What determines the size of the salary in Israel?

It cannot be said that the average salary level in Israel is the same in all its regions and for all able-bodied citizens. For an employee, it can fluctuate quite significantly depending on several main factors:

- Region of residence;

- Availability of special education;

- Practical experience;

- Confirmed qualifications;

- Age;

- Paul;

- Nationality;

- Knowledge of Hebrew and foreign languages.

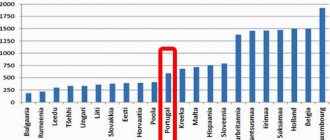

Workers from various countries flock to Israel for high salaries. This is not surprising, because this indicator in a Middle Eastern country is comparable to the income level in developed European countries. However, Israeli employers are not ready to accept everyone for existing vacancies. They give preference to qualified personnel.

It is much easier for foreign specialists with higher education and practical experience to find work than for a general worker applying for simple work that does not require special knowledge. At the same time, statistics show that people of Slavic origin can get a job with higher earnings than representatives of other nationalities. However, keep in mind that men will be paid approximately 35% more than women.

Salary taxes

Salaries in Israel are higher than in many European countries. Depending on the income of the employee, up to 50% can be deducted from his salary. According to the latest data from the Ministry of Finance, there are plans to reduce income taxes in Israel, which is due to the sale of Mobileye for $13.5 billion. Now the income rate is as follows (shekels per month):

- from 5,300 – 10%;

- up to 8,900 – 14%;

- up to 12,800 – 21%;

- up to 19,800 – 31%;

- up to 41,100 – 34%;

- up to 66,900 – 48%;

- over 66,900 – 50%.

Tax in Israel is calculated by the employer. Also, social contributions are charged: medical (5%) and national (14.5%) insurance.

Pension provision

After retirement, residents of the country can count on old-age subsidies (kitzvat zikna) or savings from social insurance (Bituach Leumi). The maximum bet is 2,250 shekels. To receive pension benefits, you must work for at least 144 months. You can also deduct 6.5% of your salary for “pitsuim” - money for dismissal.

Average earnings by region of the country

It is impossible to unequivocally answer the question of how much foreign workers earn in Israel. Often, the amount of income will depend on which city a job vacancy is open in. For example, one of the most prosperous in terms of earnings is Tel Aviv. This city is home to the offices of international corporations, banks, trading floors and cultural institutions. Therefore, the average salary in Tel Aviv is significantly higher than in other cities.

If you provide income data depending on the city in which a job vacancy is open, the result can be presented in the following table:

| City | Shekels | U.S. dollars |

| Tel Aviv | 10660 | 3000 |

| Haifa | 9580 | 2700 |

| Ashdod | 7850 | 2200 |

| Netanya | 7600 | 2150 |

| Jerusalem | 7550 | 2100 |

| Be'ersheva | 7000 | 1950 |

| Nazareth | 6500 | 1800 |

However, do not forget that the average salary indicated above includes taxes that must be transferred to the state treasury. After deducting contributions at an income-appropriate progressive rate, your salary may be significantly reduced.

Who receives the minimum wage in Israel

When planning to earn money, you should take into account that the average salary in Israel, determined according to statistical data, is not guaranteed for an immigrant who arrived in the country for the purpose of employment. Therefore, it is more correct to focus on the minimum wage in Israel.

For the current period, it is approved in the amount of 5,000 shekels, which corresponds to 1,400 US dollars. Below this level, the employee should not receive income, and for a Russian it may seem quite worthy. However, taking into account the fairly high costs of food, rent and taxes, this salary is assessed by local residents as quite low.

Where to look for a job as a driver?

There are many websites with vacancies. For example:

- rabota-israel.ru - an adapted Israeli bulletin board, with many vacancies available in Russian;

- il4ru.com - Israeli message board, with guarantees, without dubious and illegal offers;

- doska.orbita.co.il is a popular bulletin board in Israel, where you can safely post your resume without worrying about the results.

You can even go to Israel on a tourist visa and discuss the details with a potential employer on the spot. And only then start obtaining work permits. But be careful - it is better to leave the true purpose of the visit a secret. For repatriates, the best option is employment through Sokhnut . For several years now, the agency has been running special driver training programs - the country is struggling with their shortage as best they can.

