Why do you need a certificate from your place of employment?

The HR department of an organization most often works with incoming requests for the issuance of confirmation of employment of people employed by the enterprise.

A certificate from the place of employment at the place of request is used to confirm the fact of employment and receipt of income by the employee in certain bodies.

It indicates where the employee works, in what profession and for what period. Therefore, this document is the main source of information for third parties about the employee’s place of work, his profession and length of service.

Where is a work certificate most often required:

- Social protection authorities most often request certificates to establish appropriate subsidies and benefits for the employee, to provide his family and friends with other guarantees established by law (scholarships, free meals).

- New employers may request certificates from a previous place of employment. They are necessary to confirm the length of service and assign sick leave benefits. In the latter case, certificate 182-n must be drawn up in a strictly established form.

- When applying for a second job, an external part-time worker must provide his second employer with a certificate that he works at his main place of work in another organization.

- This is necessary to explain the absence of a work book when entering a new place. I also provide these categories of workers with certificates from their place of work to establish their right to leave out of turn, since at the second employer it must coincide with leave at the main place of work.

- Employees often take salary certificates to apply for loans from banks.

- When considering a case in court, an employee may also need a certificate from his employer to confirm employment and income.

- For a similar purpose, the migration service may request a certificate of employment from a company employee when applying for a foreign passport and visa at foreign embassies.

Why is a work certificate needed?

Important! Please keep in mind that:

- Each case is unique and individual.

- A thorough study of the issue does not always guarantee a positive outcome. It depends on many factors.

To get the most detailed advice on your issue, you just need to choose any of the options offered:

- Use the online chat in the lower corner of the screen.

- Call: Federal number: +7 (800) 511-86-74

A certificate from the place of work for obtaining a visa demonstrates the fact of official employment. For the consulate, this is an additional guarantee that the person has a reason to return to his or her country. The risk of illegal migration is reduced.

The document demonstrates the presence of a source of stable income. Additionally, the certificate shows your financial status. Schengen states require foreigners to have a certain income level. The document also guarantees the fact that, upon returning to their homeland, the person will begin to perform professional duties.

Types of certificates

Conventionally, all certificates issued to employees can be divided into two types:

- Certificates confirming his employment at this enterprise.

- Certificates containing information about the income received by the employee.

When receiving a request from an employee, it is very important to determine what information needs to be included in the certificate. Since all requested data is personal and subject to protection from disclosure. Therefore, the application must require the employee to indicate exactly what information needs to be provided.

Certificates to confirm employment or length of service are filled out based on employment data. Their main goal is to confirm employment, work experience, and the profession in which the employee is employed. Such certificates are provided by the employee to the judicial authorities, bailiffs, his new employer, and upon admission to educational institutions.

Salary certificates are issued by the accounting department based on payslip information. When receiving a request for such a certificate, it is important to indicate in what form it should be and for what period the information should be reflected in it.

Requests for such documents are most often necessary for social security about income, credit institutions, for a new employer, for the employment service, the Federal Migration Service department, for bailiffs, etc.

At the same time, for the employment center, banks and other recipients of these documents, it is necessary to comply with a strictly defined form of the certificate. It is then advisable to require a sample of the certificate to be attached to the employee’s application for a certificate.

You might be interested in:

Certificate of absence of an employee from the workplace: how to draw up, sample [year] year

If an employee combines several jobs, then to apply for sick leave benefits, he may need a certificate 182 n.

Attention! Upon dismissal, the employee must be given certain certificates upon his request. These include a salary certificate for two years in form 182 n, a 2-NDFL certificate, etc.

Who issues the document

The employee submits an application for a certificate to the personnel service of the business entity. In it, he must indicate what information must be indicated in the requested document.

It is important to remember that no more than three days should pass from the moment the employee submits the application until the certificate is issued to him. This is the period established by the Labor Code of the Russian Federation.

After receiving consent to disclose the PD and the application, the inspector determines who will fulfill the received request.

If the certificate needs to indicate data that is filled out on the basis of personnel documents, then the certificate is prepared by a specialist from the HR service. In its absence, this duty can be performed by a clerk or accountant.

If the requested information relates to the income received by the employee, then the application is sent to the accounting department, where the accounting department accountant prepares the certificate.

Attention! The completed certificate must be certified by the seal of the company, if available, and the visa of the head of the company. The certificate may also contain the signature of the specialist who prepared it.

Validity periods

The validity period of the certificate is set by the entity that requests it. In most cases, the validity period of the certificate is set from two weeks to a month.

