax Service.

This procedure is provided to reduce the specified data and transmitted information. In addition, this method of transmitting taxpayer data eliminates the need for handwriting recognition and interpretation of records. Specifying a specific combination of numbers instead of the full name simplifies the work of the tax authorities and speeds up the processing time for reporting and reduces its volume.

Codes for foreigners

Citizens of other countries who legally reside in the Russian Federation can conduct business activities if they have the appropriate permits. These include temporary residence permits and residence permits. Therefore, when filling out tax documentation, you should indicate the passport code of the foreign citizen. Code 10 is provided for this.

Salaried workers who arrive in the Russian Federation for only a few months are not required to provide a foreign citizen’s passport. They are required to pay payroll taxes. Reports to the tax office are submitted by the accountant of the organization in which the person works.

Passport code of a citizen of the Russian Federation for the tax service

If the declaration requires indicating the digital designation of the passport of a Russian citizen, then it is necessary to use the specified Appendix 1. According to it, the document code “Passport” is 21. However, in its absence, the taxpayer should enter a combination of numbers that corresponds to what is being represented. For example, what passport code of a foreign citizen is indicated by the interested party for the tax office? In this case, the number 10 should be entered in the tax return.

Many citizens are also interested in the question of what is the department code in the passport? This is a special designation that characterizes the place where it was issued and issued. This number is unique for each department of the passport issuing service, so it can be used to uniquely determine the place of receipt. It consists of 6 digits that indicate the region where the document was issued, the type of unit of the Main Department of Migration Affairs of the Ministry of Internal Affairs and its specific number.

How is a residence permit designated?

Based on clause 2 of Art. 10 of Federal Law No. 115-FZ of July 25, 2002, one of the documents that stateless persons present instead of a passport is a residence permit. The tax authorities assigned a separate number to this blue (green) booklet: the document code for the residence permit of a foreign citizen, which is written in all forms for the Federal Tax Service, is 12.

What is the code when applying to the Pension Fund?

The tax passport code determines the type of document specifically in the case of filling out declarations and other papers for the Federal Tax Service. However, there is another designation used if it is necessary to contact the Pension Fund. According to the rules for submitting information, special encoding should be used to simplify data processing and speed up the processing process. The pension system has adopted slightly different designation rules. For this purpose, the word “PASSPORT” is indicated in capital letters in the reporting. Digital encryption is not provided in this case.

The document used as the main identification document contains not only basic information about the owner, but also about his place of permanent residence. Why do you need “registration” in your passport (since 1993 – registration)? Since living without registration is illegal, a stamp indicating its presence is affixed to the appropriate page. This allows you to reliably confirm the “registration” address of any citizen. If it is temporary, then the information is not entered on a specific page, and a separate paper is issued indicating the presence of registration at the place of residence.

Thus, for a type of document such as a passport, the tax code is indicated by numbers. The remaining papers, presented in various situations, also have their own designations. When applying to the Pension Fund of Russia, a slightly different designation procedure is provided, according to the meaning of which the name of the document should be indicated in capital letters.

Codes of types of identification documents

A military ID card, as well as other documents, must be designated with special codes. Moreover, each type of such is established by law.

That is why you need to carefully work out all the main subtleties and nuances of the design process. First of all, you need to be careful when filling out the following forms:

- form 14001;

- form 13001.

If you are filling it out for the first time, you should definitely familiarize yourself with the correctly compiled sample.

This is the only way to easily avoid standard mistakes that can generally be made in such a case.

At the moment, there is a wide list of subtleties associated with the document form. Knowledge of the law will allow you to avoid the most common mistakes in this case.

Form 14001

This form is used to carry out the registration process of a legal entity and its address.

At the moment, the main document that determines this moment is the Order of the Federal Tax Service No. ММВ-7-6/ dated May 25, 2016, and the list of reflected data is standard.

This document must include the following:

- number of pages;

- serial number of the form;

- KND code;

- the name of the document itself;

- information about legal entities contained in the Unified State Register of Legal Entities;

- OGRN;

- the full name of the organization in Russian - and in block letters;

- the reason for providing such a statement is indicated.

At the bottom of the documents, space is left for official notes.

Form 13001

Form 13001 is a request to amend a special state registry.

This document also provides information on how exactly changes will be made.

If you have no compilation experience, you should carefully read the correctly compiled sample.

Other

In addition to the usual forms in which you will need to indicate the document code, there are a number of others. You will also need to carefully read all of them.

Moreover, not only the passport code may be required. But also some other documents. At the moment the encoding looks like this:

The full list is quite wide; you will need to carefully read all the subtleties of its design.

