Going shopping abroad or returning from a vacation with souvenirs for friends is a common practice for modern tourists. However, not all travelers study Russian customs regulations in advance. This document indicates the goods (and their quantity) that can be freely carried across the border, as well as those that must be declared or even pay customs duty. Russian customs rules have undergone changes in 2021.

Innovations

From January 1, 2021, the amount for which goods can be sent duty-free by post has been reduced - this is 200 EUR; the permissible weight - up to 31 kg - has remained unchanged.

Today, without paying customs duties across the border by land and water transport, a tourist can transport goods for personal use in an amount equivalent to 500 EUR and weighing up to 25 kg. When entering by air – no more than 10,000 EUR with a total weight of no more than 50 kg.

When going abroad on vacation or visiting, and, of course, returning from a trip, every tourist brings with him gifts, gifts and souvenirs.

It is not uncommon nowadays to travel abroad to go shopping or search for a specific item, for example, jewelry or a fur coat. However, not everyone thinks about what can and cannot be imported and exported from the country, so as not to cause additional problems.

Before you go on a trip and make a list of gifts, purchases or souvenirs, you need to familiarize yourself with the current requirements and understand what can be left in the plans and what will have to be replaced with analogues, reduced in quantity or completely crossed out.

Sample of filling out a customs declaration

Import from Finland

The reduction in the external market for the purchase of products has led individuals and organizations to the need to import goods from Finland. The rules of the Russian Federation establish that citizens-relatives (children, their parents, spouses) in the amount of 2 people can import 100 kg of goods. List prices are used to calculate costs, not purchase receipts. The import of 20 fresh-cut flowers is also allowed from Finland.

Authorized Products

There is a limit on the import of goods from Finland to Russia - individuals can transport food products weighing no more than 5 kg. They must be intended for the personal use of one person. If the weight limit is exceeded, customs officers confiscate the excess and issue a fine.

FCS rules allow you to transport:

- butter;

- margarine;

- canned food of all kinds;

- fish and fish products;

- sausage;

- dairy products.

Products must have high-quality heat treatment and sealed packaging. If the integrity of the container is compromised, you will need to obtain permits from Rosselkhoznadzor.

Important! Meat, fish and milk cannot be imported from Finland without original packaging.

Import of goods to/from Finland

Products with some restrictions

Import rules into Russia do not prohibit the import of fresh fish. Transportation conditions - Finnish certificate confirming the safety of products grown only in an environmentally friendly environment.

Sturgeon caviar will not be allowed through customs. But the import of goods has restrictions - the presence of factory packaging and the weight of 250 g per person. There is no ban on raw smoked sausages in natural casings purchased in a store or supermarket.

Import and export of funds

Not a single trip is complete without the tourist not having the necessary amount of money. It's different for everyone. You can avoid declaring your financial capabilities at the border and then have no problems if the import of currency (the total amount of cash and traveler's checks) does not exceed $10,000. Moreover, the available funds can be in any currency, but should not exceed the specified threshold.

Import and export of any currency is permitted without submitting additional documents if the amount does not exceed 10 thousand US dollars. A customs declaration can be completed in this case if desired.

If tourists need to take out of the country an amount the equivalent of which exceeds 10 thousand dollars, when declaring an amount of more than 100 thousand dollars, confirmation of the source of income is required. Money on a bank card is not subject to declaration.

Documents for children

A foreign passport will have to be issued even for the youngest children if the parents have a biometric passport (with a chip). If the parents have an old-style passport (without a chip), a child under the age of 14 can be entered into it - then there will be no need to make a separate passport. In addition, do not forget to take your child’s birth certificate with you on your trip - and the original. This way you can confirm that the child is yours.

Attention! Foreign border guards may ask you to show your return tickets when entering the country.

But the notarized consent of one of the parents for a minor to travel abroad must be issued only if the child is traveling without parents at all (for example, with a grandmother or other accompanying person) (Article 20 of the Law of August 15, 1996 N 114-FZ).

Although some countries require consent from the non-travelling parent to obtain a visa. Just in case, take it with you on your trip.

Alcohol and tobacco

Import rules mean that these goods can only be transported by adult citizens who are over 18 years of age.

The following restrictions apply for 2021:

- 3 liters of alcohol can be imported into Russia without entering it into the declaration and, accordingly, without paying a duty. What kind of alcohol it will be is completely unimportant for customs workers: beer, whiskey, wine and absinthe;

- 2 liters of alcohol can be carried in excess of the established duty-free limits per person, provided that they are included in the declaration. For each liter you will have to pay a separate customs duty - 10 euros, that is, for two in excess of the norm - 20 euros. Whether alcohol was purchased abroad or in a duty-free zone does not matter.