This period is considered sufficient for the employee to be able to obtain the relevant document from his employer and present it at the place of request. At the same time, the relevance of the data contained in the certificate will be maintained.

However, some points need to be taken into account when setting the validity period of the certificate. If a certificate of current income of an employee is requested, then when a new month begins, it will lose its relevance, since it will not contain information about the last month.

In such cases, it is best for employees to contact their employer for such information at the beginning of the next month, when the previous period has already closed and the employer can provide them with information about income in full.

What is needed to obtain a certificate

Typically, no additional documents are required to obtain a certificate from an employee. In this case, it is enough for him to make an oral request to the manager or the person in charge.

However, it must be remembered that the Labor Code directly requires that the employee submit a request for documents in writing, usually in the format of an application addressed to the manager.

It is recommended to resort to this method if there is a possibility that the employee may be denied a certificate for any reason. However, with a written and registered application, it will be possible to defend your rights through the labor inspectorate or the court.

Filling out applications is also practiced in large companies with a large number of employees and serious paperwork.

Since the certificate that will be issued for the employee will contain his personal data, the responsible employee at the time of issue is recommended to independently request his consent to disclose such data.

It is advisable to do this even if the employee, when hired, signed a general provision on the protection of personal data and the possibilities of their disclosure.

Attention! Since each certificate will contain a unique set of information and will be transferred to a new location each time, it is best to request consent for each fact of document execution.

What do you need to obtain a certificate from your place of work?

To obtain a certificate, especially in large companies, an employee must submit a written application for a certificate. You must indicate the purpose of receiving it and the required information for confirmation.

According to the law, an employee has every right to receive any information from the employer regarding his work activities.

The period between the request for a certificate and its receipt should not be more than three days.

If you are an entrepreneur, then to confirm your employment, you must submit copies of certificates of registration of your business and registration with the tax inspectorate of the Russian Federation, an extract from the register to the Unified State Register of Individual Entrepreneurs.

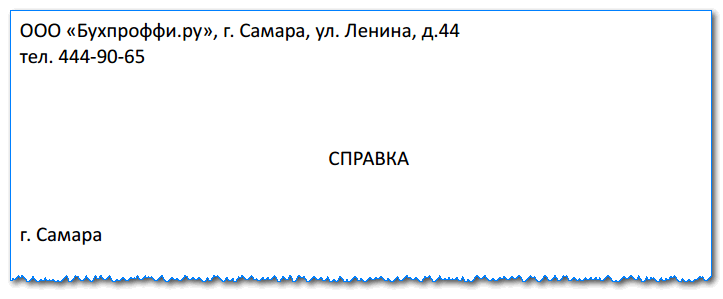

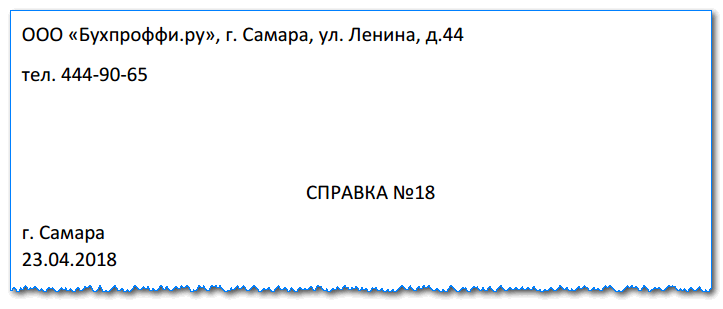

Sample of a certificate of employment

To whom it May concern

A simple certificate at the place of request is the simplest document. It does not have any special requirements for the design and content of information.

You might be interested in:

Key rate of the Central Bank of the Russian Federation in 2021, table of values, what it affects

It is best to draw up such a certificate on company letterhead, since it already contains all the necessary details of the company. If the document is drawn up in free form, then the full name of the company, its location address, TIN, KPP and OGRN codes are written at the top.

The certificate may contain registration of outgoing correspondence by indicating the number and date. Or you can indicate only the date of issue of the certificate, and indicate its serial number next to the name of the document.

Next, on a new line in the middle, put the name of the form - “Certificate”.

