Do you need insurance in Kazakhstan?

I recommend taking out insurance in any case, because during my travels I had three insurance cases and all of them immediately recouped the cost that I paid to purchase the insurance policy. And I didn't pay anything out of pocket at the hospitals. The last such incident was in Bali, when I was bitten by a monkey. In the video I tell you what I did after the bite and how the insurance company acted:

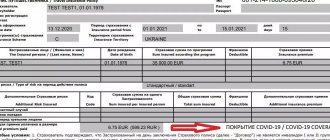

Therefore, when traveling to Kazakhstan , I recommend taking out insurance first of all for yourself, so that you feel protected and not worry about what will happen if something goes wrong. In addition, the cost of insurance is very low. For example, how much will insurance cost in Kazakhstan for a week :

For this amount, upon the occurrence of an insured event, you will receive:

- Call a doctor or local ambulance

- Hospital reception and outpatient treatment

- Medical transportation from abroad

- Reimbursement for prescription drugs

- Reimbursement of communication expenses while traveling when communicating with an insurance company or hospital.

- Repatriation to homeland in case of death of the insured

You can also additionally select the options you need:

- Reimbursement for dental expenses (in Thailand, part of a tooth broke off and I had pulpitis, they treated it and put a filling in an international hospital, all covered by insurance)

- Baggage insurance

- Compensation for flight delays

- Civil liability insurance (to third parties)

- Insurance for sports and active recreation

Choosing additional options will make your insurance policy a little more expensive, but will allow you to feel safe in any situation and know that if something happens, the first thing you need to do is call the insurance company. Therefore, a life hack : immediately add the insurance company’s number to your phone and Skype so that you don’t have to look for it when an insured event occurs.

What changes await Kazakhstanis regarding compulsory car insurance?

Vehicle owners, get ready for changes to your insurance product: compulsory civil liability insurance for vehicle owners (OS GPO VTS) will be modified! The changes will also affect the procedure for insurance payments for damage to life and health.

***

As an analysis of the current loss ratio for OS GPO VTS in the insurance market of Kazakhstan shows, it is very variable in the context of insurance organizations, territories of registration of vehicles and other insurance parameters.

Thus, in different regions the share of payments from premiums (collected contributions) ranges from 60% to 85%. But, for example, in the Turkestan region, the real loss ratio not only reached 100%, but also exceeds this limit.

“This indicates the inadequacy of the current insurance tariffs for OS GPO VTS in relation to certain groups of policyholders (increased loss ratio). At the same time, the overall level of unprofitability remains at a fairly low level, which indicates a deviation of current insurance rates from their actual values,” noted in the draft Concept of the bill on the development of the insurance market and the securities market.

Alien slogans of the Kazakh opposition 05/19/2021 12:302968

Thus, today there is an urgent issue regarding the recalculation of current insurance tariffs for OS GPO VTS. At the same time, the authors of the document are confident that the issue of recalculating insurance rates must be considered every few years, taking into account the current situation in the auto insurance market.

Therefore, in order to increase the efficiency of compulsory insurance of car owners and ensure the speed of making adjustments to the applied tariffs, it is proposed to revise the model for calculating insurance tariffs for OS GPO VTS, taking into account international practice.

Firstly, flexible insurance rates will be established regionally, depending on the values of loss ratios in the territory of registration of the vehicle. For example, if a certain threshold of loss in the region is exceeded/lowered, the basic insurance rate can be adjusted using an adjustment factor. At the same time, by region it is proposed to use such parameters as actual loss ratio, reliability factor and targeted loss ratio.

Therefore, the law will give the Agency of the Republic of Kazakhstan for Regulation and Development of the Financial Market the right to determine the methodology for calculating the adjustment coefficient. This coefficient will be calculated on the basis of the Unified Insurance Database (USID).

Secondly, for the full implementation of electronic insurance services in Kazakhstan and to simplify the process of receiving insurance payment, a mechanism for making insurance payment under the OS GPO VTS online will be legally defined, as one of the ways to resolve an insured event.

Girl Greta is used by adult uncles 05/17/2021 15:303740

“The introduction of online settlement of an insured event under the GPO VTS OS is due to the need to create an effective claims settlement system in the insurance market, which is determined by the time of claims settlement, the adequacy of the amount of insurance payment and the costs of claims settlement,” the draft concept says.

***

Future changes in legislation also provide for restrictions on the activities of intermediaries in the settlement of insurance cases involving harm to the life of the injured person. The law will provide for the duty of insurance companies on legal beneficiaries.

The draft Concept states that currently in the insurance market of Kazakhstan there are persons providing intermediary services in matters of settlement of fatal insurance cases, within the framework of the classes of OS GPO MTC and the civil liability of the carrier to passengers.

Yes, the legislation requires insurance companies to pay a lump sum insured amount to beneficiaries (dependents) in the event of a citizen’s death as a result of an accident. Given that, according to civil law, there is no statute of limitations for cases of personal injury, intermediaries often bring up insurance cases that are many years old. When finding dependents of a person who died as a result of an accident, intermediaries promise assistance in obtaining insurance payment in their favor on the basis of a notarized power of attorney to represent the interests of beneficiaries in relations with insurance companies. Intermediaries charge significant commissions for providing such services.

