Laws controlling TIN in Russia

The legislation of the Russian Federation carefully protects personal data about every citizen, even if it is a foreigner. There are serious penalties for illegal invasion of privacy.

Personal Data Law

Personal data is any information relating to a directly or indirectly identified or identifiable natural person, for example:

- FULL NAME;

- Date and place of birth;

- education;

- place of registration;

- TIN, etc.

Additionally, there are many other areas where data can be personalized. For example, information about your health, fingerprints. According to the law, personal data is any information that can be used to identify a specific person.

The TIN number is information that cannot be shared with others. It can only be used in exceptional cases. The use of the number is prescribed by law. The person who has been assigned the TIN can give permission to a specific person or company to use, process and store personal data.

Find out identification code by date of birth

Using any of these methods, you can find out the exact date of birth of any person. If it is not possible to access the basic or minimum information to access any of these alternatives, it will simply not be possible. And you will need to find the information you need to implement any of our recommendations. Parents are allowed two options: announce the birth of the child. Whichever you choose, the facility or home must provide you with a copy of the birth certificate completed by the doctor or midwife, and must also forward to the director a copy of the birth certificate that is addressed to him or her.

Package of documents for obtaining and checking TIN

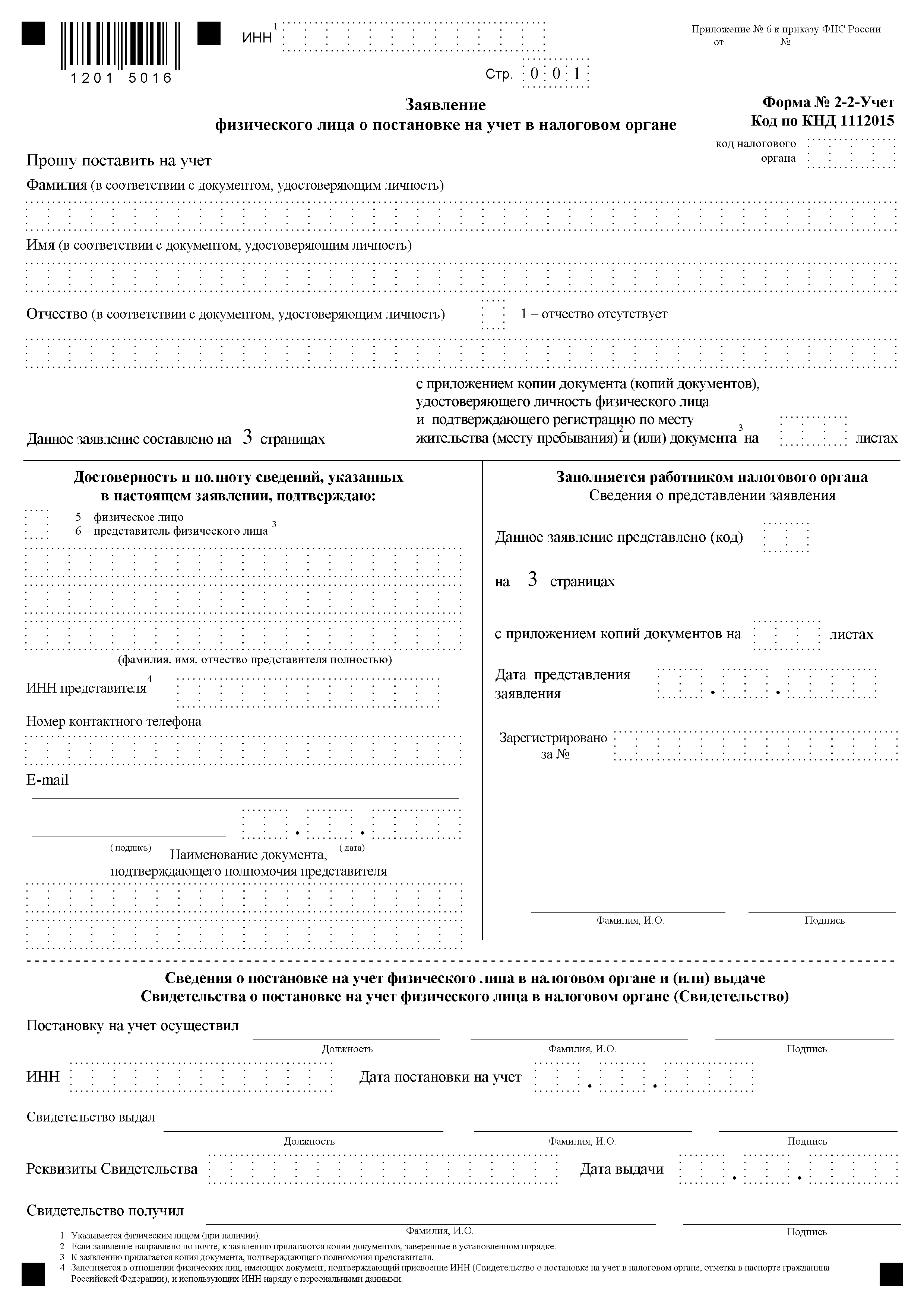

To obtain a Taxpayer Identification Number (TIN) in Russia, migrants must register for taxes with the relevant authority at their place of residence or stay. To do this you need to fill out an application. The form can be downloaded here.

This is what the application form for tax registration looks like:

You will also need a number of documents:

- temporary residence permit in Russia;

- notarized translation of the passport into Russian;

- tear-off part of the migration registration form about arrival in the country, migration card with registration at the place of stay.

The identification code of a citizen of the Russian Federation and a foreigner are the same. The person is assigned an individual number.

After submitting the documents, in case of a positive decision, the applicant is issued a certificate of tax registration of the citizen.

How to find out your identification code by last name via the Internet Ukraine

An individual taxpayer who has objects of taxation or pays other fees must register in the State Register to obtain a TIN.