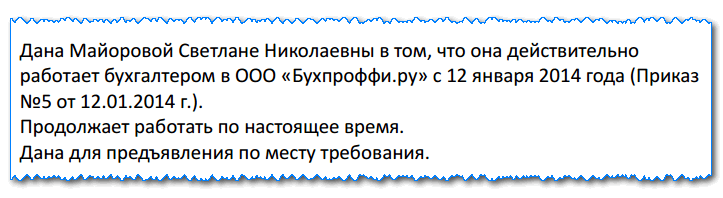

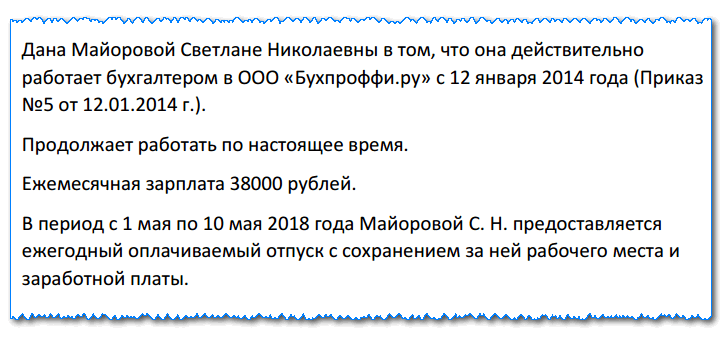

Its text should be composed as follows. It must begin with the word “Issued”, and after it indicate the full name. employee. Further, the text must confirm that he actually works in the organization (indicating its name) in his position (indicating it).

If an employee can tell you for what purposes the certificate is being requested, then this can be written down in the text of the document. Otherwise, it is permissible to limit oneself to the standard phrase that the certificate will be presented at the place where it is required.

The text may indicate any other data that the employee requires.

Attention! If documents are attached to the certificate, they must be listed as attachments.

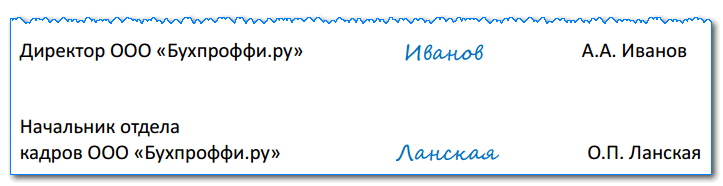

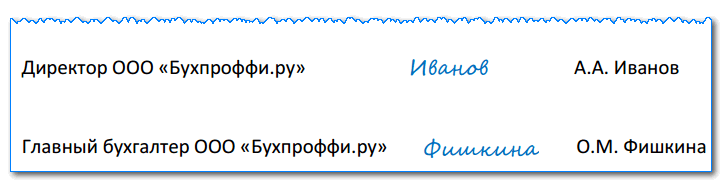

The certificate is signed by the head of the company or another person who is responsible for drawing up such forms (HR employee, accountant, etc.).

If a business entity uses a seal, then it must be stamped on the certificate.

To obtain a visa

Let's look at how to correctly issue a certificate for a visa. Unlike a simple certificate, it must indicate two more parameters - the employee’s salary and a guarantee of a job after returning from travel.

It is best to use letterhead to draw up a document. Typically, visa centers treat such certificates more favorably. If this is not possible, then the full name of the organization, its location address, registration codes TIN, KPP and OGRN, as well as bank details are indicated at the top.

Next, it is advisable to enter the details of the outgoing document - registration number and date of registration. You can also indicate only the date in this place, and put the certificate number next to the name of the form.

If it is known for what purpose the certificate is being issued, then this can be indicated on a new line aligned to the right. For example, “For submission to the French consulate.”

Then in the middle of the line the name of the document is written - “Help”.

The text is structured as follows. You must start with the word “Issued”, after which the full name must be indicated. employee. Next, it should be noted that this person actually works in the organization, indicate its name, and the start date of work. It is imperative to indicate that this employee continues to work to this day.

Next, the monthly salary must be entered.

bukhproffi

Important! The visa certificate must contain confirmation that for the period of the trip abroad the employee is provided

paid leave while maintaining his job.

The completed certificate is signed by the manager and the chief accountant. It must also be stamped (if used).

What form should the certificate be?

There is no uniform form for the form. However, all Schengen countries have similar requirements for documents. Free format design is acceptable. However, the certificate must meet the following requirements:

- At the top of the sheet is the name of the consulate to which the documents are submitted. If it is impossible to reflect the information in accordance with the internal rules of the organization, you can use the phrase “for submission at the place of requirement.”

- The employer's details are indicated. They are reflected in the header of the form. The address of the institution, its website, mail, OGRN and TIN are registered.

- In the center of the sheet is written the name of the document - “Help”. Then comes the main body of the paper. Initially, the full name and position of the employee to whom the document is provided is indicated. Next, the name of the organization and the date from which the person carries out activities in it are recorded.

