What is considered the minimum wage in Switzerland?

The minimum income is not regulated by the state. However, this does not apply to workers in the following industries: tourism and hotel business, catering. In these areas, minimum wages are regulated to ensure that unskilled workers are not exploited. But, basically, wages, working hours and vacations are individual and depend on the employer.

The cost of living in Switzerland is 29,000 francs per year. This annual income can be earned by unskilled or low-skilled workers, such as waiters, cleaners and janitors, and laborers in factories. The average salary of an employee in a similar profession is 2,200 – 3,000 francs per month.

Even with minimal earnings, there is enough money for a living wage. But is the subsistence minimum enough for a comfortable life? You have to pay dearly for a high standard of living in Switzerland. It is better to consider the approximate costs in the table:

| Necessary expenses | Amount of expenses (in Swiss francs) |

| Diet including meat, fruit and dairy products | 600-700 per month |

| Flat rent | From 1250 per month |

| Communal payment | 200-300 |

| Taxi | 31 for one trip around the city |

| Public transport | 3.5 for one trip, 90 for a travel card |

| Wired Internet | 68 per month |

| Average bill in an inexpensive cafe | 19 per person |

As you can see, most of the income comes from renting an apartment. As a rule, students living with relatives or renting rooms, rather than entire apartments, receive the minimum payment. However, even a minimum wage can provide the conditions necessary to live in Switzerland.

As for unemployment benefits, they depend on wages. To receive payments you must work for at least 200 days. The duration of receiving benefits depends on the amount of contributions. Its amount cannot exceed 6,980 euros per month.

Salaries by city and region of the country

The level of wages is influenced not only by industry factors. Regional is also important.

Earnings in the Russian capital are much higher than in the regions. But they are far from Swiss cities, even with the lowest incomes

The cities of Zurich and Geneva are recognized as the most expensive to live in Switzerland. In them, hired labor is paid higher.

To give you an idea: with an average rate of 22.5 francs per hour in Basel and Bern, similar work in Geneva would be priced at 24 francs.

- Zurich is the largest city in Switzerland

The average salary is 2 thousand dollars higher than the national salary and amounts to more than 12 thousand. To be fair, it should be said that in “pure” form it is only 6.9 thousand.

- Geneva

The average salary in dollar equivalent is 10.56 thousand dollars. Net – 5.6 thousand.

- Grisons

High mountainous areas have low average earnings - no more than 8.5 thousand dollars

- Ticino

The smallest salaries are less than 5.4 thousand dollars.

Average wage level in Switzerland

According to statistics, a Swiss person earns on average 6,500 CHF (Swiss franc) per month. However, the average salary rarely reflects the real income of the population. For greater accuracy and information content, it is better to consider the salaries of various professions in Switzerland separately:

| Profession | Monthly salary to CHF | Annual salary to CHF |

| Therapist, dentist | from 9 400 | 122 200 |

| Surgeon | from 10 500 | 136 500 |

| Nurse | 5 700 | 74 100 |

| Teacher | 7 300 | 94 900 |

| Banker | from 9 600 | 124 800 |

| Engineer | 9 000 | 117 000 |

| Plumber | 6 600 | 85 800 |

| Driver | 4 500 | 58 500 |

| Police officer | 6 850 | 89 000 |

| Programmer | from 10 000 | 130 000 |

| Cook | 4 200 | 54 600 |

| Electrician | 5 500 | 71 500 |

| Nanny | 5 900 | 76 700 |

| Lawyer | 9 000 | 117 000 |

| Accountant | 8 100 | 105 300 |

| Auto Mechanic | 5 800 | 75 400 |

| Builder | 5 700 | 74 100 |

The earnings indicated in the table are written without taking into account taxes. It is important to clarify that annual income is formed taking into account 13 months. The December salary is calculated in Switzerland at a double rate. Salaries may vary depending on the region, place of work and a person’s length of service.

Salary by profession

If we compare wages in Switzerland in 2021 for workers in different specialties, we can identify, as in any other European state, the sectors of the economy that generate the greatest income.

So, the most sought-after bankers in the country are employees of banking structures. It is extremely difficult for foreigners to find work in this industry.

The work of top managers and financiers, programmers and dentists is highly paid. Their monthly income exceeds 10,000 francs.

In Russia, dentists are also among the professions in demand, but their earnings are not comparable to their colleagues from Switzerland.