The taxpayer identification number is mandatory for use by all institutions, regardless of the form of business, including the National Bank of Ukraine, in case of payment of income from which taxes and other mandatory fees are withheld, as well as civil agreements, the subject of which is taxation objects or opening accounts in financial institutions. With the introduction of the identification number, the development of a unified information space regarding personalized registration of citizens began. The numbers have become basic in the created systems of the Unified State Automated Passport Service, the Pension Fund, social security bodies and other government bodies.

If an individual has a document confirming registration, in order to clarify the information available to the tax authorities regarding such an individual, it is recommended that the specified individual contact the tax authority at the place of residence (you must have an identification document and a document confirming registration with you). accounting - certificate or notification), or send to the Federal Tax Service of Russia an application to clarify personal data through the Taxpayer Personal Account service for individuals, or use the Contact the Federal Tax Service of Russia service. If an individual does not have a document confirming registration, such an individual can, to register and obtain a TIN, contact the tax authority at his place of residence (you must have an identification document with you), or use the service Submitting an application for an individual for registration.

Find out identification code by date of birth

Using any of these methods, you can find out the exact date of birth of any person. If it is not possible to access the basic or minimum information to access any of these alternatives, it will simply not be possible. And you will need to find the information you need to implement any of our recommendations.

Parents are allowed two options: announce the birth of the child. Whichever you choose, the facility or home must provide you with a copy of the birth certificate completed by the doctor or midwife, and must also forward to the director a copy of the birth certificate that is addressed to him or her.

How to find out your identification number

For example, knowing his personal certificate code, a citizen has the opportunity to obtain up-to-date information about his own property on which taxes are assessed. You can also track information on the absence, or, conversely, the presence of debt to the budget.

- You must indicate your last name, first name and patronymic. If there is no middle name, you must mark this in a special field.

- Using the drop-down menu with a calendar or manually, enter your date of birth.