It will not be difficult for a repatriate to get a job as a driver, and training through Sokhnut can be done for free. Photo: pixabay.com

How much do qualified specialists earn?

Regardless of whether a foreigner plans to work as a programmer or a cook, his qualifications and experience will be of paramount importance to the employer. They will have the main influence on what salary in Israel awaits this particular job applicant.

The highest average salaries in Israel are among specialists employed in the following industries:

- Pharmaceuticals;

- Electricity supply;

- Mechanical engineering;

- Metallurgy;

- Oil distillation;

- Medicine;

- Tourism.

How much welders, builders, nurses and teachers earn directly depends on their experience and qualifications. For example, a builder who carries bricks or mixes cement can only count on a minimal income. And a crane operator or electrician of a certain qualification will be able to earn an order of magnitude more.

The average rate in Israel for various categories of workers is:

| Profession | Salary | |

| in shekels | in US dollars | |

| Financiers, insurers | 17000 | 5000 |

| Programmer | 16000 | 4500 |

| Doctor | 15000 | 4200 |

| Engineer | 14000 | 3900 |

| Metallurgists, machine builders | 13900 | 3700 |

| Electricians, welders | 10000 | 2900 |

| Auto mechanics | 8500 | 2400 |

| Builders | 8100 | 2200 |

| Teachers | 7500 | 2100 |

| Cooks | 7200 | 2000 |

| Nurses | 6000 | 1700 |

| Service staff | 5000 | 1400 |

Working in the healthcare sector

Medicine in Israel has reached a high level of development. The best doctors from all over the world work in this field. Jobs in the healthcare field are highly valued and well paid. An aspiring doctor earns monthly 2,500 – 3,000 US dollars. An experienced specialist can expect a salary of $5,000.

To apply for a vacancy in an Israeli clinic, a doctor must have the appropriate license. Only Israeli citizens who are fluent in Hebrew can receive it in a short time. To work in a hospital, foreign specialists must, in addition to higher medical education, have at least 14 years of practical experience, and also undergo an internship in an Israeli clinic for six months.

Specialists whose work experience has not reached 14 years, in addition to a six-month internship, will have to pass a state exam to confirm their knowledge and qualifications. A nurse in Israel must also pass an exam and train in a clinic. Only after receiving a license will she be allowed to work with people.

There is a shortage of highly qualified dentists in Israel. The country's two medical faculties annually graduate only about 60 specialists, some of whom leave to work in the United States immediately after graduation. Therefore, dentists from Russia, Ukraine and European countries often work in Israeli clinics. Despite high earnings, not every specialist can open his own office and, most often, dentists who come to Israel to work work in large private clinics.

Metapellet work in Israel

Israelis willingly hire foreigners to care for disabled or elderly people. In this case, the monetary costs of paying for metapellet services are borne by the state. At the same time, it frees their loved ones and relatives from worries about infirm citizens.

The salary of such a nurse is equal to the subsistence level, but the owners most often provide the foreign worker with housing and food, so the work of a metapelet in Israel is very popular among immigrants.

To work as a nurse, no qualifications or education are required. Often women who come from Russia or Ukraine do not speak Hebrew. However, this circumstance does not become an obstacle to hiring foreign women with Slavic roots. The responsibilities of the metapellet include:

- Cleaning;

- Caring for an elderly or disabled ward;

- Cooking;

- Feeding;

- Hygiene procedures.

- Walks.

But often older people simply need attention and are looking not so much for a housekeeper and nurse in one person, but for a companion and interlocutor. The work of metapellets is regulated by the labor legislation in force in the country. The nurse should not work more than the established hourly rate per week. She is entitled to days off, vacation and paid medical insurance, just like an employee of any other profession. In addition, the law obliges the employer to give the employee 100 shekels per month for pocket expenses.

Since the state compensates older people for a limited number of hours of work by a caregiver, one woman often provides services to several wards at once. Thanks to this, she is able to provide herself with a decent income.

Prospects

After successful completion of the medical certificate program, you become a participant in the next training program aimed at further language learning and repatriation.

The duration of training for this program is 10 months. All this time you have been studying Hebrew for doctors in a specialized ulpan. The program organizers provide you with a hostel, the cost of which is about $100 per month. During your studies, you are also provided with monthly financial support, the so-called minimum subsistence basket, amounting to approximately $400 per month. The remaining $300 (minus hostel fees) should be enough for food and small pocket expenses.