- 50 cigars.

- 200 cigarettes.

- 250 grams of tobacco,

- or the specified products in assortment, weighing no more than 250 grams.

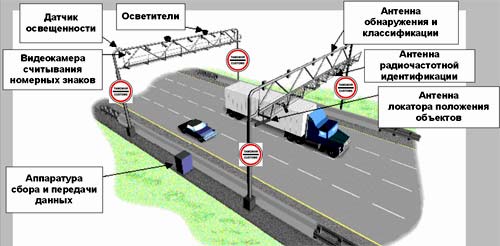

Scheme for checking a truck at customs

Violation of customs rules regarding the import of alcoholic beverages is punishable by the seizure of contraband goods, the initiation of administrative proceedings and the imposition of penalties. Moreover, the fine can range from half to twice the cost of the goods.

Whether or not to confiscate goods that have crossed the border with violations will be decided on a case-by-case basis, as will the size of fines.

The rules for the export of alcoholic beverages from Russia do not provide for restrictions. But they are clearly stated in the customs regulations of other countries. This means that you can export as much alcohol as you like, but it is unlikely that you will be able to import it into another country.

Customs officers may be interested in a large volume of alcohol, using an excerpt from the rules as an argument: goods can be taken out of the country in the amount necessary for personal use.

Video: rules for the transit of goods in the Russian Federation

Find out from the video:

- Is a TIR Carnet needed for transit transport;

- what threatens the complication of customs rules.

Import of products to Russia

The import of products into Russia for personal use is limited to 5 kg. If customs officers discover “extra pounds,” then confiscation of goods and penalties against the violator are possible. It is allowed to transport animal products (meat, cheese, milk) only in factory packaging with factory details, otherwise customs will ask you to present a quality certificate.

A permanent ban has been established on the import of physical goods. persons:

- Products without factory packaging, for example, purchased at the market;

- Potatoes;

- Seeds (including bulbs, for example tulips from Holland);

Products from a number of countries where outbreaks of dangerous diseases have occurred are periodically banned, but such restrictions are temporary. More information about these products can be found on the Rosselkhoznadzor website (fsvps.ru/fsvps/importExport), specifically for each country from which entry into the Russian Federation is carried out.

"Sanctioned" products

The food embargo, introduced as a response to sanctions from a number of countries, does not apply to individuals if the goods were purchased for personal use.

Simply put, a Russian tourist can legally bring any of the products prohibited for import by sanctions , provided that their quantity does not exceed 5 kg and they are in the original packaging. That is, when traveling around Italy, cheese lovers can bring a couple of Parmesan triangles without breaking the law. But here, again, we should not forget that customs officers may consider several kilograms of similar products to be goods of a commercial nature, and not products for personal use.

Duty-free import and export of things

In order to transport things across the Russian border and not fill out a declaration and, accordingly, not pay a duty, all luggage must comply with three basic import rules:

- Anything you intend to transport across the border must be for you and your family personally. Including new goods, used items, clothing and equipment. That is, 10 new iPhones or other modern expensive gadgets will definitely interest a customs officer;

- If the border is crossed by car, train or ferry, the total weight of your luggage should not exceed 25 kg. Air travelers are allowed to carry up to 50 kg;

- The total cost of your luggage cannot exceed 500 euros if you are returning to Russia by land, and 10 thousand euros when crossing the border at the airport. The cost in any currency not exceeding the equivalent is taken into account.

The exception is things that refugees and migrants bring into the territory of the Russian Federation.

Refugees crossing the Russian border

But for this you need to have proof of your social status. There is also a special attitude towards things that you inherited. However, in order to transport them, it is necessary to submit documents confirming ownership to customs inspectors.

The rules for duty-free import into the territory of the Russian Federation apply to works of art, but with one caveat. They must be declared and, after crossing the border, registered with a regional cultural institution.

Violation of customs rules entails administrative liability and payment of an administrative fine. In some cases, customs officers have the right to confiscate items that are prohibited from entering the country or that have not been properly declared.

Confiscation of goods at the customs point

What is customs?

Customs is a specialized government agency that controls the transportation of various types of cargo across the Russian border, including luggage and postal items, and collects fees and duties for certain goods. It is prohibited to bring some items into the country, while others are allowed only within certain limits or for a fee in favor of the state.

Customs is located at checkpoints across the state border: at air and sea ports, at railway stations and automobile checkpoints. Organizations involved in international transportation, or ordinary individuals, for example, tourists traveling abroad, will one way or another have to deal with customs officers.