- In the next field, you can optionally indicate your place of birth.

- Next, using the additional menu, you need to specify the type of identity document. If the identification number is searched using a passport, then you should select the line “21 – passport of a citizen of the Russian Federation.”

- In the fields below you enter information about the series and number of the document, as well as the date of issue of the passport.

- In the field below you need to enter the numbers from the proposed picture to confirm your actions.

Decoding IIN number for Ukraine and Russia online

- for pensioners to apply for and receive a pension;

- work with banking institutions (receive loans, make deposits, manage accounts, etc.

); - formalize real estate purchase and sale transactions;

- register a particular transaction;

- obtain registration of citizens;

- conduct any kind of business.

For a more detailed decoding of registration numbers, public service centers have been created at the place of residence.

The decoding itself reveals the essence of the individual identification 12-digit digital code. It should be remembered that the identification code is assigned to an individual once. The only exception is if the taxpayer's surname changes. IIN has already replaced RNN and SIC.

When carefully deciphering the number, you should remember that the code numbers from 8 to 11 are filled in by the corresponding official body of Justice. It is possible to check the correctness of the personal number. Its essence lies in isolating the date of birth from the IIN number and carefully documenting it.

It is important to note that when deciphering this group of codes, an error in the date will result in an incorrect value. It has been proven that the probability of error is almost 100% provided that the seventh digit coincides with a value of zero or greater than 6. There is no need to discount the omnipresent human factor.

It all depends on the operator, who may make a typo. Therefore, checking the decryption is not only possible, but also necessary. This can also be done by the individual who received the code. The main code check is to recalculate the check digit (12th bit). To do this, use the 12th bit generation algorithm.

Features of obtaining, restoring and refusing TIN in Ukraine

If the TIN is lost or damaged, the owner can restore the document. To do this, you should contact the local tax office at your place of registration. You can also restore the code in any other branch. There are no penalties for loss. The document is issued within 24 hours, sometimes more time is needed. The new TIN is marked o.

The issuance, verification and restoration of a taxpayer identification code is carried out at the place of permanent or temporary registration in the branches of the Ministry of Revenue of the region. The processing time for an application for a TIN is 5-10 working days. A person is not required to pay any government fees or charges for issuing an identification number.

24 Dec 2021 marketur 356

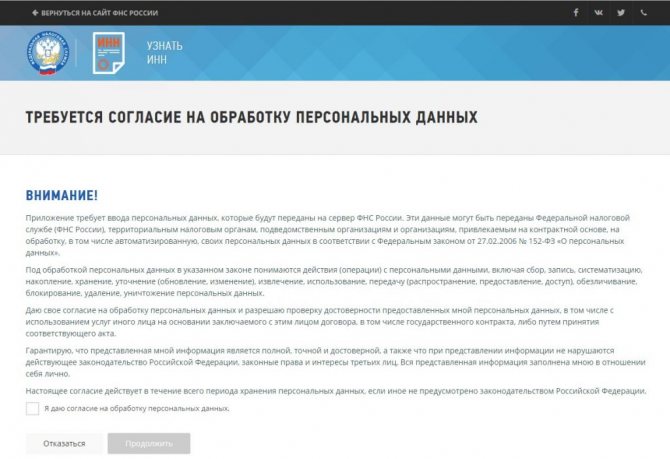

Federal Tax Service website

Using the Federal Tax Service service to search for a TIN, you need to follow the step-by-step instructions:

- On the main page of the site in the “Services” section, you need to click on “Information about the TIN of an individual”;

- You should enter personal information about yourself step by step. Fields that must be filled in are marked with an asterisk. If a foreigner does not have a middle name, he can check the “no middle name” box. The “place of residence” column may not be filled in, but this information can help identify a foreign guest. Next are the columns about the document confirming the identity (From the Soviet passport and Birth Certificate to the residence permit for foreigners) and its data.