As a rule, many program participants take on additional work. A recently passed law in Israel prohibited working in a specialty without a Hebrew exam. Therefore, it will be possible to get a job during the training period, but it will be non-specialized work, for example, washing dishes in a restaurant, caring for the elderly, etc. The minimum wage in Israel is $7 per hour.

After 10 months of training, you take a language proficiency exam (Hebrew). If you pass successfully, you begin working as a junior doctor.

Today you can easily find work in the following specialties: therapy, surgery, anesthesiology.

Working as a programmer in Israel

Working as a programmer in Israel is the highest paid job on the labor market. Specialists working in the field of software development receive a monthly income of at least 10 thousand shekels. The main requirements for job applicants are:

- Qualification;

- Experience.

- Knowledge of English.

The demand for programmers is due to the fact that 30% of the Israeli market is occupied by the hi-tech industry. This country is famous for a large number of startups in this field; representative offices of the world's largest companies, such as Apple, Microsoft, and Oracle, operate on its territory.

A highly qualified programmer with practical experience can earn NIS 30,000 per month. However, he will have to pay taxes on a progressive scale, which could amount to 11,000 shekels per month. Therefore, many companies not only pay their employees salaries, but also compensate for:

- Lunches;

- Travel to your place of work by public transport;

- Visiting sports clubs and fitness centers.

When planning to work in Israel as a programmer, you should take into account that the employer will require the applicant to have a good knowledge of English, since this is the language in which all documentation in the hi-tech world is conducted. In English, the programmer will have to communicate with customers and outsourcers. But knowledge of Hebrew does not affect the decision to grant a work contract.

Requirements for drivers in Israel

Despite the shortage of drivers (and some other specialties) in the country, finding a job will not be easy . It is advisable to be an Israeli citizen - they have priority over foreigners. But at worst, a work visa and a permit to work as a driver will do. The employer is responsible for completing the latter. When searching for vacancies, remember that not all Israeli companies have the right to invite foreigners to work . So repatriates will have a tangible advantage here too.

- Israel

Languages of Israel - what speech is heard more often in the country?

- Alena Orlova

- 26.11.2019

Knowledge of the language is desirable, but not required. If the vacancy does not involve the need for regular communication with locals, it is quite possible to get by in English - especially in international companies.

And in some places Russian is sufficient, for example, in the field of domestic cargo transportation. Still, there are many Russian speakers in the country - both immigrants from the USSR and their descendants, and new immigrants from the CIS countries.

But if you plan to stay in the country for a long time, it is better to take care of language courses. Repatriates have the opportunity to visit them for free.

The driver's qualifications will have to be confirmed. To gain access to the exams, you will have to take courses, the duration of which, depending on the category, can be up to six months. Training, of course, is paid, and the employer is not always ready to undertake it . It is especially difficult for public transport drivers.

You can get a job as a public transport driver only if you have an ideal biography: no fines, violations, or problems with law enforcement. Photo: pixabay.com

Working day in Israel

When going to work in Israel, you should know that in this country the working week has its own characteristics. All over the world it starts on Monday, but in Israel the first working day is Sunday. A week can be five days or six days. Each of them has its own hourly rate.

With a week of 5 days, working time lasts 8.4 hours. Moreover, their total number is 42. If an employee works 6 days a week, the duration of his time is 8 hours. Accordingly, he works 45 hours per week. Today, Israeli unions are fighting to reduce the 5-day work week to 40 hours, which will lead to an automatic increase in hourly wages.

For work exceeding the standard, an additional payment is due at the rate of:

- For the first 2 hours – 125% of the rate;

- For subsequent hours – 150% of the bet.

However, the country's labor legislation limits overtime work, allowing the working day in Israel to be extended by no more than 4 hours.