Mandatory declaration

It is imperative to indicate cash in the customs declaration if the amount exceeds $10,000 in any currency, and even provide additional permits if you are going to cross the border with larger sums of 20,000-30,000 in your pocket.

You also need to mention two liters of alcohol in the document if you have exhausted the duty-free limit, which is equal to three liters for each adult.

Imported personal items are also indicated if their total value exceeds 500 euros when traveling by train, and 10 thousand euros when traveling by air.

If all your property costs less and falls within these limits, but exceeds the permissible weight limits (25 kg when crossing the border by land and 50 kg by plane), then the customs clearance rules of the Russian Federation also require their mandatory registration.

In addition to the cases already mentioned, the following things need to be included in the customs document when returning from a trip in 2021:

- Precious stones and metals;

- Weapons and ammunition, explosives and dangerous substances;

- Medicines containing psychotropic and narcotic substances;

- Works of art and cultural property;

- Encryption devices are devices that receive and transmit signals that operate at a frequency of 9 kHz and higher.

Some items on this list will require a special export permit obtained from the relevant authorities, or certificates and documents explaining their need for personal use, for example, a prescription from a doctor.

How is compliance with import rules for individuals checked?

Customs officers control all persons crossing the border.

They verbally report the items they are carrying, and a FCS representative inspects the luggage. Read also: Law on water supply and sanitation

If it is necessary to register items, a citizen submits applications and receipts indicating the cost with permits. If there are no checks or receipts, the inspector has the right to recalculate the cost. The basis is the amount of duty-free import - 500 euros and the weight of goods for 1 month - 31 kg.

Recalculation is carried out as follows:

- if the currency limit is exceeded, 30% of the amount that is greater is paid. For example, 700 euros are imported. For 200 euros you must pay 30% or 60 euros;

- excess weight - 4 euros per 1 kg.

On a note! If the value and weight of goods exceed the limit, recalculation is carried out towards a higher duty.

Goods with you: we export them from the Russian Federation

Gifts to relatives and friends that our vacationers take abroad are not such a rare occurrence. It also happens that on vacation you want to take something familiar, for example, several packs of cigarettes.

By goods we will further mean any movable property moved across the customs border (and not goods intended for resale). Please note that only goods for personal use that are not related to business activities are exempt from customs duties (Memo, approved by Letter of the Federal Customs Service of Russia dated July 19, 2011 N 04-30/34327).

The purpose of the goods is determined by the customs inspector, based on the citizen’s statement about the goods being moved, the nature and quantity of goods and the frequency of transportation of goods across the border (Article 3 of the Agreement between the Government of the Russian Federation, the Government of the Republic of Belarus and the Government of the Republic of Kazakhstan dated June 18, 2010 (hereinafter referred to as the Agreement dated June 18. 2010)).

| Name of exported goods | Conditions for export from Russia (from the customs territory of the Customs Union) |

| Temporarily exported jewelry | No declaration required. But they must be intended for personal use (Clause 20 of Appendix 3 to the Agreement dated 06/18/2010). A large number of jewelry (especially in packages and/or with price tags) may attract the attention of customs officers and raise suspicions about being transported for sale. It is better to declare very expensive products so that when returning to the Russian Federation, customs officers do not mistake them for purchased abroad |

| Alcohol, tobacco (cigarettes, cigarillos, etc.) | They do not require declaration, there are no strict restrictions on quantity (Clause 20 of Appendix 3 to the Agreement dated 06/18/2010). However, you can only export it for personal use and not for commercial purposes. |

| Paintings, books and other things that can be classified as cultural property | Modern books (not older than 100 years) and paintings (not older than 50 years) do not belong to cultural values (Section 2.20 of Appendix No. 2 to the Decision of the Board of the Eurasian Economic Commission dated April 21, 2015 No. 30). They can be exported without any conclusions, certificates, licenses or permits (Clause 54 of the Methodological Recommendations, approved by the Ministry of Culture of Russia on December 25, 2015 (communicated by Letter of the Ministry of Culture of Russia dated January 11, 2016 N 1-01-39-VA)). For items related to cultural values, an export permit is required (mkrf.ru -> Ministry -> Departments -> Department of Cultural Heritage) |

| Fish, caviar | It is prohibited to export more than (Clause 2 of Appendix 1 to the Agreement dated 06/18/2010; sub-clauses “h”, “and” clause 3 of the Decree of the Government of the Russian Federation dated 09/26/2005 N 584; Letter of the Federal Customs Service of Russia dated 12/12/2011 N 04-30/60671 ):