Table 2. Average wages by profession in 2018

| Profession | Per month | |

| francs | Euro | |

| Top managers of companies | 16500 | 14350 |

| Financier | 12100 | 10500 |

| Programmer | 11560 | 10050 |

| Dentist | 11200 | 9700 |

| Doctor | 10000 | 8700 |

| Lawyer | 8500 | 7400 |

| Engineer | 8250 | 7100 |

| Teacher | 8100 | 7050 |

| Builder | 7900 | 6850 |

| Welder | 6850 | 5950 |

| Accountant | 6800 | 5900 |

| Driver | 6600 | 5700 |

| Firefighter | 6400 | 5550 |

| Police officer | 6100 | 5300 |

| Guide | 5800 | 5050 |

| Taxi driver | 5800 | 5050 |

| Nurse | 5750 | 4850 |

| Worker | 5600 | 4870 |

| Nanny | 5500 | 4800 |

| Loader | 5400 | 4700 |

| Electrician | 5400 | 4560 |

| Driver | 5000 | 4350 |

| Street cleaner | 4350 | 3800 |

| Salesman | 4300 | 3700 |

| Housemaid | 4200 | 3650 |

Source: migrantvisa.ru

Rice. Teachers protesting in the canton of Neuchâtel in November 2016 against salary cuts

Which areas have the highest salaries?

The most in-demand professions are often the highest paid in Switzerland. The top vacancies in demand are doctors of all specialties, as well as nurses. The salary of a doctor in Switzerland leads in Europe in terms of salary, since the state invests large amounts of money in the healthcare budget. In addition to doctors, diplomats, programmers, top managers and bank employees have incomes exceeding CHF 10,000.

Special mention should be made of the translators. Switzerland has 4 official languages - French, German, Italian and Romansh. One of them is common in every region, which makes the specialty of a translator relevant and in demand.

If we talk about regions, the highest wages are in Geneva and Zurich. But this is also where the highest cost of housing and rent is. Prices for food and services do not vary much between regions.

Labor market

IT specialists and engineers have many options where to go to work. Here are some large companies that have representative offices in Switzerland:

- Google,

- HP

- CISCO

- DELL

- IBM

- Logitech

This is not to mention the large number of banks and the same startups.

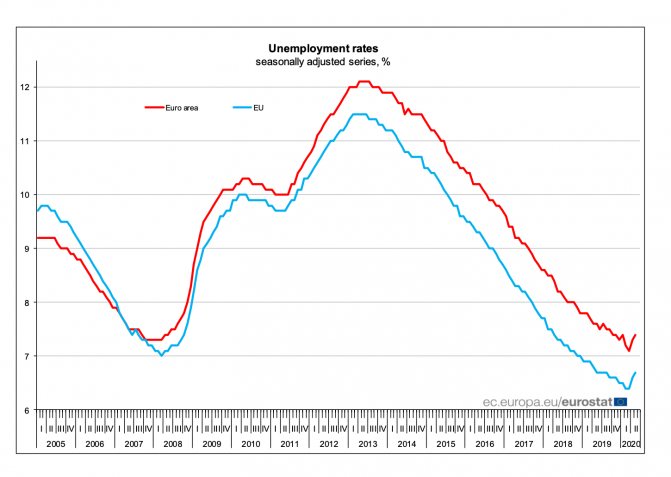

The Swiss economy is stable, and the country's unemployment rate is one of the lowest in the world - in March 2021 it was 4.3%, which is significantly lower than the EU average of 6.4%.

The Swiss government has published on its website a list of key economic sectors, including information technology:

- Agriculture

- mechanical engineering, electrical engineering and metalworking

- tourism

- trade

- media

- chemical and pharmaceutical industry

- watch production

- banks and insurance companies

- retail

There are more than 78,000 job openings in Switzerland for 2021. Among the sectors where the shortage of personnel is most acute are finance, IT and everything related to engineering.

Salaries in Switzerland are at a high level compared to the EU. The median gross salary in 2021 exceeded 6.5 thousand local francs (more than €6,000). The highest salaries are in Zurich - almost 7,000 CHF.

There is no official minimum wage in the country, but usually employment contracts include figures of 2,200-4,200 per month for low-skilled workers and 2,800-5,300 for skilled workers.

If we talk more specifically about IT, then salaries here are much higher than average. So, according to the PayScale service, a Software Engineer in Zurich can count on an annual salary of up to 98,000 CHF before taxes, and a Senior developer even up to 113,000 CHF per year (share more relevant data in the comments, if you have it, we’ll add edits to the post) .

IT companies are hiring quite actively even despite the pandemic - on the job sites of Google and Facebook you can find various positions from Data Science to ML and Computer Vision.

An important point to consider when relocating to Switzerland is that there are 4 official state languages. Therefore, many local companies want to see in their ranks people who speak not only English - German is in high demand, Italian or French can be a plus. This, however, does not apply to giants like Google and Facebook; such companies are ready to relocate engineers with knowledge of English.