- Then the average monthly salary is reflected. It is acceptable to specify 1 digit. However, some states require the indicator to be reflected for 3 months.

- The fact of provision of planned leave is recorded. It must be for the duration of the trip along with its dates.

- The date of provision of the paper is reflected.

- Signatures are affixed. The certificate must be signed by the director and chief accountant. Sometimes a HR representative signs instead.

The paper is sealed. It should be round. If a representative of an organization is afraid of making mistakes when filling it out, it is better to have a ready-made example before his eyes.

Can an employer refuse to issue a certificate?

The Labor Code establishes that an employee has the right to request from the employer any information related to his work, and the organization, in turn, must provide it to him. The request is best made in writing in the form of a statement.

Attention! After receiving the request, the responsible person in the company must, within 3 days, draw up the requested document and hand it over to the employee.

It is also impossible to refuse to issue a document, citing the fact that such a certificate has already been requested, information is requested for a long period of time, etc. The law does not establish any concessions for an organization when issuing a document. This means that the certificate must be issued in any situation and with any amount of information requested.

Who can be exempt from this procedure?

The conditions relating to foreign persons applying for Russian citizenship are officially prescribed in the Federal Law “On Citizenship of the Russian Federation”, Articles 13, 14.

Admission to Russian citizenship of foreign and stateless citizens occurs in a general (Article 13 of the Law) or simplified procedure (Article 14 of the same Law).

Find out how to obtain Russian citizenship for a citizen of Belarus and Tajikistan here.

Latest changes in legislation

On April 17, 2021, Federal Law No. 134 was adopted by the State Duma and approved by the Council of Federation on amendments to Federal Law No. 62, which significantly simplifies the procedure for obtaining citizenship: https://publication.pravo.gov.ru/Document/View/0001202004240038?index=0&rangeSize= 1. Most categories of applicants now do not have to renounce their previous citizenship, comply with the condition of a 5-year period of residence, submit certificates of the source and amount of income, and also attend the Commission on Russian Speakers. The amendments entered into force on July 23, 2020.

List of persons exempt from submitting a certificate

Despite the fact that the obligation of foreign citizens to submit income certificates is approved at the legislative level, for most people this norm has been abolished. These categories of foreign citizens are listed in Article 14 of Federal Law-62:

- stateless persons who had citizenship of the former USSR, who lived and are living in states that were part of the USSR, and did not receive citizenship of these states.

- were born on the territory of the RSFSR and had citizenship of the former USSR;

- have been married for at least three years to a Russian citizen living in Russia;

- are disabled and have a capable son or daughter who has reached the age of eighteen and is a citizen of the Russian Federation;

- have a child who is a citizen of Russia - if the other parent of this child, who is a citizen of Russia, has died, or has been declared missing, incompetent or limited in legal capacity, deprived of parental rights or limited in parental rights by a court decision that has entered into legal force ;

- have a son or daughter who has reached the age of eighteen years, who are citizens and by a court decision that has entered into legal force, recognized as incompetent or limited in legal capacity - if the other parent of these Russian citizens, who is a citizen of Russia, has died or by a court decision that has entered into force legal force, declared missing, incompetent or limited in legal capacity, deprived of parental rights or limited in parental rights;

- received a diploma of professional education after July 1, 2002 in Russia and have been working for at least a year, a prerequisite is the calculation of insurance contributions to the Pension Fund of Russia;

- are individual entrepreneurs and have been carrying out business activities in Russia continuously for at least three years in the types of economic activities established by the Russian Government. In this case, the amount of taxes and fees must be at least 1 million rubles;

- are investors for three years in the types of economic activities established by the Russian Government, and the amount of taxes and fees must be at least 6 million rubles;

- during the year they work in a specialty included in the List of Qualified Specialists;

- have at least one parent with Russian citizenship living in Russia;

- are citizens of the Republic of Belarus, the Republic of Kazakhstan, the Republic of Moldova or Ukraine;

- have a certificate of recognition as native speakers of the Russian language;

- a temporarily or permanently residing citizen is married to a Russian citizen living on the territory of Russia and has common children in this marriage;

- disabled foreign citizens and stateless persons who arrived in Russia before July 1, 2002 and received a temporary residence permit or residence permit in Russia;

- Resettlement Program participants;

- category of citizens determined by the President of Russia;

- veterans of the Great Patriotic War who had citizenship of the former USSR and living in the Russian Federation;

- minor children and incompetent persons who are foreign citizens who are admitted to Russian citizenship by their parents or guardians.

You will learn even more useful information about simplifying the process of obtaining citizenship from the video below.