- The procedure ends by clicking on the “Send request” button and the TIN number of the foreign citizen appears.

In most cases, you should wait no more than two minutes for a response.

How to Find Out Your TIN Ukraine

A taxpayer identification number is an element of the State Register of Individuals of Ukraine, which is assigned to individual taxpayers to pay various incomes and fees, as well as other payments, and is retained by them throughout their lives.

Any individual can obtain a TIN, regardless of the person’s age and citizenship. A TIN can be assigned to both a citizen of Ukraine and a resident of another state who carries out economic or financial activities on the territory of Ukraine.

How to find out the identification code through “Privat 24” on a smartphone

We present to your attention detailed instructions so that you can find out your identification code at any time through the Privat24 application on the Internet.

Indeed, in most cases, a person cannot remember his TIN, since there are a lot of numbers there. And there are situations when this information is urgently needed, but the document is not at hand.

In this case, you will need a mobile phone, laptop or desktop computer with Internet access.

If you use your smartphone, you must:

- In the Wallet section, select a hryvnia card;

- Open the “Managements” window by clicking on the card settings;

- Select "Details".

After that, in the card details you will see your TIN in the recipient’s RNUKPN column:

The procedure is very simple, if it is difficult for you, ask your relatives to help. Now we’ll tell you how to find out the identification code through “Privat 24” using a desktop computer. Here, too, everything is quite clear and simple:

- Open the “Privat 24” application – All services – Info – My details;

- We open the method of replenishing the card “Cash in other Ukrainian banks”, then - “Get details”.

After these steps, you will receive information about the recipient and his TIN.

Also today you can find out the identification code using the payer’s electronic account. But, this is only if there is an EDS (electronic digital signature). To do this, you need to open the link https://cabinet.sfs.gov.

ua/registers, indicate your password and key, and as soon as the key is loaded, you will find out the data and identification code of the payer.

To ensure that your TIN is always with you, contact the tax office, where they will put a stamp with an identification code in your passport.

How to find out your identification number

To do this, you need to contact the tax office that issued you a taxpayer identification number and present your passport or other identification document. Then you fill out an application in the prescribed form (the sample and form will be provided to you by the tax office) and wait for a response.

It is impossible to find out your TIN by other means. The services offered by Internet services to determine the taxpayer identification number, yours or another person, are fraudulent, since there are no databases containing such information on the Internet.

First of all, because posting such information in the public domain contradicts the Legislation of Ukraine on the protection of personal data of individuals. According to the current legislation of Ukraine, your personal data cannot be used, changed, entered into a database, published, etc. without your consent.

Also, when publishing a database of identification numbers in the public domain, for example, on the Internet, it will not be difficult to find out your number, either for you or for another person. This opens up wide opportunities for fraud.

For example, when issuing loans or opening a deposit account, financial institutions focus primarily on the identification number. The person who manages to find out your Taxpayer Identification Number (TIN) receives wide opportunities for transactions with your current accounts.

It is also not possible to find out the TIN by using the services of persons who offer on the Internet for a fee to provide you with the information you are interested in. You can find out your TIN only at the tax office at the place of issue. It is impossible to find out someone else's TIN.

An individual taxpayer who has objects of taxation or pays other fees must register in the State Register to obtain a TIN.

The taxpayer identification number is mandatory for use by all institutions, regardless of the form of business, including the National Bank of Ukraine, in case of payment of income from which taxes and other mandatory fees are withheld, as well as civil agreements, the subject of which is taxation objects or opening accounts in financial institutions. The TIN is mandatory for an individual taxpayer if this person is engaged in entrepreneurial activities, as well as when applying for a tax credit.

The TIN consists of ten digits, which are assigned according to a certain formula. The decoding of the formula is as follows:

- the first five digits indicate the date of birth of the TIN holder - a five-digit number determines the number of digits from December 31, 1899 to the date of birth of the person who owns the TIN;

- the next four digits determine the serial number of the person born on that day;

- the penultimate digit indicates the gender of the person. If the number is even, the gender is male, if it is odd, female;

- the last, tenth, digit is the control digit.