Paying taxes on wages

Switzerland has 3 levels of taxes: federal, cantonal and municipal. Payroll payments are subject to federal tax. Every employer is also required to withhold income tax from an employee's salary. The amount of the fee depends on the level of income and increases as it increases:

| Annual income in CHF | Basic tax in CHF | Annual tax rate as a percentage |

| Up to 31,600 | — | 0,77 |

| From 31 600 to 41 400 | 131,65 | 0,88 |

| From 41 400 to 55 200 | 217,9 | 2,64 |

| From 55,200 to 72,500 | 582,2 | 2,97 |

| From 72,500 to 78,100 | 1096 | 5,94 |

| From 78 100 to 103 600 | 1 428 | 6,6 |

| From 103 600 to 134 600 | 3 111 | 8,8 |

| From 134,600 to 176,000 | 5 839 | 11 |

| From 176,000 to 755,000 | 10 393 | 13,2 |

| Over 755,000 | 86 848 | 11,5 |

The figures in the table are indicated for one individual. The tax calculation is the same for local residents and foreigners. There are no mandatory contributions for health insurance, since each resident chooses his own company.

Also, a percentage is withdrawn from the salary to the pension fund. It consists of three levels:

- State social security (mandatory). It is 5.12%, which must be paid by the employee and the same amount by the employer. The social security pension corresponds to the Swiss minimum subsistence level.

- Social security from work (mandatory). Equals 6.8% of annual revenue. All employees with an income of 21,000 francs per year pay it. Unlike state support, it does not have a minimum threshold and depends on the person’s income.

- Voluntary insurance. If desired, a person can save part of his money in a special bank account. The maximum annual contribution is CHF 6,826 for an ordinary citizen and CHF 34,120 for an individual entrepreneur. Before reaching retirement age, a person cannot claim his savings.

Switzerland is one of the top ten countries in terms of the level of security for pensioners. The pension benefits may seem high, but they are actually one of the lowest in Europe. It’s just that in Switzerland the pension tax is transparent.

Tax system

Taxation is complex. The system is represented by three areas of taxation:

• federal; • cantonal; • municipal.

Fiscal interest is allocated to cantonal bodies and unitary enterprises with federal status. The tax percentage depends on the annual salary. For example, 13 percent is charged on amounts over 250 thousand francs. In the most expensive cities, a 19% tax is deducted on incomes over 600 thousand francs. The Swiss tax system is considered favorable and lenient in comparison with some other European countries.

Work for migrants

Switzerland looks promising in the eyes of any migrant. However, the country has very high requirements for foreign workers. Since the employer takes on most of the hassle, he will do this only for the sake of a highly qualified person. Basic requirements for a foreign worker:

- knowledge of one of the national languages. English will be sufficient when working in an international company. If your goal is to stay in the country, you will need to learn the national language that is common in your chosen region. For example, in Zurich you will need German, and in Geneva - French;

- qualifications and work experience. The diploma must meet Swiss standards. For some professions, for example, a doctor, you will have to additionally undergo qualification confirmation;

- quotas. A limited number of migrants can enter Switzerland each year. If the quotas run out, you won’t be able to move in. At the same time, quotas are more preferably issued to residents of EU countries;

- having your own home. It is at this stage that Switzerland appears as a closed state. It is not possible to buy housing without citizenship in every part of the country; as a rule, this is possible in developing regions. In addition, square meters in Switzerland are among the most expensive in Europe.

All of the above points make the country one of the most inaccessible for migration. But, if a family member lives in Switzerland (mother, father, husband/wife, children), then this gives the right to work on an equal basis with local residents and greatly simplifies obtaining citizenship.

It is worth noting that Swiss law allows you to obtain refugee status. In this case, it is not necessary to have a visa and a package of documents required for entry. You need to prove that in your home country your life is in danger for political reasons. But this will not be enough. It is also necessary to explain why Switzerland was chosen as a refuge and not another country.

The procedure for paying wages in Switzerland

The main feature of Swiss salaries is 13 monthly payments. At the same time, even if the employee has worked for less than a year, he will still be paid the 13th salary, but its amount will correspond to the number of months worked. It should be clarified that these payments have nothing to do with bonuses.

Switzerland is one of the best countries to live. It doesn’t matter whether you are a student or a pensioner, you will have a decent standard of living. However, this only applies to local residents. The closed nature of the country makes Switzerland for many just an excellent ski resort, and not a place for a happy life.

Some payment features

Wages in Switzerland are paid in a strictly established manner. Annual earnings are divided into 13 lump sum payments. The country's labor legislation officially recognizes the 13th salary. And the right to it remains with the employee, even if he has worked for less than a full year. They will simply recalculate its volume to the actual number of months he worked.

The general trade union labor contract between the employer and the workers' union stipulates the number of working days per month and the duration of one working day.

You cannot work more than 45 hours a week. Overtime work is required to be paid. Its rate has been increased and is 1.25.

Men earn 15% more than women.