In accordance with the “Regulations on the passport of a citizen of the Russian Federation”, this document is the main document of a citizen in our country and every citizen who has reached the age of 14 is required to have a passport. Each document is assigned an individual number, which is a six-digit code indicating the number of the passport form issued for circulation. In addition, the main data of the document also includes the passport series, consisting of four digits: 2 of them indicate the region of issue of the document, and the other 2 indicate the year of issue of the form.

For a foreign citizen

Representatives of other states who are in the Russian Federation legally, if they have permits (residence permit or temporary residence permit), have the right to engage in entrepreneurial activities. It follows from this that they need to indicate the foreign citizen’s passport code for the tax authorities. It is designated by the number 10.

For hired workers who come to Russia for only a few months, providing a document code such as a foreign citizen’s passport is not required. Their taxes are withheld from their salaries, and the reports are filled out by the accountant of the company they work for.

Passport codes by region

There is also a code for the type of passport document by region, by which you can decipher when and in what region the document was issued. This “cipher” refers to nothing more than a series, which is indicated next to the number on the second and third pages in red, and on other pages is made in the form of perforations.

The first two digits in the series indicate the region in which the passport of a citizen of the Russian Federation was issued, and the other two digits indicate the year of issue.

To understand which region your document belongs to, we suggest that you familiarize yourself with the table below.

| The passport number is the number of the form that was assigned during printing |

| Previously assigned to a person when registering in the Register. But then, Order No. 605 of the Ministry of Internal Affairs of Russia dated September 15, 1997 was issued, which stated that such details were temporarily not filled in due to the development of the system. |

| Series of passport forms | ||

| REPUBLIC | ||

| Republic of Adygea (Adygea) | ||

| Altai Republic | ||

| Republic of Bashkortostan | ||

| The Republic of Buryatia | ||

| The Republic of Dagestan | ||

| The Republic of Ingushetia | ||

| Kabardino-Balkarian Republic | ||

| Republic of Kalmykia | ||

| Karachay-Cherkess Republic | ||

| Republic of Karelia | ||

| Komi Republic | ||

| Mari El Republic | ||

| The Republic of Mordovia | ||

| The Republic of Sakha (Yakutia) | ||

| Republic of North Ossetia-Alania | ||

| Republic of Tatarstan (Tatarstan) | ||

| Tyva Republic | ||

| Udmurt republic | ||

| The Republic of Khakassia | ||

| Chechen Republic | ||

| Chuvash Republic - Chavash Republic | ||

| Altai region | ||

| Krasnodar region | ||

| Krasnoyarsk region | ||

| Primorsky Krai | ||

| Stavropol region | ||

| Khabarovsk region | ||

| Arhangelsk region | ||

| Astrakhan region | ||

| Belgorod region | ||

| Bryansk region | ||

| Vladimir region | ||

| Vologda region" | ||

| Voronezh region | ||

| Ivanovo region | ||

| Irkutsk region | ||

| Kaliningrad region | ||

| Kaluga region | ||

| Kamchatka region | ||

| Kemerovo region | ||

| Kirov region | ||

| Kostroma region | ||

| Kurgan region | ||

| Kursk region | ||

| Leningrad region | ||

| Lipetsk region | ||

| Magadan Region | ||

| Moscow region, Baikonur complex | ||

| Murmansk region | ||

| Nizhny Novgorod Region | ||

| Novgorod region | ||

| Novosibirsk region | ||

| Omsk region | ||

| Orenburg region | ||

| Oryol Region | ||

| Penza region | ||

| Perm region | ||

| Pskov region | ||

| Rostov region | ||

| Ryazan Oblast | ||

| Samara Region | ||

| Saratov region | ||

| Sakhalin region | ||

| Sverdlovsk region | ||

| Smolensk region | ||

| Tambov Region | ||

| Tver region | ||

| Tomsk region | ||

| Ulyanovsk region | ||

| Chelyabinsk region | ||

| Chita region | ||

| Yaroslavl region | ||

| CITIES OF FEDERAL SIGNIFICANCE | ||

| Moscow city | ||

| city of St. Petersburg | ||

| AUTONOMOUS REGIONS | ||

| Jewish Autonomous Region | ||

| AUTONOMOUS DISTRICTS | ||

| Aginsky Buryat Autonomous Okrug | ||

| Komi-Permyak Autonomous Okrug | ||

| Koryak Autonomous Okrug | ||

| Nenets Autonomous Okrug | ||

| Taimyr (Dolgano-Nenets) Autonomous Okrug | ||

| Ust-Ordynsky Buryat Autonomous Okrug | ||

| Khanty-Mansiysk Autonomous Okrug | ||

| Chukotka Autonomous Okrug | ||

| Evenki Autonomous Okrug | ||

| Yamalo-Nenets Autonomous Okrug | ||

The passport number is the number of the form that was assigned during printing. It does not contain any special information.