Procedure for assigning a tax identification number

The assignment of a TIN to a citizen of Ukraine or a resident of another state takes place at the tax authorities at the place of residence of the person wishing to receive a TIN.

The basis for assigning a TIN is registration card No. 1DR, submitted by an individual in the prescribed manner and submitted to the tax authorities in accordance with the Instructions on the procedure and conditions for transferring information to state tax inspectorates for registration of individuals in the state register of individual taxpayers.

To register and assign this number, an individual submits a passport or other document that replaces it to the tax service at the place of residence. This document must contain the following statements:

- last name, first name and patronymic of the individual;

- date of birth;

- statements of place of residence.

After filling out the above form No. 1DR, the individual taxpayer receives a taxpayer identification number on paper.

If a taxpayer identification number is lost, an individual must contact the tax office that issued him the identification number with his passport and fill out an application to restore the taxpayer identification number.

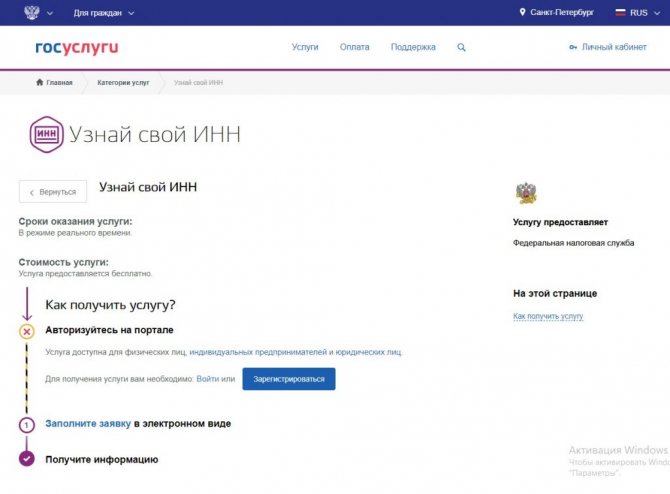

State Services Portal

On the State Services website, checking the TIN takes a little longer, so it is recommended to first carry out the operation on the Federal Tax Service website. If you are unable to use it, there is an alternative option.

On the State Services website you cannot do without user registration. There you can check the TIN of a foreign citizen exclusively through your personal account.

- Having entered the site, you first need to click on “personal account” in the upper left corner, or click “register” just below.

- Complete all sections.

- Within a few minutes, an SMS with a code will be sent to the specified number. The numbers must be entered into the window that appears and a password must be created to further enter the account.

- Already having an account, you need to log into your personal account.

- After entering, you should find the “services” section.

- In the information search window on the website, enter “find out TIN.”

- After that, enter your information.

- Click on “fill in the data” and wait for a response with a number. Obtaining information from the departments of the Federal Tax Service

Not all foreigners are comfortable using Russian websites, so it is still important to obtain information about your own taxpayer number.

You can contact the tax service at your place of residence, or at the place where you received registration in the country’s tax system. You can call the authority in advance and find out how best to submit your application.

You can make an appointment online through the Federal Tax Service resource. You must have your passport with you.

Employers often want to find out the TIN from a patent, which is issued to foreigners as a work permit. But this is impossible. Passport details are required for online verification.

This is what a patent looks like

How to find out your tax identification number via the Internet using a Ukrainian passport

05.01.

2020

How to find out a TIN from a passport What is a TIN and why is it needed? Such a document is issued to every citizen of the Russian Federation (and even a foreign one) who is a taxpayer. Thanks to the TIN, the state controls the timely payment of taxes, payment of pensions, and contributions of working citizens to the Pension Fund. To obtain a certificate, you must personally come to the tax office at your place of residence and submit the following documents: Completed application in form No. 2-2.