|

| Food | Does not require declaration, can be exported for personal use (Clause 20 of Appendix 3 to the Agreement dated 06/18/2010) |

| Weapons, ammunition | In most cases, export is prohibited |

| Medicines | In most cases, they do not require declaration (with the exception of potent drugs containing narcotic and/or psychotropic drugs) if they are exported for personal use in reasonable quantities (Part 8 of Article 47 of the Law of 04/12/2010 N 61-FZ; Law of 01/08/1998 N 3-FZ; List, approved by Decree of the Government of the Russian Federation of June 30, 1998 N 681). For prescription drugs, it is advisable to have a prescription (medical certificate). For potent drugs, you also need a certificate from the attending physician with the seal of the medical institution and documents confirming the legality of their purchase: a prescription with a note of dispensing from a pharmacy or a certificate of dispensing of these drugs at a medical institution |

For your information. A list of goods that are prohibited from being imported into the Russian Federation or exported outside the Russian Federation, as well as goods that can be imported without paying customs duties, can be found on the FCS website: https://customs.ru/ -> Website for individuals -> Information for information when traveling abroad.

When traveling by car, remember that, in addition to the fuel in the tank, you can take with you no more than 10 liters in a canister.

Reference. There is a list of goods that cannot be classified as goods for personal use. These are, for example, natural diamonds (not part of jewelry), medical equipment and equipment (except for those necessary for medical reasons), as well as any goods subject to export customs duties.

When taking food, alcohol and/or tobacco with you, ask whether the customs officers of the country of entry will let them through. Typically, if foreign customs officials suspect that a tourist wants to bring goods into their country for sale, they require payment of tax (customs duty).

Let’s take, for example, the import rules in force in one of the closest EU countries to us—Finland. If you are traveling to Finland by train or car and plan to be there for more than 72 hours, then without paying an “import” tax you can bring for one adult (over 18 years old):

- 4 liters of still wine and 16 liters of beer;

- 1 liter of strong alcohol (more than 22% strength - only those over 20 years old can import it) or 2 liters of weaker alcohol (less than 22%, for example vermouth, liqueur, liqueur, champagne, long drink, cider).

Tobacco products can be carried by persons over 18 years of age, and each person can import 200 cigarettes (1 block or 10 packs), or 50 cigars, or 250 g of smoking or pipe tobacco without paying tax.

The import of perfumes, tea and coffee into Finland is also limited. Each traveler can take with him the maximum:

- 50 ml of perfume and 250 ml of eau de toilette;

- no more than 200 g of tea or 40 g of tea extract;

- no more than 500 g of coffee or 200 g of coffee extract.

Meat and meat products, milk and dairy products are prohibited from importing into Finland from Russia. But if you intend to eat, for example, chicken or a sausage sandwich in a train compartment, customs officers will not find fault.

As an exception, a passenger may import for personal use breast milk substitutes, food products for infants, and food products consumed for medical reasons (with a total weight of no more than 2 kg).

Medicines intended for self-treatment can be imported in a limited volume corresponding to consumption for no more than 3 months (related to narcotic drugs - no more than 14 days). For prescription drugs, you must have a prescription or medical certificate.

Other goods can be imported duty-free if their value does not exceed:

- 430 euros per person for passengers of sea and air transport;

- 300 euros per person for passengers of other modes of transport.

If, for example, a husband and wife from Russia import new equipment worth 500 euros, then they will have to pay tax on the entire cost of the equipment. After all, it cannot be divided between two persons. To confirm the value of the goods, the customs officer may require you to present a purchase receipt.

Advice. Sometimes problems arise when importing expensive equipment into Russia that tourists took with them on vacation. Customs officers ask to provide evidence that it was purchased in the Russian Federation, and not in the country of the vacation. Or they ask you to pay a fee. To avoid such situations, it is better to declare your expensive equipment when exporting it from Russia (as well as expensive jewelry). This is not necessary, but when returning to your home country, you will be able to present your copy of the “export” declaration. And this will remove all the questions from customs officers.

There are also goods prohibited for import into Finland. Thus, it is prohibited to import telescopic batons, baseball bats, stun guns, brass knuckles and stilettos. You also cannot import radar detectors, even if they are built into the DVR and/or are turned off. If such a device is discovered, Finnish customs officers will confiscate it and may fine you.

Information about importing goods into your holiday destination can be found at the embassy. You can also find it on the Internet, and it is better to use the official websites of government agencies. For example, information for passengers traveling to Finland by car can be found on the website of the Finnish Border Guard, in Russian (https://www.raja.fi/ru/ -> Information -> Information for passengers).