“In order to protect the rights of consumers of insurance services and ensure their legitimate interests in receiving insurance payments in a timely manner and in full, within the framework of the draft law it is proposed to adopt amendments aimed at changing the scheme of insurance payments covered within the framework of causing harm to the life and health of the victim, from the principle applications for responsible insurance companies to search for legal beneficiaries,” the document says.

P.S. Currently, changes and amendments to legislation are being discussed with professional market participants.

***

© ZONAkz, 2021 Reproduction is prohibited. Only a hyperlink to the material is allowed.

Insurance cost calculator

The total cost of insurance will depend on several factors: the amount of insurance coverage, additional options, the selected insurance company, the number of days of rest and the age of the insured. calculate the current price of insurance in Kazakhstan using an online calculator:

Within a few minutes after payment, your current medical insurance in Kazakhstan will be sent to your email. The policy can be printed or simply saved to your phone. The main thing is to write down his number. This is what they will ask when calling and/or going to the hospital.

Where can I apply?

Insurance in the Republic of Kazakhstan is traditionally issued in the offices or on the websites of insurance companies. But not all companies issue policies for this country. Therefore, the driver must take care of obtaining the document in advance.

Instructions for purchasing car insurance online:

- Find an insurance company that provides this service.

- Use the calculator to determine the cost of the policy.

- Submit your application.

- Upload a package of driver and vehicle documents.

- Pay for your purchase.

- Receive the contract by email or pick it up at the office.

Package of documents for registration of insurance:

- Passport of a citizen of the Russian Federation.

- Vehicle registration document.

- Inspection certificate.

- Driver license.

- Previous insurance policy (if available).

- Application in the form of SK.

Insurance for Kazakhstan takes several days to be issued. After receipt, the driver should carefully read the information specified in the policy. If a mistake is made, the insurance company will legally refuse payment.

Most car owners prefer to buy insurance when entering Kazakhstan. After the customs inspection point, there are trailers in which managers quickly issue a policy valid on the roads of Kazakhstan.

Disadvantages of taking out insurance in the Republic of Kazakhstan:

- A large number of scammers.

- Inflated prices.

- Pitfalls of the country's legislation.

The list of documents required for on-site express insurance is the same as for online registration in Russia.

The procedure will not take much time. The actions of insurers in Kazakhstan are streamlined.

Tips for choosing insurance

- Take out an insurance policy for +2 weeks for your travel dates . Why is this better? Because if you suddenly get sick or break something at the end of your vacation and you are admitted to the hospital or scheduled for surgery, it is important that the insurance is valid the entire time you are in the hospital. Otherwise, you will have to pay all expenses. Therefore, add two weeks to the dates of your vacation and buy insurance for this period.

- If you are going to visit several countries during your trip, or are going on a trip for more than 30 days, then in this case it will be more profitable to take out an annual insurance policy . I wrote a separate article about annual insurance, read it.

- Choose an insurance company not only by price, but also by the availability of a deductible. The deductible is the amount that you will have to pay out of your own pocket to the hospital, and everything above this amount will be covered by the insurance company. Typically the deductible is about $30. And if you were simply prescribed ointment or tablets in the hospital, then most likely you will have to pay for it yourself. But if you choose an insurance policy without franchise, then even such minimal expenses will be covered by the insurance company, and you will not pay anything.

Advantages and disadvantages of car insurance

The OSAGO pole has more disadvantages than advantages. Of course, insurance allows you to travel abroad with peace of mind and be able to partially compensate for losses in the event of a traffic accident, but there are also a number of problematic issues:

- You can only get a car insurance policy on the territory of Russia, which is always less convenient for foreigners than doing it in your own country;

- Russian compulsory motor liability insurance is valid only in the Russian Federation, so if you are transiting the country, you will later have to buy insurance in the state that is the purpose of the trip, and it will not be useful at home;

- technical inspection is required;

- relatively high cost with a moderate amount of payments.

The fine for not having an insurance policy is 800 rubles. They have no right to remove license plates or send them to a parking lot for this violation, at least in 2021. For a issued but missing policy, 500 rubles are issued. However, it is worth remembering that the number of times the police can fine you on the road has no restrictions. Therefore, it will be much more profitable for citizens of Kazakhstan to complete all documents in full, insuring their losses in the event of an accident and avoiding additional expenses for paying fines to the traffic police.

Fines

The legislation of the Republic of Kazakhstan provides for penalties for foreigners who crossed the border of the Republic of Kazakhstan in a car that does not have insurance. The numbers in the protocol will unpleasantly surprise the driver. Kazakh fines for this violation are higher than Russian ones.

So, 1 KZT = 0.18 RUB. The fine for lack of insurance for a car from Russia starts from 10,600 tenge (1,925 rubles). The inspector will estimate a repeated violation at 42,000 tenge, which is equal to 7,000 rubles.

Attention ! Failure to obtain insurance may result in not only fines, but also arrest.

It will not be possible to leave Kazakhstan with unpaid fines. They will have to be paid at the border. Refusal may have more serious consequences. Malicious violators of the laws of the Republic of Kazakhstan risk being blacklisted and no longer able to cross the border of Kazakhstan.

Traffic inspectors recommend paying for insurance, because if violations are detected, you will have to pay several times more.