For individuals, the TIN is a code consisting of 12 digits: the first two characters are the code of the subject of the Russian Federation; the next two digits are the tax authority number; the next six characters are the taxpayer number; the final two digits are control numbers.

Re-verification of passport registration

To see if the passport has been prepared incorrectly, please contact the email address of your designated territorial authority (select electronic screenshots) from your contact details:

You will need the appropriate certificate to make payments to the budget, open a bank account, obtain the status of an entrepreneur and for many other actions. When contacting the tax office, you will need to fill out an application form 1DR.

How to find out your tax identification number via the Internet using a Ukrainian passport

How to find out your TIN via the Internet How to find out your TIN on the government services portal Electronic on the unified government services portal is available only to authorized users. It can be found in the catalog of services of the Federal Tax Service of the Ministry of Finance of the Russian Federation.

How to find out your TIN Any individual can obtain a TIN, regardless of the person’s age and citizenship. A TIN can be assigned to both a citizen of Ukraine and a resident of another state who carries out economic or financial activities on the territory of Ukraine.

How to find out your tax identification number from a Ukrainian passport

An individual taxpayer who has objects of taxation or pays other fees must register in the State Register to obtain a TIN.

The taxpayer identification number is mandatory for use by all institutions, regardless of the form of business, including the National Bank of Ukraine, in case of payment of income from which taxes and other mandatory fees are withheld, as well as civil agreements, the subject of which is taxation objects or opening accounts in financial institutions.

With the introduction of the identification number, the development of a unified information space regarding personalized registration of citizens began. The numbers have become basic in the created systems of the Unified State Automated Passport Service, the Pension Fund, social security bodies and other government bodies.

We recommend reading: How the funded part of the pension is paid

Every person asks himself these two questions when he is first asked to indicate his TIN in any application or document.

What is this mysterious three-letter abbreviation and why do you need to know your Taxpayer Identification Number? Taxpayer identification number, or abbreviated TIN, is a code consisting of numbers by which taxpayers are registered in our country.

The number of digits in the TIN of individuals and organizations varies.

Where the first two digits are the code of the subject of the Russian Federation, the third and fourth digits are the number of the local Federal Tax Service inspection, the next five are the number of the taxpayer’s tax record in the territorial section of the OGRN (Main State Registration Number) and the last one is a check digit, which is used to reduce the likelihood of errors when electronic processing of documents.

Checking TIN online Ukraine

TIN Ukraine is an individual tax number. TIN Ukraine is issued to both individuals – citizens of Ukraine and non-residents. TIN Ukraine contains encrypted information about the owner of the TIN Ukraine.

To check the tax identification number online in Ukraine, you need to enter the Ukraine identification code and you will be able to obtain information on the tax identification number online of an individual, such as the date of birth of the owner of the tax identification number in Ukraine, the gender of the owner of the tax identification number in Ukraine, and whether such tax identification number exists in Ukraine at all Ukraine.

If an individual does not have a document confirming registration, such an individual can, to register and obtain a TIN, contact the tax authority at his place of residence (you must have an identification document with you), or use the service Submitting an application for an individual for registration. If an individual has a document confirming registration, in order to clarify the information available to the tax authorities regarding such an individual, it is recommended that the specified individual contact the tax authority at the place of residence (you must have an identification document and a document confirming registration with you). accounting - certificate or notification), or send to the Federal Tax Service of Russia an application to clarify personal data through the Taxpayer Personal Account service for individuals, or use the Contact the Federal Tax Service of Russia service.

In the first two cases, the individual must fill out the form again with the correct information. If there is no TIN, a citizen should contact the tax office of his area of residence with an application for registration.

You must take your passport or other document with you to confirm your identity. If an adult citizen of the Russian Federation wants to find out his identification number, then he needs to indicate his passport; if he is a minor (up to fourteen years old), then his birth certificate.