VAT refund in Israel

The opportunity is available only to tourists and citizens who are not tax residents (foreigners spending less than 182 days a year in the country). The goods and services tax in the state is 18%; unlike the EU republics, this jurisdiction promises a full tax refund

in Israel for both refugees and the ordinary population. To get the specified VAT rate back, you should know some nuances:

- The procedure is possible for all foreign visitors

. If a tourist is a citizen of the Russian Federation, then in order to receive a kickback he needs to present a receipt from a store that has a signed agreement with Russia on the return of the added value fee. There are many such points. - Receiving money back is only available for purchases of more than 400 shekels

. - When purchasing tobacco products and alcohol,

returns are not provided unless the buyer can prove that the goods were not taken for personal use. - The higher the purchase amount, the lower the duty refund rate

. - Returns are carried out only by stores with a Tax Refund

. The procedure is carried out on the basis of a receipt and a special return form.

Tourists are often interested in the availability of VAT in Israel when booking a hotel.

.

This fee is equal to 17% of the room rate. For citizens of the country, the duty is already included in the price; for non-residents there is a special system: at customs points at airports, foreigners do not always have their passports stamped. If you do not have a mark, then 17%

will have to be paid

on top of the cost of the reservation

. Otherwise, you will only owe the amount specified at the time of booking. You can ask the checking customs officer to affix the stamp.

Salary taxes in Israel

High economic growth is greatly facilitated by the progressive income tax applied in Israel. This means that people with lower earnings pay a tax rate of 10% to the treasury. And wealthy citizens are forced to pay up to 50% of their total income to the state every month. This high rate applies to persons whose income reaches 560 thousand shekels per year.

Today the average income tax is 40%. An increase in salary for every 1,400 shekels entails an automatic increase in tax contributions by 1%. At the same time, citizens of the country can enjoy certain tax benefits. However, there are no tax breaks for immigrants. Foreign specialists have to make deductions in full.

The country has an officially approved division of taxpayers into categories depending on the size of their salary. Each category has a specific tax rate:

- 1st category – 10%;

- category 2 – 14%;

- category 3 – 21%;

- category 4 – 30%;

- category 5 – 34%;

- Category 6 – 48-50%.

In Israel, all business owners and employees must pay wage taxes if they are tax residents, that is, they permanently reside in the country for at least 183 days a year. Any tax evasion is strictly prosecuted by law, so even the highest paid specialists, forced to give half of their earnings to the state, do not risk receiving their salaries unofficially.

Israel is an economically stable and developed state that attracts labor resources from all over the world. Foreign specialists are welcome in this country. They are provided with jobs in a variety of fields of work. However, when planning to go to the Middle East, you should remember that only highly qualified specialists can apply for European-level salaries. Handyman services in Israel are paid at minimum wage rates.

What is the income tax in Israel?

Before I begin to list the professions of workers and their average salaries, I want to warn you that in Israel there are rather large income taxes and other taxes, which are calculated at a relatively high equivalent percentage of wages.

Income tax in Israel is progressive, that is, the tax rate increases as income increases (from 10% to 50%)

At the same time, the amount of income tax is reduced according to the preferential tax units granted to Israeli citizens. In other words, if you are not an Israeli citizen, then your income tax will be calculated according to the maximum criteria, as shown in this table:

| Income per month in shekels (1 shekel ≅ 16 rubles) | Tax rate |

| up to 5.220 | 10% |

| 5,221 – 8,920 | 14% |

| 8,921 – 13,860 | 21% |

| 13,861 – 19,800 | 31% |

| 19,801 – 41,410 | 34% |

| 41,411 – 66,960 | 48% |

| 66,961 and above | 50% |

You can read more about income tax.

Other taxes on monthly income

In addition to income taxes, there are taxes for Social Security and Medicare, which amount to approximately 12% of wages.

And, by law, every working Israeli is required to contribute at least 2.5% of his salary to his pension fund. The employer is obliged to add at least the same percentage to the worker's pension fund.

In government agencies and in some large companies, the employer supplements the worker's pension fund from 5% to 7.5%.

Therefore, in order to understand the real (net) salary of an Israeli citizen, you need to do the following arithmetic problem:

Y (net salary) = X (dirty salary - gross) - 10% (income tax) - 2.5% (pension fund) - 12% (social and medical insurance)

So, a maximum of 75% of your original salary will remain, which can be deposited into a bank account, and this is only if your salary does not exceed the minimum tax threshold (see table). The higher the salary, the higher the tax rate percentage.

I hope that I did not confuse you too much with these numbers and percentages, but without these numbers, the subsequent information will not be complete and reliable.

Now let's find out what the average salary is in Israel.