If a foreign citizen wants to find out his TIN, then he must select the type of foreign document that he has.

Find out your tax identification number using your passport online in Ukraine

If an adult citizen of the Russian Federation wants to find out his identification number, then he needs to indicate his passport; if he is a minor (up to fourteen years old), then his birth certificate. If a foreign citizen wants to find out his TIN, then he must select the type of foreign document that he has.

How to find out your TIN To do this, you need to contact the tax office that issued you a taxpayer identification number and present a passport or other identification document.

How to find out your TIN via the Internet using your passport

To find out your TIN, go to the website of the Federal Tax Service https://service.nalog.ru/inn.do and fill out the form.

The certificate includes the following taxpayer data:

To clarify the information available to the tax authorities regarding an individual, such individual is recommended to contact the tax authority at his place of residence. You must have with you an identification document and a document confirming registration - a certificate or notification (if such a document is available).

We recommend reading: GK article 173

How to find out your TIN

Individuals who are registered in the ATO zone or in the Autonomous Republic of Crimea, in order to obtain an IIN or make a note about the refusal of the TIN for religious reasons, can contact any tax office on the territory of Ukraine, regardless of the address of the registered place of residence or stay.

The legislation of Ukraine provides for the possibility of refusing to obtain an identification number for religious reasons; then, to make payments and other legally significant actions, the series and number of an individual’s passport are used, for which you can obtain a certificate, and if you have a passport in the form of a booklet, put a stamp on it . When contacting the tax office, you will need to fill out an application form 1DR.

How to find out your TIN number via the Internet using your passport

To find out information about your TIN via the Internet using the official website of the tax service or through the government services portal, a citizen will have to enter his passport data in a specially designated form.

Having access to the Internet and a passport, each individual can obtain information about his TIN. To do this, it is enough to make a request to the tax service using a certain form, and then wait for a response containing the taxpayer identification number.

Settlement bank NKO "MONETA" (LLC), Bank of Russia license 3508-K, OGRN 1121200000316 To send a request, you must enter the numbers indicated on the captcha at the bottom of the electronic form, and at the end click on the Send request button.

Last update of the database: 2020-11-15 12:13:02 The result of the search will be displayed on the page after entering the series and document number, confirming the captcha, and pressing the “Search” button (the page will be re-engaged).

The passport series in the form of a booklet is entered by great Ukrainian writers, certificates about the people are entered in numbers and by great Ukrainian writers! Status of document processing: To view the status of an incorrectly generated passport, please contact the email address of the relevant territorial authority (transfer of electronic screenshots) from your contact details: Priymalnya VHIU Ukraine They are located at the address: st.

Find out the tax identification number of an individual online

You can also find out your tax identification number from your passport using the Federal Tax Service website. This service is similar to the tax service service “find out your tax identification number nalog ru”. Unfortunately, it is impossible to find out the TIN by last name without other data. This is done both to protect the data of individuals and to facilitate the search process itself.

Of course, you can find your tax identification number through the taxpayer’s personal account or the government services website, if you are registered with them. The easiest way is to find out the tax identification number using your passport data, but if there are no registrations on the indicated sites, then all that remains is to contact the tax office directly.

How to find out your tax identification number via the Internet using a Ukrainian passport Link to main publication

Find out identification code by date of birth

The last name cannot contain numbers or initials. The only child whose father or mother's filiation is established bears the name of the family, in whole or in part, the parent whose name appears on the birth certificate. A common first name for your baby is what will be used every day to name your baby in addition to being mentioned on the birth certificate. In addition to the usual name, you can choose other names for your child. However, it is recommended to limit the number of first names to four. The child's birth certificate is drawn up in the language of the form used, and no correction relating to that language can be made there unless it is shown that an error was made in registering the child. Birth. Correction of an error in the language in which the civil status document was issued. The certificate or copy of the document issued in respect of the deed is in the same language as the deed.